|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – September 30, 2019 – SHARE

|

|

<

|

|

|

Manufacturing Sentiment Continued to Decline in the Third Quarter |

|

| The Weekly Toplines |

|

- In the latest NAM Manufacturers’ Outlook Survey, 67.9 percent of manufacturing respondents felt either somewhat or very positive about their own company’s outlook in the third quarter. This was down from 89.5 percent and 79.8 percent who said the same thing in the first and second quarters, respectively, and it was the lowest reading since the third quarter of 2016.

- The inability to attract and retain workers remained respondents’ top concern for the eighth consecutive survey, noted by almost 70 percent of respondents. Underscoring the severity of this challenge, 78.7 percent of respondents said they have open positions they are struggling to fill, and roughly one-third were forced to turn down business opportunities due to their inability to find sufficient talent. Trade uncertainties were the second most mentioned concern facing manufacturers, with 63.4 percent of respondents reporting it as the top company issue.

- Other reports also reflected soft manufacturing activity. For instance, surveys from the Kansas City and Richmond Federal Reserve Banks showed contracting activity in their districts in September, even as manufacturers continued to be positive about the next six months.

- Nationally, the IHS Markit Flash U.S. Manufacturing PMI improved in September, rising after expanding at the slowest pace since September 2009 in the August data. The headline index increased from 50.3 in August to 51.0 in September, according to preliminary data, led by a rebound in new orders, which had contracted in the previous survey.

- In contrast to better performance in the U.S., the IHS Markit Flash Eurozone Manufacturing PMI was 45.6 in September, down from 47.0 in August and the weakest reading since October 2012. This was led by severe challenges in Germany, which has contracted in every month so far in 2019, falling from 43.5 to 41.4, the lowest since June 2009.

- New durable goods orders edged up 0.2 percent in August, slowing after a solid gain of 2.0 percent in July. With transportation equipment excluded, new orders rose 0.5 percent in August.

- Overall, global economic headwinds and trade uncertainties continue to challenge growth in the manufacturing sector, with new durable goods orders down 3.0 percent over the past 12 months but with a slight increase of 0.2 percent with transportation equipment excluded.

- At the same time, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—fell 0.2 percent in August, and on a year-over-year basis, this figure decreased 0.3 percent.

- Personal income rose 0.4 percent in August, strengthening from the 0.1 percent gain in July. Over the past 12 months, personal income has risen 4.6 percent. In addition, manufacturing wages and salaries increased to $923.6 billion in August, up a solid 4.3 percent year-over-year.>

- Meanwhile, personal consumption expenditures edged up 0.1 percent in August, slowing after jumping 0.5 percent in July. Personal spending has increased a modest 3.7 percent over the past 12 months. The saving rate rose from 7.8 percent in July to 8.1 percent in August. The two measures of consumer confidence provided mixed data in September, with the University of Michigan report improving from August but the Conference Board noting some weakening data.

- The PCE deflator was flat in August, easing from the 0.2 percent gain in July and the slowest pace since January. Excluding food and energy, core prices edged up 0.1 percent in August. Over the past 12 months, the PCE deflator has risen 1.4 percent, the same pace as in July, but down from 2.3 percent year-over-year in August 2018. For eight consecutive months, or in every month so far in 2019, this measure has remained below the Federal Reserve’s stated goal of 2 percent core inflation.

- As such, the pricing data should provide some comfort to the Federal Open Market Committee, as it allows participants the luxury of being more “dovish” in setting monetary policy. The Federal Reserve has reduced short-term rates at both of the past two meetings, and while some are calling for another federal funds rate reduction at the Oct. 29–30 meeting, it is clear that there is no consensus on the FOMC yet for such a move.

- The U.S. economy grew 2.0 percent at the annual rate in the second quarter, consistent with the Bureau of Economic Analysis’ earlier estimate but down from 3.1 percent growth in the first quarter. Moving forward, I estimate 2.3 percent growth at the annual rate in the third quarter, with the same pace for 2019 as a whole. The outlook is for 1.8 percent growth in 2020, but with strong cases for both upside and downside risks to that figure, at least for now.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, September 23

Chicago Fed National Activity Index

IHS Markit Flash U.S. Manufacturing PMI

NAM Manufacturers’ Outlook Survey

Tuesday, September 24

Conference Board Consumer Confidence

Richmond Fed Manufacturing Survey

Wednesday, September 25

New Home Sales

Thursday, September 26

Gross Domestic Product (Second Revision)

