|

| If you’re having trouble reading this, click here. |

|

|

|

|

| MONDAY ECONOMIC REPORT |

| Essential Takes on Leading Economic Indicators |

|

| By Chad Moutray, Ph.D., CBE – December 17, 2018 |

|

| Presented by Microsoft |

|

|

|

|

Manufacturing Job Openings Reach Another All-Time High |

|

| The Weekly Toplines |

|

- Job openings in the manufacturing sector jumped to a new all-time high, rising from 485,000 in September to 522,000 in October. In addition, there was net hiring among manufacturers of 39,000 in October, the fastest month pace in 14 months. Overall, this is another solid reading for manufacturing job growth, consistent with the strong outlook and a tight labor market.

- Indeed, manufacturers continue to report the difficulties in finding talent as their top concern. For the eighth consecutive month, there were more job openings in the U.S. economy (7,079,000 in October) than the number of people looking for work (6,075,000 in October and 5,975,000 in November). In addition, the number of nonfarm payroll job openings was not far from the all-time high (7,293,000) set in August.

- With that said, there were several readings last week suggesting that manufacturing activity had slowed more recently. For instance, the IHS Markit Flash U.S. Manufacturing PMI® grew at the weakest pace in 13 months. Encouragingly, manufacturers completing the survey remained upbeat about production over the next six months, even with some easing in sentiment over the past few months.

- Manufacturing production was flat in November, with output in the sector slowing over the past few months. On a year-over-year basis, manufacturing production has risen a modest 2.0 percent. In addition, manufacturing capacity utilization edged down to 75.7 percent in November but remains not far from September’s pace (76.0 percent), which was the best rate since August 2015.

- Meanwhile, total industrial production rose 0.6 percent in November, bouncing back from the decline of 0.2 percent in October, on robust growth in mining and utilities output. Over the past 12 months, industrial production has risen 3.9 percent—a solid reading—and total capacity utilization increased to 78.5 percent, equaling the level in August, which was the highest since January 2015.

- Consumer and producer prices slowed in November, pulled lower by reduced energy costs. Both measures reflected some stabilization from more-accelerated paces midyear, even as pricing pressures remained above rates that Americans have become accustomed to in recent years.

- Retail sales softened in November, up 0.2 percent, with reduced gasoline station sales (and lower prices) serving as a bit of a drag on the headline number. Despite the smaller increase for the month, consumer spending remained strong overall, continuing to be one of the bright spots in the U.S. economy. Over the past 12 months, retail sales have risen by a relatively healthy 4.2 percent.

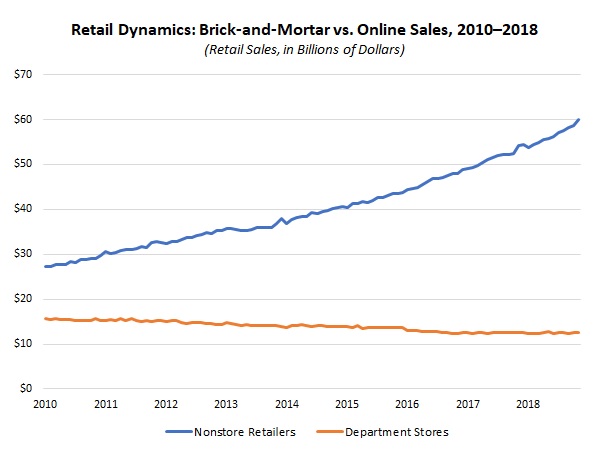

- On a year-over-year basis, the clear winner was nonstore retailers, with retail sales growth of 10.8 percent since November 2017. In contrast, department store sales decreased 0.2 percent year-over-year. As such, the brick-and-mortar versus online retail dynamics continued to play out in the sales data.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, December 10

Job Openings and Labor Turnover Survey

Tuesday, December 11

NFIB Small Business Survey

Producer Price Index

Wednesday, December 12

Consumer Price Index

Thursday, December 13

None

Friday, December 14

IHS Markit Flash U.S. Manufacturing PMI

Industrial Production

Retail Sales |

|

|

|

This Week's Indicators:

Monday, December 17

NAHB Housing Market Index

New York Fed Manufacturing Survey

Tuesday, December 18

Housing Starts and Permits

Wednesday, December 19

Existing Home Sales

FOMC Monetary Policy Statement

Thursday, December 20

Conference Board Leading Indicators

Philadelphia Fed Manufacturing Survey

Friday, December 21

Durable Goods Orders and Shipments

Gross Domestic Product (Second Revision)

Kansas City Fed Manufacturing Survey

Personal Consumption Expenditures (PCE) Deflator

Personal Income and Spending

State Employment Report |

|

|

| Deeper Dive |

|

- Consumer Price Index: Consumer prices were flat in November, the slowest monthly pace since March. Reduced energy costs, down 2.2 percent, helped to pull down the headline number in November, even with food prices up 0.2 percent for the month. Excluding food and energy, consumer prices increased 0.2 percent in November. The consumer price index has risen 2.2 percent over the past 12 months, continuing to decelerate since peaking at 2.9 percent in July (the highest year-over-year rate since February 2012) and down from 2.5 percent year-over-year in October. Core inflation remained at 2.2 percent year-over-year for the fourth consecutive month, suggesting price growth excluding food and energy has stabilized for now, albeit at a pace that is higher than Americans have become accustomed to in recent years.

