|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

| By Chad Moutray, Ph.D., CBE – May 11, 2020 – SHARE |

|

|

| |

|

| The U.S. Economy Lost a Record-Breaking 20.5 Million Workers in April |

|

| The Weekly Toplines |

|

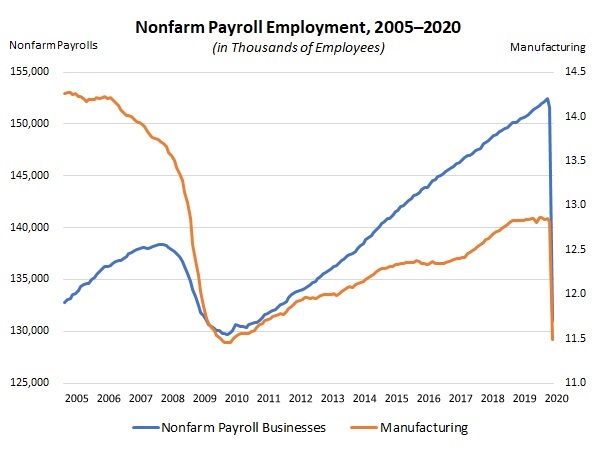

- The U.S. economy lost 20,500,000 workers in April, the largest monthly decline in employment in the history of the series, as the nation struggles with the abrupt halt in business activity amid the COVID-19 outbreak. Manufacturers shed 1,330,000 employees for the month, also a record monthly loss, with employment dropping to the lowest level since January 2010 and with declines in every manufacturing sector. The current outlook is for manufacturing employment to bounce back to roughly 12,250,000 million workers by year’s end.

- The unemployment rate soared to 14.7% in April, a staggering pace of job loss not seen since the Great Depression. At the same time, the so-called “real unemployment rate”—which includes those marginally attached to the workforce, including discouraged workers and the underemployed—rose to 22.8% in April. The participation rate in the labor force dropped from 62.7% in March to 60.2% in April, with 6,570,000 more Americans leaving the labor force.

- Of course, the key to the data will be the extent to which these jobs return once economic activity starts to resume and stay-at-home orders are lifted. Of the 20,626,000 workers who lost their job in April, 78.6% of them, or 18,063,000, said they were on “temporary layoff.” That suggests that the vast majority of nonfarm payroll workers plan to return to work once they are able to do so.

- There were 3,169,000 initial unemployment claims for the week ending May 2, and over the past seven weeks, 33,483,000 Americans filed for unemployment insurance, illustrating dire conditions in the labor market as the COVID-19 crisis has taken hold. The unemployment rate could peak around 20% to 22% this month before starting to fall. The current forecast is for the unemployment rate to be 9% to 10% by year’s end.

- The severe negative economic impacts of COVID-19 can be seen in other data released last week as well.

- New orders for manufactured goods fell 10.3% in March, the largest monthly decline since July 2014, with a decrease of 3.7% with transportation equipment excluded. Durable and nondurable goods orders fell 14.7% and 5.8% in March, respectively, with durable goods sales excluding transportation down a more modest 0.4% for the month. Nonetheless, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—edged down 0.1% in March, declining 0.8% over the past 12 months.

- Meanwhile, factory shipments decreased 5.2% in March, with durable and nondurable goods shipments off 4.7% and 5.8%, respectively.

- The U.S. trade deficit rose from $39.81 billion in February to $44.42 billion in March, but the increase came largely from dramatically reduced trade volumes globally. Goods exports and imports fell to levels not seen since 2017. Exports for automotive vehicles and parts were at levels not seen since November 2011, and the March goods trade deficit with China was the lowest since March 2004.

- In non-seasonally adjusted data, U.S.-manufactured goods exports have fallen 4% in the first quarter of 2020 relative to the first three months of 2019.

- U.S. consumer credit outstanding fell 3.4% in March. More importantly, revolving credit (which includes credit cards and other credit lines) plummeted 30.9% for the month, reflecting the anxiousness of the consumer and the extent to which purchases—at least those done on credit—have fallen sharply.