International Trade in Goods (Preliminary)

Kansas City Fed Manufacturing Survey

Friday, September 27

Durable Goods Orders and Shipments

Personal Consumption Expenditures Deflator

Personal Income and Spending

University of Michigan Consumer Sentiment (Revision)

|

|

|

|

This Week's Indicators:

Monday, September 30

Dallas Fed Manufacturing Survey

Tuesday, October 1

Construction Spending

ISM® Manufacturing Purchasing Managers’ Index®

Wednesday, October 2

ADP National Employment Report

Thursday, October 3

Factory Orders and Shipments

Friday, October 4

BLS National Employment Report

International Trade Report

|

|

|

| Deeper Dive |

|

- Chicago Fed National Activity Index: The Chicago Federal Reserve Bank reported that the National Activity Index rebounded in August after declining in July. The headline index rose from -0.41 in July to 0.10 in August. Index readings above zero are consistent with economic growth that is above trend and vice versa. The manufacturing sector helped to boost this measure, with production up 0.5 percent in the month after dropping in the prior release. Still, manufacturing output remained negative year-over-year, and employment was also softer than desired.

- Conference Board Consumer Confidence: Consumer sentiment fell to a three-month low, with the headline index down from 134.2 in August to 125.1 in September. Americans felt less upbeat in their perceptions of both current and future economic conditions, with trade tensions and market volatility in the public’s mind. This diminished their assessments of the labor market and income growth, but to be fair, consumers remained more positive than not.

The percentage of respondents suggesting that business conditions were “good” decreased from 40.9 percent to 37.3 percent, while those noting conditions were “bad” ticked up from 9.9 percent to 12.7 percent. In addition, the percentage of Americans feeling that jobs were “plentiful” dropped from 50.3 percent to 44.8 percent, but that remained significantly higher than those responding that jobs were “hard to get,” which dipped from 12.0 percent to 11.6 percent.

- Durable Goods Orders and Shipments: New durable goods orders edged up 0.2 percent in August, slowing after a solid gain of 2.0 percent in July. Yet, the previous month’s sizable increase stemmed largely from nondefense aircraft orders, which are often highly volatile from month to month. In August, new orders rose 0.5 percent with transportation equipment excluded, bouncing back from the decline of 0.5 percent in July. Fabricated metal products, primary metals and other durable goods segments strengthened in August, but computers and electronic products, electrical equipment, appliances and components and motor vehicles and parts had reduced sales.

Overall, global economic headwinds and trade uncertainties continue to challenge growth in the manufacturing sector. Indeed, new durable goods orders have decreased 3.0 percent over the past 12 months, with a slight increase of 0.2 percent with transportation equipment excluded. This suggests relatively flat demand year-over-year for the broader measure of durable goods. At the same time, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—fell 0.2 percent in August, and on a year-over-year basis, this figure decreased 0.3 percent.

Meanwhile, durable goods shipments inched up 0.1 percent in August, but with an increase of 0.5 percent excluding transportation equipment sales. On a year-over-year basis, durable goods shipments rose 0.3 percent, with core capital goods shipments up 1.7 percent since August 2018.

- Gross Domestic Product (Second Revision): The U.S. economy grew 2.0 percent at the annual rate in the second quarter, consistent with the Bureau of Economic Analysis’ earlier estimate but down from 3.1 percent growth in the first quarter. Consumer and government spending buoyed growth for the quarter, but drags from business spending and net exports counterbalanced this somewhat. Slowing global growth and trade uncertainties were both challenges in the second quarter, with businesses hesitant to increase spending. Along those lines, nonresidential fixed investment fell 1.0 percent in the second quarter, the first decline since the first quarter of 2016.

Moving forward, I estimate 2.3 percent growth at the annual rate in the third quarter, with the same pace for 2019 as a whole. The outlook is for 1.8 percent growth in 2020, but with strong cases for both upside and downside risks to that figure, at least for now.

- IHS Markit Flash U.S. Manufacturing PMI: Manufacturing activity in the United States improved in September, rising after expanding at the slowest pace since September 2009 in the August data. The headline index increased from 50.3 in August to 51.0 in September, according to preliminary data, led by a rebound in new orders, which had contracted in the previous survey. Output and employment also accelerated in September, with the rate of decline for exports slowing. Looking ahead six months, manufacturers completing the survey remained positive in their outlook for production, with stronger growth expected. Raw material costs had expanded in August at the slowest rate since June 2017, and in September, pricing pressures picked up somewhat, but only modestly.

