|

| If you're having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE - May 20, 2019 - SHARE

|

|

<

|

|

|

Manufacturing Production Disappointed in April, Should Rise 1.4% in 2019 |

|

| The Weekly Toplines |

|

- Manufacturing production continued to disappoint, falling for the third time in the past four months, with output in the sector down 0.5 percent in April. This suggests that slowing global activity has taken its toll so far in 2019. Indeed, manufacturing production has declined 0.2 percent since April 2018, the first negative year-over-year reading since October 2016.

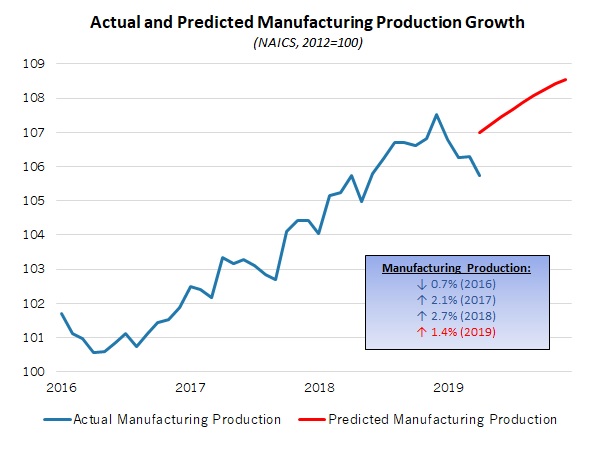

- Looking ahead, the current forecast is for manufacturing production (NAICS) to rise 1.4 percent in 2019, down from 2.7 percent in 2018 (see the attached graph). This would suggest some improvement in output data in the coming months, but perhaps at a pace that remains softer than desired.

- More encouragingly, regional economic surveys from the New York and Philadelphia Federal Reserve Banks point to improvements in manufacturing activity in May, and respondents feel upbeat about the next six months.

- New housing starts rose 5.7 percent in April, increasing for the second straight month to an annualized 1,235,000 units. Single-family and multifamily starts both increased for the month. With that said, new residential construction starts have fallen 2.5 percent over the past 12 months, illustrating ongoing challenges in the sector.

- Moving ahead, I expect 1.32 million housing starts for 2019, which would indicate a modest rebound from current levels. For their part, builders feel optimistic about sales over the next six months. Mortgage rates, which fell to 4.07 percent for a 30-year fixed-rate loan on average, are essentially the lowest since January 2018, which should help boost demand.

- Consumer sentiment rebounded in preliminary data to the best reading since January 2014, with Americans feeling more upbeat in their economic outlook. With that said, the University of Michigan and Thomson Reuters noted that survey responses largely pre-dated the latest news on ongoing trade negotiations, which could be reflected in the final data out on May 31.

- Meanwhile, retail sales decreased 0.2 percent in April, falling for the third time in the past five months. Overall, the data suggest that consumers have continued to be hesitant in their purchasing so far in 2019, but over the past 12 months, spending has risen a modest 3.1 percent.

- Virginia created the most net new manufacturing jobs in April, adding 2,100 workers, and Texas saw the greatest job gains in the sector over the past 12 months (up 31,600). Meanwhile, Vermont had the lowest unemployment rate in the nation in April at 2.2 percent.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, May 13

None

Tuesday, May 14

NFIB Small Business Survey

Wednesday, May 15

Industrial Production

NAHB Housing Market Index

New York Fed Manufacturing Survey

Retail Sales

Thursday, May 16

Housing Starts and Permits

Philadelphia Fed Manufacturing Survey

Friday, May 17

Conference Board Leading Indicators

State Employment Report

University of Michigan Consumer Sentiment

|

|

|

|

This Week's Indicators:

Monday, May 20

Chicago Fed National Activity Index

Tuesday, May 21

Existing Home Sales

Wednesday, May 22

FOMC Minutes (April 30 - May 1 Meeting)

Thursday, May 23

IHS Markit Flash U.S. Manufacturing PMI

Kansas City Fed Manufacturing Survey

New Home Sales

Friday, May 24

Durable Goods Orders and Shipments

|

|

|

| Deeper Dive |

|

- Conference Board Leading Indicators: The Leading Economic Index increased 0.2 percent in April, rising for the third straight month. As such, this is a sign the U.S. economy is possibly rebounding from recent weaknesses, which should bode well for growth over the next six months. With that said, manufacturing was one of the weaker aspects of the report, with new orders being a drag on the LEI for the month. The bright spots in the April report included consumer confidence, lending conditions and stock prices, among others. Meanwhile, the Coincident Economic Index edged up 0.1 percent for the second consecutive month in April. While industrial production was disappointing in April (see below), the other components (manufacturing and trade sales, nonfarm payrolls and personal income) provided a positive contribution to the CEI for the month.