- Manufacturing labor productivity fell 3.3% at the annual rate in the first quarter, the fastest rate of decline since the fourth quarter of 2015. Output in the sector fell sharply at rates not seen since the second quarter of 2009, plummeting 7.1%.

|

|

|

| Economic Indicators |

|

Last Week’s Indicators:

(Summaries Appear Below)

Monday, May 4

Factory Orders and Shipments

Tuesday, May 5

International Trade Report

Wednesday, May 6

ADP National Employment Report

Thursday, May 7

Consumer Credit

Productivity and Costs

Weekly Initial Unemployment Claims

Friday, May 8

BLS National Employment Report |

|

|

|

This Week's Indicators:

Monday, May 11

None

Tuesday, May 12

Consumer Price Index

NFIB Small Business Survey

Wednesday, May 13

Producer Price Index

Thursday, May 14

Weekly Initial Unemployment Claims

Friday, May 15

Industrial Production

Job Openings and Labor Turnover Survey

New York Fed Manufacturing Survey

Retail Sales

University of Michigan Consumer Sentiment |

|

|

| Deeper Dive |

|

- ADP National Employment Report: There were 20,236,000 fewer workers at nonfarm private business establishments in April, according to ADP estimates, illustrating the sharp drop in economic activity as the nation grapples with the COVID-19 outbreak. That was the largest employment decline in the history of the ADP report, which dates to April 2002.

Manufacturing employment fell by 1,674,000 for the month, with total employment in the sector dropping from 12,782,000 in March to 11,108,000 in April. The steep job declines are both sobering and heartbreaking, with dramatic decreases in employment in many sectors, especially for service-sector businesses. In addition to manufacturing, the number of workers fell sharply for leisure and hospitality (down 8,607,000), trade, transportation and utilities (down 3,440,000), construction (down 2,477,000) and professional and business services (down 1,167,000). The data are likely to remain bleak in May, but should start to rebound in the months that follow.

In April, small and medium-sized businesses (i.e., those with fewer than 500 employees) shed 11,274,000 workers, or 55.7% of the total. This speaks to the unique challenges that smaller businesses face during the COVID-19 crisis.

- BLS National Employment Report: The U.S. economy lost 20,500,000 workers in April, the largest monthly decline in employment in the history of the series, which dates to 1939, as the nation struggles with the abrupt halt in business activity amid the COVID-19 outbreak. The manufacturing sector shed 1,330,000 employees for the month, also a record monthly loss, falling from 12,852,000 in February, to 12,818,000 in March, to 11,488,000 in April. That was the lowest employment level in the manufacturing sector since January 2010.

Employment declines occurred in each of the major manufacturing sectors in April:

- Transportation equipment (down 421,300, including a decline of 381,500 for motor vehicles and parts)

- Fabricated metal products (down 108,700)

- Miscellaneous durable goods (down 90,800)

- Food manufacturing (down 86,300)

- Machinery (down 79,500)

- Printing and related support activities (down 79,000)

- Plastics and rubber products (down 65,500)

- Nonmetallic mineral products (down 61,600)

- Furniture and related products (down 59,200)

- Miscellaneous nondurable goods (down 54,900)

- Apparel (down 42,200)

- Primary metals (down 34,300)

- Chemicals (down 31,100)

- Wood products (down 27,900)

- Electrical equipment and appliances (down 20,800)

- Textile product mills (down 21,100)

- Textile mills (down 19,500)

- Computer and electronic products (down 9,600)

- Petroleum and coal products (down 8,700)

- Paper and paper products (down 8,200)

The unprecedented losses in nonfarm payroll employment were led by service-providing sectors, which lost 17,165,000 in April. Goods-producing sectors, including manufacturing, shed 2,355,000 employees in the month.