In contrast to better performance in the U.S., the IHS Markit Flash Eurozone Manufacturing PMI was 45.6 in September, down from 47.0 in August and the weakest reading since October 2012. It was also the eighth straight monthly contraction in European manufacturing, highlighting the dramatic slowdown in activity on the continent. This was led by severe challenges in Germany, which has contracted in every month so far in 2019, falling from 43.5 to 41.4, the lowest since June 2009. In France, manufacturing activity slowed to near neutral, down from 51.1 to 50.3 but expanding (slightly) for the second consecutive month. New orders, output and exports fell modestly, however, in France in September.

- International Trade in Goods (Preliminary): In advance statistics, the goods trade deficit ticked somewhat higher, up from $72.46 billion in July to $72.83 billion in August. The increase stemmed from a gain in goods imports (up $549 million) that exceeded the rise in goods exports (up $178 million) for the month. For goods exports, stronger growth for automotive vehicles, foods, feeds and beverages and industrial supplies were just enough to offset declines for capital goods and consumer goods. Final data will be released Oct. 4, which will also include the service-sector trade surplus.

- Kansas City Fed Manufacturing Survey: Manufacturing activity in the district contracted for the third consecutive month in September, albeit with rebounds in production and shipments. The rate of decline for new orders also slowed. At the same time, hiring fell for the third straight month, decreasing at the fastest pace since March 2016, and exports were lower for the third time in the past four months. In contrast, the average employee workweek increased modestly. Beyond those indicators, after falling for the first time in more than three years last month, the prices paid for inputs declined once again in September, building on the deceleration in raw material costs seen over much of the past year

Meanwhile, manufacturers remained positive about activity over the next six months. Thirty-eight percent of manufacturing firms in the region predict increased orders in the coming months, with 35 percent and 26 percent anticipating accelerated hiring and capital spending growth, respectively. Still, it is notable that respondents have become less upbeat than this time last year. In the sample comments, those completing the survey noted ongoing trade concerns and the inability to find sufficient talent as challenges in their outlook.

- NAM Manufacturers’ Outlook Survey: There has been a sizable deterioration in business confidence over the past six months, as shown in the latest NAM Manufacturers’ Outlook Survey. In the third quarter of 2019, 67.9 percent of manufacturing respondents felt either somewhat or very positive about their own company’s outlook. This was down from 89.5 percent and 79.8 percent who said the same thing in the first and second quarters, respectively, and it was the lowest reading since the third quarter of 2016 (61.0 percent).

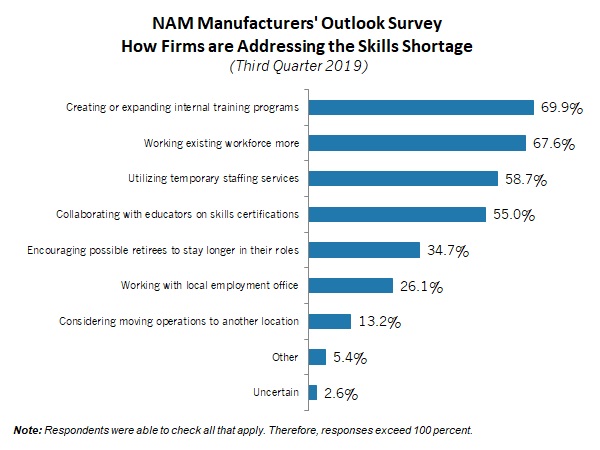

The inability to attract and retain workers remained respondents’ top concern for the eighth consecutive survey, noted by almost 70 percent of respondents. Underscoring the severity of this challenge, 78.7 percent of respondents said they have open positions they are struggling to fill, and roughly one-third were forced to turn down business opportunities due to their inability to find sufficient talent—a challenge heightened by the tight labor market and baby-boomer retirements. Trade uncertainties were the second most mentioned concern facing manufacturers, with 63.4 percent of respondents reporting it as the top company issue.

Other top challenges cited included rising health care and insurance costs (51.8 percent), the weaker domestic economy (45.3 percent), increased raw material costs (41.7 percent) and a weaker global economy (34.2 percent). The business climate, which for years used to be one of the top challenges facing manufacturers, continued to languish toward the bottom of the list of top challenges, largely as a result of pro-growth federal policies over the past few years like tax reform and regulatory certainty. When asked about the impact of Congress potentially rolling back tax reform’s pro-growth provisions, as some lawmakers and presidential candidates have discussed, 63.8 percent of respondents said it could lead to reduced capital investments in the United States, and half said it might force them to scale back employment.

