|

| If you’re having trouble reading this, click here. |

|

|

|

|

| MONDAY ECONOMIC REPORT |

| Essential Takes on Leading Economic Indicators |

|

| By Chad Moutray, Ph.D., CBE – November 12, 2018 |

|

|

|

|

| Federal Reserve Poised to Hike Rates in December,

Largely on Labor Market Strength

|

|

| The Weekly Toplines |

|

- The Federal Reserve left interest rates unchanged, as expected, but the Federal Open Market Committee is widely anticipated to hike short-term rates at its December 18–19 meeting. The Federal Reserve not only noted slowing business investment, but it also continued to acknowledge overall strength in the U.S. economy, especially the tight labor market.

- Pricing pressures remain elevated, especially relative to what firms have become accustomed to, but also appear to have stabilized somewhat, at least for now. With that said, producer prices for final demand goods and services jumped 0.6 percent in October, the fastest monthly pace of growth in six years, with 2.9 percent growth year-over-year.

- There was more evidence of just how strong the labor market is right now. In September, there were roughly 7 million job openings in the United States, or roughly 1 million more than the number of people actively looking for work. Indeed, it was the sixth straight month with job postings exceeding the number of unemployed.

- Manufacturing job openings pulled back a little in September, with 484,000 postings in the sector, but remained not far from the all-time high set in August, which was 508,000.

- Consumer sentiment edged down slightly in November but remained mostly upbeat, largely on Americans’ positive perceptions about jobs and income expectations, according to the University of Michigan and Thomson Reuters.

- With that said, Americans were less willing to take on credit in September, especially for credit cards. This could indicate some hesitance to make purchases, but Hurricane Florence might also have been a factor, especially with retail sales data already reflecting some negative weather impacts on spending. Over the longer term, total credit outstanding has risen 4.8 percent year-over-year.

|

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, November 5

None

Tuesday, November 6

Job Openings and Labor Turnover Survey

Wednesday, November 7

Business Employment Dynamics

Consumer Credit

Thursday, November 8

FOMC Monetary Policy Statement

Friday, November 9

Producer Price Index

University of Michigan Consumer Sentiment

|

|

|

|

This Week's Indicators:

Monday, November 12

VETERANS DAY (OBSERVED)

Tuesday, November 13

NFIB Small Business Survey

Wednesday, November 14

Consumer Price Index

Thursday, November 15

New York Fed Manufacturing Survey

Philadelphia Fed Manufacturing Survey

Retail Sales

Friday, November 16

Industrial Production

Kansas City Fed Manufacturing Survey

State Employment Report |

|

|

| Deeper Dive |

|

- Business Employment Dynamics: Net employment growth rose by 740,000 in the first quarter, extending the 979,000 gain in the fourth quarter. Manufacturers had gross job gains of 420,000 in the first quarter, with 386,000 from expanding establishments and 34,000 from new establishments. At the same time, there were gross job losses of 354,000 in the first quarter, with 315,000 from contracting establishments and 39,000 from closing establishments. Therefore, there was a net employment change of 66,000 more workers in the manufacturing sector in the first quarter, easing somewhat from the net gain of 93,000 in the fourth quarter.

- Consumer Credit: U.S. consumer credit outstanding increased a modest 3.3 percent in September, slowing from a 7.0 percent gain in August. Total consumer credit registered $3.950 trillion in September, with $1.041 trillion in revolving credit and $2.909 trillion in nonrevolving credit. Nonrevolving credit (including auto and student loans) rose 4.7 percent in September, but revolving credit (including credit cards and other lines of credit) declined 0.4 percent. This suggests Americans felt less willing to incur credit card debt in September, which could indicate some hesitance to make purchases. (It might also simply reflect weather problems during the month.) Overall, consumer credit has increased 4.8 percent over the past 12 months.