- Leisure and hospitality (down 7,653,000)

- Education and health services (down 2,544,000)

- Professional and business services (down 2,128,000)

- Retail trade (down 2,106,900)

- Manufacturing (down 1,330,000)

- Other services (down 1,267,000)

- Government (down 980,000)

- Construction (down 975,000)

- Transportation and warehousing (down 584,100)

- Wholesale trade (down 362,800)

- Financial activities (down 262,000)

- Information (down 254,000)

- Real estate and rental and leasing (down 221,900)

- Mining and logging (down 50,000)

Meanwhile, the unemployment rate soared from 4.4% in March to 14.7% in April, a staggering pace of job loss not seen since the Great Depression. The number of unemployed workers in the U.S. has jumped from 5,787,000 in February, to 7,140,000 in March, to 23,078,000 in April, and the weekly unemployment claims data (see below) suggest that this will rise to more than 30 million in May. Indeed, the so-called “real unemployment rate”—which includes those marginally attached to the workforce, including discouraged workers and the underemployed—has risen sharply from 7% in February, to 8.7% in March, to 22.8% in April. The participation rate in the labor force dropped from 62.7% in March to 60.2% in April, with 6,570,000 more Americans leaving the labor force.

Of course, the key to the data will be the extent to which these jobs return once economic activity starts to resume and stay-at-home orders are lifted. Of the 20,626,000 workers who lost their job in April, 78.6% of them, or 18,063,000, said they were on “temporary layoff.” That suggests that the vast majority of nonfarm payroll workers plan to return to work once they are able to do so.

The current outlook is for manufacturing employment to bounce back to roughly 12,250,000 million workers by year’s end. The current expectation is for the unemployment rate to peak at 20% to 22% in May, improving to a still-elevated 10% unemployment rate by year’s end.

- Consumer Credit: U.S. consumer credit outstanding fell 3.4% in March, with Americans pulling back on spending during the COVID-19 pandemic. More importantly, revolving credit (which includes credit cards and other credit lines) plummeted 30.9% for the month, reflecting the anxiousness of the consumer and the extent to which purchases—at least those done on credit—have fallen sharply. In contrast, nonrevolving credit (which includes auto and student loans) rose 6.2% in March.

Overall, total consumer credit registered $4.209 trillion in March, down from $4.221 trillion in February. Revolving credit dropped from $1.094 trillion to $1.066 trillion for the month, with nonrevolving credit rising from $3.127 trillion to $3.143 trillion. Over the past 12 months, consumer credit outstanding has increased 2.1%, with nonrevolving credit up 3.5% year-over-year but revolving credit down 1.7% year-over-year. It was the first decline in year-over-year growth for outstanding revolving credit since July 2012.

- Factory Orders and Shipments: New orders for manufactured goods fell 10.3% in March, the largest monthly decline since July 2014, as firms continue to struggle with disruptions due to COVID-19. The data were skewed by significant declines in demand for transportation equipment and nondefense aircraft and parts. Excluding transportation equipment, orders decreased 3.7% in March, extending the loss of 1.1% in February. Durable and nondurable goods orders fell 14.7% and 5.8% in March, respectively, with durable goods sales excluding transportation down a more modest 0.4% for the month.

The underlying data mostly decreased, including new orders for fabricated metal products, furniture and related parts, machinery, motor vehicles and parts and primary metals. In contrast, sales of electrical equipment, appliances and components increased in March, with computers and electronic products demand flat.

On a year-over-year basis, new orders in the manufacturing sector have plummeted 11.4% since March 2019, with sales down 4.2% year-over-year with transportation equipment excluded. Moreover, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—edged down 0.1% in March, declining 0.8% over the past 12 months.

Meanwhile, factory shipments decreased 5.2% in March, with durable and nondurable goods shipments off 4.7% and 5.8%, respectively. With transportation equipment excluded, shipments declined 3.6% for the month. Since March 2019, manufactured goods shipments have decreased 6.5%, or a decline of 4.2% without transportation equipment included. Core capital goods shipments fell 1% year-over-year.

- International Trade Report: After falling to the lowest level since September 2016 in the previous release, the U.S. trade deficit rose from $39.81 billion in February to $44.42 billion in March. With economies around the world slowing due to COVID-19, sharp reductions in trade volumes accounted for the shift in March, but with goods exports (down from $137.33 billion to $128.11 billion) falling by more than goods imports (down from $198.37 billion to $193.71 billion). The paces for goods exports and imports were the lowest since May 2017 and August 2017, respectively. Service-sector trade volumes also declined dramatically, both for exports and imports, but the surplus changed little at $21.18 billion. On the positive side, the petroleum trade surplus was the highest on record, at $2.10 billion.

