|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – March 9, 2020 – SHARE   |

|

|

| |

|

| Outlook Worries Send Rates to Historic Lows Despite Federal Reserve Action |

|

| The Weekly Toplines |

|

- The COVID-19 pandemic has dramatically disrupted supply chains, demand and production for manufacturers. A special survey conducted by the NAM and released March 12 examined the economic and operational impacts of COVID-19. More than 78% of manufacturers anticipate a financial impact, more than 53% of manufacturers anticipate a change in operations and more than 35% of manufacturers are facing supply chain disruptions as a result of COVID-19.

- Meanwhile, fears of getting sick have forced closures and other measures to contain the virus from spreading further. The economic impacts of this are immense, especially as businesses and consumers pull back on spending and grapple with the additional costs. Financial markets have tumbled significantly over the past month, with equities in “bear” territory and bond yields shifting into record-low rates.

- The turbulence in stock and bond markets will no doubt hamper confidence, potentially forcing more hesitance in spending, at least in the short-term. On the positive side, the record lows in interest rates have resulted in huge jumps in mortgage refinancing. That should help to spur further growth in housing construction and sales. With that said, preliminary data for March from the University of Michigan and Thomson Reuters suggest that consumer sentiment did not fall as much as feared. Final figures will be released on March 27.

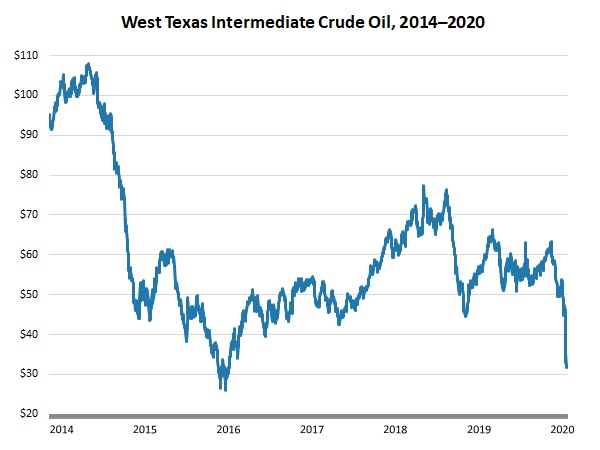

- The other notable development was the oil market battle between the Organization of the Petroleum Exporting Countries and Russia, which has pushed petroleum prices down to levels not seen since early 2016. This may likely result in sizable pullbacks in energy output, potentially damaging manufacturers and the macroeconomy, especially if the battle is prolonged.

- There is great uncertainty in several significant factors contributing to our overall economic outlook. I expect the U.S. economy to grow around 1.2% in 2020, almost half of the pace seen in 2019, which was 2.3%. More importantly, though, the risk of a recession has increased substantially, especially given the pullback in spending related to the global COVID-19 pandemic and with the potential of further retrenchment in the energy sector.

- We are likely to see reduced real GDP readings in the first and second quarters, especially given the global retrenchments in activity. Ideally, though, any downturn would be short-lived. A v-shaped recovery is entirely plausible in the second half of this year if activity rebounds once the current challenges abate.

- Last week, the New York Federal Reserve Bank’s Open Market Trading Desk said that it would offer up to $1.5 trillion in repurchase agreements (“repo” market). Its previously announced plan to purchase $60 billion in short-term assets each month will now span a “wide variety of maturities.” According to its statement, “These changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak.”

- Producer prices for final demand goods dropped by 0.9% in February, its largest monthly decline since September 2015. Lower input costs are likely due to disruptions in activity from COVID-19 worries. Core inflation for goods, which excludes food and energy, edged down 0.1% in February. Over the past 12 months, producer prices for final demand goods and services decelerated from 2.1% in January to 1.3% in February.