- New Home Sales: New single-family home sales rebounded, up 7.1 percent in August after falling 8.6 percent in July. New home sales rose from 666,000 units in July to 713,000 units in August. Sales of new homes in the South and West led the improvements in August, while sales in the Midwest and Northeast lagged. While the data have been highly volatile in recent months, the trendline has been largely positive, suggesting that homebuyers are reacting favorably to reduced mortgage rates. Indeed, new single-family home sales have jumped 18.0 percent over the past 12 months, up from 604,000 units in August 2018.

There were 5.5 months of supply on the market in August, down from 5.9 months in July. In general, there has been a notable decrease in inventories of new homes for sale this year, down from 7.4 months in December. The median sales price was $328,400 in August, up 2.2 percent from one year ago.

- Personal Consumption Expenditures Deflator: The PCE deflator was flat in August, easing from the 0.2 percent gain in July and the slowest pace since January. Reduced food and energy prices helped keep a lid on costs, with those measures down 0.2 percent and 2.0 percent in August, respectively. The core PCE deflator, which excludes food and energy prices, edged up 0.1 percent in August. Over the past 12 months, the PCE deflator has risen 1.4 percent, the same pace as in July but down from 2.3 percent year-over-year in August 2018. For eight consecutive months, or in every month so far in 2019, this measure has remained below the Federal Reserve’s stated goal of 2 percent core inflation.

As such, the pricing data should provide some comfort to the Federal Open Market Committee, as it allows participants the luxury of being more “dovish” in setting monetary policy. The Federal Reserve has reduced short-term rates at both of the past two meetings, and while some are calling for another federal funds rate reduction at the Oct. 29–30 meeting, it is clear that there is no consensus on the FOMC yet for such a move.

- Personal Income and Spending: Personal income rose 0.4 percent in August, strengthening from the 0.1 percent gain in July. Over the past 12 months, personal income has risen 4.6 percent, the same year-over-year pace as in July but down from 4.9 percent in June. In addition, manufacturing wages and salaries increased from $920.0 billion in July to $923.6 billion in August. That would indicate a solid 4.3 percent growth rate since August 2018, which was $885.1 billion.

Meanwhile, personal consumption expenditures edged up 0.1 percent in August, slowing after jumping 0.5 percent in July. Durable goods spending rose 0.7 percent in August, but consumers spent 0.2 percent less on nondurable goods for the month. On a year-over-year basis, personal spending has increased a modest 3.7 percent, with durable and nondurable goods purchases up 4.4 percent and 3.4 percent since August 2018, respectively.

With strong income growth but slowing spending, the saving rate rose from 7.8 percent in July to 8.1 percent in August. In general, Americans have saved more this year than last, with the saving rate averaging 8.2 percent year to date in 2019, up from 7.7 percent through the first eight months of 2018.

- Richmond Fed Manufacturing Survey: The Richmond Federal Reserve Bank reported that manufacturing activity, after stabilizing in August, fell for the second time in three months in September. The composite index of general business activity decreased from 1 in August to -9 in September, led by declines in new orders, shipments, capacity utilization and the average workweek. Hiring rebounded in September after shifting lower in the prior two months, with wage growth accelerating. Moving forward, manufacturers in the district remained mostly optimistic about the next six months, albeit with some easing in the growth expected for sales and shipments. Respondents expected employment and capital spending to pick up in the coming months, and firms continued to note an inability to find sufficient talent.

Raw material costs changed little in the latest survey, up 2.68 percent at the annual rate in September but down slightly from 2.69 percent in August and a pullback from the 3.04 percent annual rate in July. Manufacturers also predict some deceleration in price growth, with respondents expecting an annualized 2.10 percent increase six months from now, down from 2.28 percent in August and the slowest pace since June 2018.

- University of Michigan Consumer Sentiment: The Index of Consumer Sentiment stabilized in September after falling to the lowest point in nearly three years in August, according to the University of Michigan and Thomson Reuters. The headline measure rose from 89.8 in August to 93.2 in September, an improvement from the preliminary estimate of 92.0 released a few weeks ago. Overall, Americans felt somewhat more upbeat in their assessments of current and future conditions in this survey relative to last month, when consumers expressed anxiousness about increased trade policy uncertainties and volatility in financial markets.

|

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|