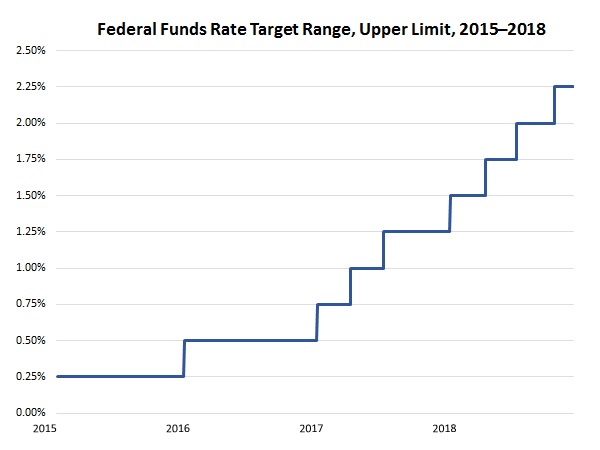

- FOMC Monetary Policy Statement: As expected, the Federal Open Market Committee (FOMC) left interest rates unchanged at the conclusion of its November 7–8 meeting. The Federal Reserve said that “growth of business fixed investment has moderated from its rapid pace earlier in the year,” but it also noted that economic activity remained strong, with solid growth in the labor market. In addition, core inflation remains near the Federal Reserve’s stated target of 2 percent year-over-year. At the same time, the FOMC is widely expected to hike short-term rates—for the fourth time this year—at its next meeting on December 18–19, particularly given the tight labor market and overall strength of the U.S. economy.

- Job Openings and Labor Turnover Survey: Job openings in the manufacturing sector pulled back from an all-time high of 508,000 in August to 484,000 in September. Despite the slippage, which occurred for both durable and nondurable goods firms, the pace of job postings remained very elevated. The level of hires and separations also decelerated in the sector, and one cannot help but wonder if weather—particularly Hurricane Florence in this case—played a factor in explaining the slower rates of activity in the month.

With that said, the data also continue to show how tight the labor market is right now. Total nonfarm payroll job openings exceeded 7 million for only the third time, even though postings declined slightly from the record high of 7,293,000 in August to 7,009,000 in September. More importantly, there were more job openings in the U.S. economy than the number of people looking for work (5,964,000 in September and 6,075,000 in October). In addition, total quits in the nonfarm sector in September (3,601,000) were just shy of the all-time high in August (3,648,000). This is a sign Americans are feeling more comfortable leaving their job—likely to pursue other opportunities.

- Producer Price Index: Producer prices for final demand goods and services jumped 0.6 percent in October, the fastest monthly pace of growth since September 2012. For manufacturers, producer prices for final demand goods and services also rose 0.6 percent, spurred higher by sizable increases for both energy and food costs. Core inflation for goods, which excludes food and energy, was unchanged in October. Over the past 12 months, producer prices for final demand goods and services has risen 2.9 percent, or 2.8 percent year-over-year with food, energy and trade services excluded. As such, core pricing pressures remain elevated, especially relative to what firms had become accustomed to, but on the positive side, these costs appear to have stabilized, down from 3.0 percent year-over-year in the previous report, at least for now.

- University of Michigan Consumer Sentiment: The Index of Consumer Sentiment edged down from 98.6 in October to 98.3 in November in preliminary data. Americans’ assessments of current and future economic conditions changed little from last month, with slight easing coming from the expectations component. Even as the public’s perceptions about the economy have slipped somewhat since March’s reading (101.4), which was the highest since January 2004, the data remain upbeat overall, especially in terms of job and income expectations. Final data will be released November 21.

|

|

| Take Action |

|

- The Manufacturing Institute’s Center for Manufacturing Research has received a grant from the Alfred P. Sloan Foundation to examine how manufacturers are utilizing their older workforce, especially in such a tight labor market. Manufacturers often tell us they are encouraging workers to delay or phase in retirement in light of the difficulties in finding talent. If your company would like to share its experiences along these lines, please contact NAM Chief Economist and Center for Manufacturing Research Director Chad Moutray at [email protected].

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|

|