- Housing Starts and Permits: New residential construction increased for the second straight month in April even as activity remains softer than desired overall. New housing starts rose 5.7 percent from an annualized 1,168,000 units in March to 1,235,000 units in April. Single-family and multifamily starts both increased for the month. With that said, new residential construction starts have fallen 2.5 percent over the past 12 months, down from 1,267,000 units in April 2018, with single-family activity off 4.3 percent. As such, the housing market remains somewhat challenged, despite the progress made in the April release. Builders feel upbeat about sales over the next six months (see below), largely on expectations that construction will rebound on reduced mortgage rates. Yet, affordability and workforce challenges remain.

With that in mind, the housing permits data--a proxy of future activity--are watched closely. New residential permits increased 0.6 percent, up from 1,288,000 units at the annual rate in March to 1,296,000 units in April. However, single-family permits dropped from 816,000 units to 782,000 units, the weakest reading since November 2016. In addition, housing permits fell 5.0 percent year-over-year, down from 1,364,000 units in April 2018, with single-family permitting dropping 9.4 percent. Therefore, there remains a lot of room for improvement.

Moving ahead, I expect 1.32 million housing starts for 2019, which would indicate a modest rebound from current levels.

- Industrial Production: Manufacturing production continued to disappoint, falling for the third time in the past four months, with output in the sector down 0.5 percent in April. Durable and nondurable goods production fell 0.9 percent and 0.1 percent, respectively, for the month, led by steep declines for electrical equipment, appliances and components; machinery; and motor vehicles and parts, among others. This suggests that slowing global activity has taken its toll so far in 2019. Indeed, manufacturing production has declined 0.2 percent since April 2018, the first negative year-over-year reading since October 2016. In addition, manufacturing capacity utilization has dropped from 77.3 percent in December, the best reading since March 2008, to 75.7 percent in the latest data, a 15-month low.

Looking ahead, the current forecast is for manufacturing production (NAICS) to rise 1.4 percent in 2019, down from 2.7 percent in 2018 (see the attached graph). This would suggest some improvement in output data in the coming months, but perhaps at a pace that remains softer than desired.

Meanwhile, similar to manufacturing production, total industrial production declined 0.5 percent in April, also falling in three of the past four months. In April, mining production increased 1.6 percent, but that was offset by declines in manufacturing and utilities output, with the latter down 3.5 percent for the month. Over the past 12 months, industrial production has risen just 0.9 percent, continuing to decelerate from the recent peak, a robust 5.4 percent in September. Total capacity utilization declined from 78.5 percent in March to 77.9 percent in April, the weakest reading in 14 months.

- NAHB Housing Market Index: The National Association of Home Builders and Wells Fargo reported that confidence rose in May to the best reading since October, with respondents continuing to feel optimistic about activity over the next six months. The Housing Market Index rose from 63 in April to 66 in May. Builders felt optimistic that reduced mortgage rates will help boost demand and increase overall affordability, and the sector has also bounced back from severe weather in recent months. With that said, the NAHB continued to cite challenges posed by higher construction costs and worker shortages.

- New York Fed Manufacturing Survey: Manufacturers in the New York Federal Reserve Bank’s district reported that activity improved in May. The headline index increased from 10.1 in April to 17.8 in May, a six-month high, with slightly better growth in new orders and shipments. With that said, hiring slowed in April, and inventories declined. Encouragingly, respondents to the Empire State Manufacturing Survey remain very positive in their outlook for the next six months, with roughly half expecting higher sales and shipments. Anticipated capital expenditures and technology spending also strengthened in the latest survey, even as hiring expectations softened somewhat. Respondents expect raw material costs to remain elevated over the coming months, albeit with some continued deceleration from the sharp rises predicted toward the end of last year.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index rose to the best reading so far in 2019, up from 101.8 in March to 103.5 in April. Despite softening from August’s all-time high (108.8), small businesses remain upbeat overall. One-quarter of respondents in April said the next three months would be a “good time to expand,” the strongest pace since November, and sales expectations also had the best reading year to date, with the net percentage of small business owners predicting increased sales over the next three months rising to 20 percent.