- IHS Markit Flash U.S. Manufacturing PMI®: Manufacturing activity in the United States grew at the weakest pace in 13 months, with the headline index dropping from 55.3 in November to 53.9 in December, according to preliminary data. New orders, output and employment slowed for the month, with each continuing to expand modestly overall. Interestingly, new export orders improved in December, with the best reading since January. Encouragingly, manufacturers completing the survey remained upbeat about production over the next six months, even with some easing in sentiment over the past few months. Pricing pressures also decelerated but remained highly elevated.

Separately, IHS Markit® also released survey results for the Eurozone, with manufacturing activity on the continent dropping from 51.8 in November to 51.4 in December. That was the slowest pace of growth since February 2016, with contracting growth in France (for the first time since June 2016) and weaker data in Germany (the slowest expansion since March 2016) helping to pull that index lower.

- Industrial Production: Manufacturing production was flat in November. In addition, the October reading was downgraded from an increase in output of 0.3 percent to a decline of 0.1 percent. As such, production in the sector has stagnated in the past two months—a sharp contrast to the stronger readings earlier in the year. In the November data, durable goods output rose 0.2 percent, led by gains for electrical equipment and appliances, machinery, motor vehicles and parts and primary metals. In contrast, nondurable goods production decreased 0.2 percent, with notable declines for apparel and leather, food, beverage and tobacco products, petroleum and coal products, printing and support and textile and product mills. Over the past 12 months, manufacturing production has risen a modest 2.0 percent. In addition, manufacturing capacity utilization edged down from 75.8 percent in October to 75.7 percent in November but remains not far from September’s pace (76.0 percent), which was the best rate since August 2015.

Meanwhile, total industrial production rose 0.6 percent in November, bouncing back from the decline of 0.2 percent in October. (It was also revised lower, as October’s figure was originally up 0.1 percent.) Robust growth in mining and utilities production boosted the headline figure for the month. On a year-over-year basis, industrial production has risen 3.9 percent—a solid reading—and total capacity utilization increased from 78.1 percent to 78.5 percent, equaling the level in August, which was the highest since January 2015.

- Job Openings and Labor Turnover Survey: Job openings in the manufacturing sector jumped to a new all-time high, rising from 485,000 in September to 522,000 in October. Durable goods firms reported the most job postings in October (332,000) since January 2001, with openings for nondurable goods manufacturers (189,000) also higher for the month. In addition, there were 384,000 hires in October, with 345,000 separations (which include quits, layoffs and retirements). As a result, there was net hiring of 39,000 workers in the manufacturing sector in October, the fastest month pace in 14 months. Overall, this is another solid reading for manufacturing job growth, consistent with the strong outlook and a tight labor market. Indeed, manufacturers continue to report the difficulties in finding talent as their top concern.

For the eighth consecutive month, there were more job openings in the U.S. economy (7,079,000 in October) than the number of people looking for work (6,075,000 in October and 5,975,000 in November). In addition, the number of nonfarm payroll job openings was not far from the all-time high (7,293,000) set in August. Along those lines, total quits in the nonfarm sector in October (3,514,000) remained highly elevated, even with some easing from the all-time high recorded in August (3,648,000). This is a sign Americans are feeling more comfortable leaving their job—likely to pursue other opportunities.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index pulled back for the third straight month from August’s all-time high (108.8), with the headline index dropping to a seven-month low (104.8). Despite some softening, small businesses remain upbeat overall. The percentage of respondents saying the next three months would be a “good time to expand” has declined from 34 in August (a record high) to 29 in November but continued to suggest robust activity. The deceleration in November’s main index stemmed largely from reduced sales expectations, which were the lowest since April.

At the same time, the labor market remained solid. Respondents cited the quality of labor (25 percent) as the top “single most important problem” for the 10th consecutive month, illustrating the current difficulty in finding new workers. The pace of job openings and hiring continued to be quite strong, even as postings slipped a little from October’s rate, which was the highest in the survey’s history. In addition, 61 percent of small business owners reported a capital expenditure over the past six months, the best reading since May.

- Producer Price Index: Producer prices for final demand goods and services edged up 0.1 percent in November, slowing after jumping 0.6 percent in October. For manufacturers, producer prices for final demand goods and services fell 0.4 percent in November, pulled lower by a 5.0 percent decline in energy costs. That was enough to offset higher food prices. Core inflation for goods, which excludes food, energy and trade services, rose 0.3 percent in November. Over the past 12 months, producer prices for final demand goods and services have risen 2.6 percent, or 2.9 percent year-over-year with food, energy and trade services excluded. As such, core pricing pressures remain elevated, especially relative to what firms had become accustomed to, but on the positive side, these costs appear to have stabilized, averaging 2.9 percent over the past five months without accelerating further—at least for now.

- Retail Sales: After jumping 1.1 percent in October, spending at retailers slowed to a 0.2 percent gain in November, which was in line with consensus expectations. Despite the smaller increase for the month, consumer spending remained strong overall, continuing to be one of the bright spots in the U.S. economy. Over the past 12 months, retail sales have risen by a relatively healthy 4.2 percent. The largest increases for the month came from nonstore retailers, electronics and appliance stores and furniture and home furnishings stores. Sales declined for gasoline stations, foods services and drinking places, clothing and accessories stores and building material and garden supply stores. Reduced prices pulled gasoline station sales lower in November.

On a year-over-year basis, the clear winner was nonstore retailers, with retail sales growth of 10.8 percent since November 2017. In contrast, department store sales decreased 0.2 percent year-over-year. As such, the brick-and-mortar versus online retail dynamics continued to play out in the sales data.

|

|

| A Message from Microsoft |

|

|

|

| Are you ready to modernize your manufacturing business? Take our digital transformation assessment. Start your journey today.

|

|

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|

|