In March, the sizable decrease in goods exports stemmed from significant reductions in industrial supplies and materials (down $2.89 billion), automotive vehicles and parts (down $2.46 billion), non-automotive capital goods (down $2.02 billion) and consumer goods (down $821 million). For goods imports, declines for consumer goods (down $3.98 billion) and automotive vehicles and parts (down $2.73 billion) were enough to counteract increases for non-automotive capital goods (up $1.51 billion), foods, feeds and beverages (up $441 million) and industrial supplies and materials (up $399 million).

The underlying data reflect weaknesses in the economy and shifting trade patterns for airplanes, automobiles and parts, cell phones, computers, jewelry, machinery, metals and petroleum, among other trends. Exports for automotive vehicles and parts ($11.30 billion) were at levels not seen since November 2011, and the March goods trade deficit with China ($11.83 billion) was the lowest since March 2004.

In non-seasonally adjusted data, U.S.-manufactured goods exports totaled $269.57 billion in the first quarter of 2020, down 4% from $280.80 billion in the first three months of 2019. As such, it suggests that demand for manufactured goods has remained weak so far this year, building on the declines seen last year.

- Productivity and Costs: Manufacturing labor productivity fell 3.3% at the annual rate in the first quarter, the fastest rate of decline since the fourth quarter of 2015. With the U.S. economy grappling with the economic impacts of COVID-19, output fell sharply at rates not seen since the second quarter of 2009, plummeting 7.1%. The number of hours worked decreased 3.9%, with unit labor costs up 3.6%. Labor productivity for durable goods manufacturers declined 8.3% in the first quarter, with output off 11.9%. In contrast, output per worker for nondurable goods firms rose 2.1% in the first quarter despite output and hours worked dropping by 1.8% and 3.8%, respectively.

Meanwhile, nonfarm business labor productivity declined 2.5% in the first quarter, the steepest decrease in six years. Output fell 6.2%, the largest decline since the first quarter of 2009, with unit labor costs up 4.8%.

One of the larger economic concerns has been sluggishness of productivity growth since the Great Recession. Labor productivity in the manufacturing sector averaged -0.2% between 2011 and 2019, with nonfarm productivity averaging 0.9% over the same time period (but averaging 1.5% over the past three years).

- Weekly Initial Unemployment Claims: There were 3,169,000 initial unemployment claims for the week ending May 2, down from the 3,846,000 claims added for the week ending April 25. Since peaking at 6,867,000 for the week ending March 28, initial claims have decelerated, which is encouraging, but these continue to be heartbreaking and unprecedented levels. Over the past seven weeks, 33,483,000 Americans filed for unemployment insurance, illustrating dire conditions in the labor market as the COVID-19 crisis has taken hold. California, Florida, Georgia, New York, Texas and Washington each had at least 100,000 initial unemployment claims in the latest week, with 18 states having new claims that exceeded 50,000.

Meanwhile, continuing claims increased from 18,011,000 for the week ending April 18 to 22,647,000 for the week ending April 25 in this report, a new all-time high. The latest figure suggests that 15.5% of the workforce received unemployment insurance that week, a rate that will continue to increase substantially given the initial claims data.

The unemployment rate could peak around 20% to 22% this month before starting to fall. The current forecast is for the unemployment rate to be 9% to 10% by year’s end—a shocking turn of events in the labor market following February’s 50-year low, which registered 3.5%.

|

|

| Take Action |

|

- If you have not already done so, please take a moment to complete the latest NAM Manufacturers’ Outlook Survey. This 25-question survey will help us gauge how manufacturing sentiment has changed since the first quarter survey. The current survey includes special questions on the COVID-19 outbreak and the outlook for the economy, the workforce and your company’s strategies post-virus. To complete the survey, click here. Responses are due by Friday, May 15, at 5:00 p.m. EDT. As always, all responses are anonymous.

|

|

|

Thank you for subscribing to the NAM's Monday Economic Report.

If you're part of an NAM member company and not yet subscribed, email us. If you're not an NAM member, become one today!

|

|

|

|

|

|

|