At the same time, the labor market remained solid overall. The percentage of small business owners saying they had job openings in April was 38 percent, just shy of the all-time high set in December and March, which was 39 percent. The net percentage planning to hire in the next three months rose from 18 percent to 20 percent in this survey, also the highest since December. In addition, respondents cited the quality of labor as the top “single most important problem” for the 14th straight month. Meanwhile, 58 percent of respondents reported making a capital expenditure in the past six months, with 27 percent of small business owners making capital spending plans for the next three to six months.

- Philadelphia Fed Manufacturing Survey: Manufacturing activity continued to expand in May, with the sector growing at the fastest rate since October, bouncing back after contracting in February. The composite index of general business activity rose from 8.5 in April to 16.6 in May, led by strength in shipments and employment. With that said, growth softened slightly for new orders and the average employee workweek. More importantly, manufacturers in the district remain optimistic in their outlook for the next six months. At least 44 percent of respondents expect new orders and shipments to rise in the coming months, with roughly one-third anticipating increased capital spending and 35.6 percent forecasting more hiring.

In addition, the index for expected input costs increased from 26.0 in April, the lowest reading since May 2016, to 42.3 in May. This suggests that raw material cost pressures are perhaps higher than desired. In special questions, respondents see product prices rising 2.8 percent over the next four quarters, with compensation up 3.0 percent over that time frame.

- Retail Sales: Consumer spending decreased 0.2 percent in April, falling for the third time in the past five months. In April, declines in building material and garden supplies, electronics and appliances and motor vehicles and parts pulled the data lower. Excluding automobiles, retail spending edged up 0.1. However, gasoline station sales increased 1.8 percent, largely on higher prices. Excluding motor vehicles and gasoline sales, Americans spent 0.2 percent less in April, and overall, the data suggest that consumers have continued to be hesitant in their purchasing so far in 2019.

Over the past 12 months, retail sales have risen 3.1 percent. Moving forward, retail sales are seen expanding a modest 3.0 percent in 2019, down from 4.7 percent in 2018.

- State Employment Report: Virginia created the most net new manufacturing jobs in April, adding 2,100 workers. Minnesota (up 1,600), North Carolina (up 1,400), New Jersey (up 1,100), Mississippi (up 1,000) and Washington (up 1,000) also topped the list of manufacturing employment gains in April. In addition, Texas saw the greatest job gains in the sector over the past 12 months, with manufacturing employment in the state up 31,600 since April 2018. Other states with the fastest manufacturing job growth year-over-year included Washington (up 10,900), Florida (up 10,300), California (up 10,200) and Virginia (up 9,200). Meanwhile, Vermont had the lowest unemployment rate in the nation in April at 2.2 percent.

- University of Michigan Consumer Sentiment: The Index of Consumer Sentiment rebounded in preliminary data to the best reading since January 2014, up from 97.2 in April to 102.4 in May. Americans felt more upbeat in their economic outlook, helping to boost the headline index. With that said, the University of Michigan and Thomson Reuters noted that survey responses largely pre-dated the latest news on ongoing trade negotiations, including the imposition of higher tariffs on imported Chinese goods. It is possible that this could reduce confidence in the final data, which will be released May 31.

|

|

| Take Action |

|

- Attend the 15th Annual Manufacturing Leadership Summit: Register now for the industry’s premier Manufacturing 4.0 conference this year, the NAM’s 2019 Manufacturing Leadership Summit at the Hyatt Regency in Huntington Beach, California, June 10-12. The overall theme for the event is Manufacturing 4.0: Going for Gold. Strategies to Identify and Deliver Business Value from the Digital Revolution’s Next Phase. Attend industry-leading keynotes, interactive think tanks, briefings from ML Awards winners, peer-to-peer networking events and the 2019 ML Awards Gala Dinner. To register, click here.

|

|

Thank you for subscribing to the NAM's Monday Economic Report.

If you're part of an NAM member company and not yet subscribed, email us. If you're not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|