|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – August 26, 2019 – SHARE

|

|

<

|

|

|

IHS Markit: Manufacturing Contracted for the First Time since 2009 |

|

| The Weekly Toplines |

|

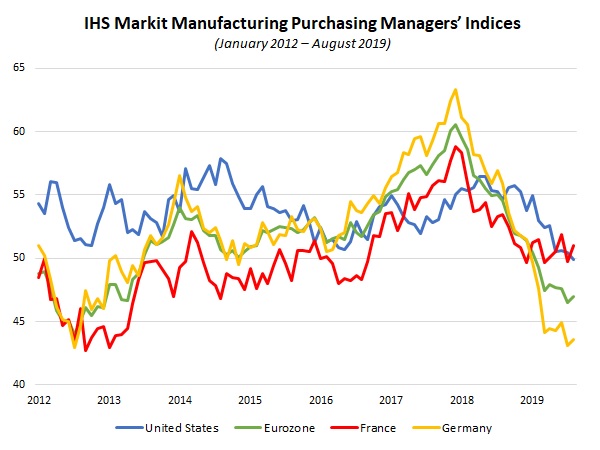

- The IHS Markit Flash U.S. Manufacturing PMI contracted ever so slightly in August for its first decline since September 2009. The headline index dropped from 50.4 in July to 49.9 in August, or just below neutral, led by declines in new orders and exports. While manufacturers remained positive in their outlook for the next six months, that optimism has waned notably year-to-date. In addition, raw material costs have decelerated to the slowest rate since June 2017.

- In a similar way, manufacturing activity in the Kansas City Federal Reserve Bank’s district contracted for the second consecutive month in August, with survey respondents citing softer overall demand, trade uncertainties and the inability to attract new talent as top concerns. This contrasts with modest expansions seen in the New York and Philadelphia Fed districts in August.

- Manufacturing activity in France rebounded in August after briefly contracting in July, with progress across the board. In contrast, German manufacturers continued to struggle, with the decline in activity not far from its worst reading in seven years. Indeed, survey respondents in Germany were also pessimistic about future output, with that measure plummeting from 43.1 to 39.9, the lowest point since the question was added in 2012.

- According to Freddie Mac, the average 30-year fixed rate mortgage rate dropped to 3.55 percent last week, the lowest since November 3, 2016. More importantly, this rate has fallen 139 basis points since peaking at 4.94 percent on November 15, 2018, roughly nine months ago.

- The housing market data last week were mixed. Existing home sales were up 2.5 percent in July, the best reading since February. This news suggests that reduced mortgage rates have produced some traction in the market despite lingering challenges with affordability and the lack of sufficient workers.

- Meanwhile, new single-family home sales dropped sharply, down 12.8 percent in July. However, this decrease came from a significant upward revision to the June data. New home sales declined from 728,000 units in June, its best reading since July 2007 and up from the previous estimate of 646,000, to 635,000 units in July.

The Federal Reserve remained in focus last week after Chair Jerome Powell delivered his speech in Jackson Hole, Wyoming, and after the minutes of the previous Federal Open Market Committee meeting were released. While the minutes reflect some disagreement over the need for additional rate cuts, I continue to expect the FOMC to reduce short-term interest rates at the September 17–18 meeting, following the 25-basis-point reduction made at the July 30–31 meeting. However, I also expect the Federal Reserve to hold rates after that to assess incoming data and economic conditions, but that could change if the situation warrants further action.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, August 19

None

Tuesday, August 20

None

Wednesday, August 21

Existing Home Sales

Thursday, August 22

Conference Board Leading Indicators

IHS Markit Flash U.S. Manufacturing PMI

Kansas City Fed Manufacturing Survey

Friday, August 23

New Home Sales

|

|

|

|

This Week's Indicators:

Monday, August 26

Chicago Fed National Activity Index

Dallas Fed Manufacturing Survey

Durable Goods Orders and Shipments

Tuesday, August 27

Conference Board Consumer Confidence

Richmond Fed Manufacturing Survey

Wednesday, August 28

None

Thursday, August 29

Gross Domestic Product (Revision)

International Trade in Goods (Preliminary)

Friday, August 30

Personal Consumption Expenditures Deflator

Personal Income and Spending

University of Michigan Consumer Sentiment (Revision)

|

|

|

| Deeper Dive |

|

- Existing Home Sales: The National Association of Realtors reported that existing home sales rose 2.5 percent, up from an annualized 5.29 million units in June to 5.42 million units in July. That reading, which was the best since February, reflected strength in every region except the Northeast, with all of the gain for the month coming from sales of single-family units. This news suggests that reduced mortgage rates have produced some traction in the market despite lingering challenges with affordability and the lack of sufficient workers. Along those lines, existing home sales have risen just 0.6 percent over the past 12 months, up from 5.39 million units in July 2018.