- The Federal Open Market Committee is likely to pursue additional monetary stimulus at its next meeting on March 17–18, building on the emergency actions taken on March 3. The main concern will be deflationary pressures in the economy and a desire to extend the recovery and avert a downturn.

|

|

|

| Economic Indicators |

|

Last Week’s Indicators:

(Summaries Appear Below)

Monday, March 9

None

Tuesday, March 10

NFIB Small Business Survey

Wednesday, March 11

Consumer Price Index

Thursday, March 12

Producer Price Index

Friday, March 13

University of Michigan Consumer Sentiment |

|

|

|

This Week's Indicators:

Monday, March 16

New York Fed Manufacturing Survey

State Employment Report

Tuesday, March 17

Industrial Production

NAHB Housing Market Index

Retail Sales

Wednesday, March 18

Housing Starts and Permits

Thursday, March 19

None

Friday, March 20

Existing Home Sales |

|

|

| Deeper Dive |

|

- Consumer Price Index: Consumer prices edged up 0.1% in February, the same pace as in January. Higher prices for food, up 0.4%, were somewhat offset by reduced energy costs, down 2.0%. Over the past 12 months, the consumer prices index has risen 2.3%, down from 2.5% year-over-year in the previous release. At the same time, core inflation (which excludes food and energy) increased by 0.2% in February, with 2.4% growth over the past 12 months, its highest rate since August.

Nonetheless, inflation appears to be stable and not far from the Federal Reserve’s stated goal of core price inflation around 2%, even with some appreciation in the latest figures. Over the past year, consumer prices were notably higher for medical care and shelter expenses. However, prices for apparel and used cars and trucks have fallen since February 2019, with costs for new vehicles up just 0.4% year-over-year.

- NFIB Small Business Survey: The National Federation of Independent Business said that the Small Business Optimism Index inched up from 104.3 in January to 104.7 in February. Overall, small business owners remained positive in their outlook.

Difficulties in finding talent remained the top “single-most important problem” for the 23rd consecutive month, signaling continued strength in the labor market for small firms. There were 38% of respondents noting job openings in February, up from 37% in January. The net percentage of firms saying that they increased hiring in the last three months was up from 9% to 13%. A net percentage of 21% reported increased hiring plans over the next three months, up from 19% in the previous survey. In addition, a net percentage of 36% observed increased compensation during the last three months, the same pace as in January, both the best readings since January 2019.

There was some easing in several key measures, albeit at still-healthy paces. The percentage of respondents saying that now is a “good time to expand” declined from 28% to 26%, and the net percentage of those feeling that sales would rise in the next three months decreased from 23% to 19%. On the capital spending front, small firms continued to cite solid growth in expenditures over the past six months despite edging down from 63% to 62% in this survey.

- Producer Price Index: Producer prices for final demand goods and services fell 0.6%, reversing the 0.5% gain seen in January. More importantly, producer prices for final demand goods dropped by 0.9% in February, its largest monthly decline since September 2015. Lower input costs are lower likely due to disruptions in activity from COVID-19 worries. Energy costs were down 3.6% for the month, with food prices off by 1.6%. Core inflation for goods, which excludes food and energy, edged down 0.1% in February. Meanwhile, producer prices for final demand services were also lower, down 0.3% in February.

Over the past 12 months, producer prices for final demand goods and services decelerated from 2.1% in January to 1.3% in February. Likewise, core producer prices have grown 1.4% year-over-year, slowing from 1.6% year-over-year in January. To illustrate just how much core PPI growth has eased over the past 12 months, the seasonally adjusted year-over-year rate registered 2.4% in February 2019.

Overall, inflation remains minimal and below the Federal Reserve’s stated target. If anything, the deceleration in input costs in February reflects weaknesses in the marketplace as the COVID-19 pandemic has taken hold. The Federal Open Market Committee is likely to pursue additional monetary stimulus at its next meeting on March 17–18, building on the emergency actions taken on March 3. The main concern will be deflationary pressures in the economy and a desire to extend the recovery and avert a downturn.

- University of Michigan Consumer Sentiment: The Index of Consumer Sentiment declined from 101.0 in February to 95.9 in March, pulling back from nearly a two-year high to a five-month low, according to preliminary data from the University of Michigan and Thomson Reuters. While confidence fell in March, both for current conditions and the outlook, the release notes that “the initial response to the pandemic has not generated the type of economic panic among consumers that was present in the runup to the Great Recession.” As such, consumers continue to be relatively confident for now, albeit only cautiously so. Final data will be released on March 27.

|

|

Thank you for subscribing to the NAM's Monday Economic Report.

If you're part of an NAM member company and not yet subscribed, email us. If you're not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Interested in becoming a presenter of the Monday Economic Report? Email us. |

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

| © 2020 National Association of Manufacturers |

|

|

|

|

|

|

|

|

|

|