Chief Economist Lawrence Yun noted that inventories remain low, and in July, there were 4.2 months of supply in the market, down from 4.4 months in June. This decline has led to higher prices. The median sales price for existing homes has increased 4.3 percent year-over-year, up to $280,800 in the latest data but pulling back from the all-time high seen in June ($285,300).

- Conference Board Leading Indicators: The Leading Economic Index jumped 0.5 percent in July following 0.1 percent declines in both May and June. The strong increase was mainly attributable to solid data for building permits, consumer confidence, unemployment claims, the stock market and overall lending conditions. In contrast, new orders in the manufacturing sector remained a drag on the LEI in July, with the average workweek of production workers and the interest rate spread also pulling the headline figure lower.

Meanwhile, in July, the Coincident Economic Index rose by 0.2 percent for the second straight month. Industrial production fell 0.2 percent in July, with output in the manufacturing sector off 0.4 percent. The other subcomponents of the CEI (manufacturing and trade sales, nonfarm payrolls and personal income) continued to be bright spots in the economic data.

- IHS Markit Flash U.S. Manufacturing PMI: Manufacturing activity in the United States contracted ever so slightly in August for its first decline since September 2009, according to preliminary data from IHS Markit. The headline index dropped from 50.4 in July to 49.9 in August, or just below neutral, led by declines in new orders and exports. On the other hand, output rebounded in August after contracting briefly in July, and employment stabilized. Looking ahead six months, manufacturers completing the survey remained positive in their outlook for production, albeit with the measure for future output down from 61.1 to 58.3. Pricing pressures continued to decelerate, with raw material costs expanding at the slowest rate since June 2017. The indices for exports and input prices were at their lowest readings since those questions were added in 2009 and 2012, respectively.

Separately, the IHS Markit Flash Eurozone Manufacturing PMI was 47.0 in August, improving slightly from 46.5 in July but contracting for the seventh straight month. July’s reading had represented the fastest pace of decline since December 2012. Manufacturing activity in France rebounded in August after briefly contracting in July, with progress across the board. In contrast, German manufacturers continued to struggle, with the decline in activity not far from its worst reading in seven years. Indeed, survey respondents in Germany were also pessimistic about future output, with that measure plummeting from 43.1 to 39.9, the lowest point since the question was added in 2012.

- Kansas City Fed Manufacturing Survey: Manufacturing activity in the district contracted for the second consecutive month in August, with survey respondents citing softer overall demand, trade uncertainties and the inability to attract new talent as top concerns. The composite index declined from -1 in July to -6 in August, with new orders, shipments, production and employment all negative for the month. At the same time, exports stabilized in August, and the average workweek increased modestly after falling in July. In addition, the prices paid for inputs fell for the first time since March 2016, building on the deceleration in raw material costs seen over much of the past year.

Meanwhile, manufacturers remained positive about activity over the next six months. Thirty-nine percent of manufacturing firms in the region predict increased orders in the coming months, with 31 percent and 28 percent anticipating accelerated hiring and capital spending growth, respectively. Still, it is notable that respondents have become less upbeat than they were at this time last year.

- New Home Sales: New single-family home sales dropped sharply, down 12.8 percent in July. However, this decrease came from a significant upward revision to the June data. New home sales declined from 728,000 units in June, its best reading since July 2007 and up from the previous estimate of 646,000, to 635,000 units in July. As such, these data have been highly volatile, and in July, the reduction in activity came entirely from sharp sales decreases in every region except the Northeast.

In general, increased construction costs and worker shortages have challenged the housing market, but demand is expected to improve given lower mortgage rates. Over the past 12 months, new home sales have risen 4.3 percent, up from 609,000 units in July 2018. The median sales price was $312,800 in July, off 4.5 percent from one year ago.

|

|

| Take Action |

|

If you have not already done so, please take a moment to complete the latest NAM Manufacturers’ Outlook Survey. This 29-question survey will help us gauge how manufacturing sentiment has changed since the second quarter survey. The current survey includes special questions on trade uncertainties, infrastructure, immigration, tax reform and new technology implementation. To complete the survey, click here. Responses are due by Tuesday, September 3, at 5 p.m. EDT. As always, all responses are anonymous.

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|