|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – April 15, 2019 – SHARE

|

|

<

|

|

|

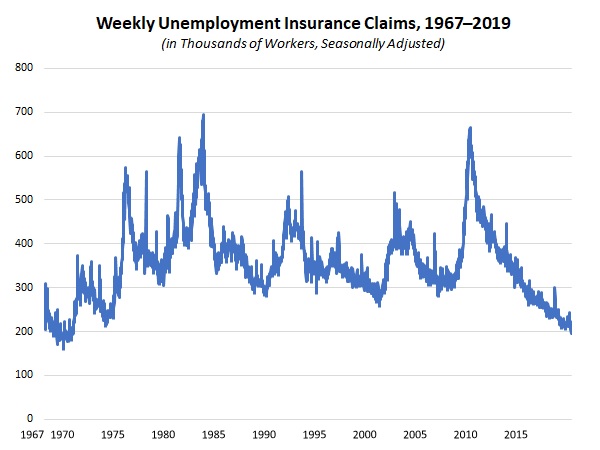

Unemployment Insurance Claims Fell to a 50-Year Low |

|

| The Weekly Toplines |

|

- Initial unemployment insurance claims fell from 204,000 for the week ending on March 30 to 196,000 for the week ending on April 6. This was the lowest level since October 4, 1969—yet another sign that employment data remain at historic lows.

- Job openings in the manufacturing sector increased from 458,000 in January to 477,000 in February. Over the past 12 months, manufacturing job openings have been solid, averaging nearly 471,000 per month over that time frame but off somewhat from the all-time high set in July (501,000).

- The labor market remained very tight. Despite some easing in nonfarm job openings in February, there were more job openings in the U.S. economy (7,087,000) than the number of people looking for work (6,235,000) for the 13th straight month. With these data points in mind, manufacturers continue to report difficulties in finding talent as their top concern.

- The National Federation of Independent Business reported that the Small Business Optimism Index inched slightly higher, up from 101.7 in February to 101.8 in March. The percentage of small business owners saying they had job openings in March was 39 percent, matching the all-time high set in December, and workforce challenges remained the top “single most important problem” for the 13th straight month.

- At the same time, new orders for manufactured goods fell 0.5 percent in February. With that said, there was a significant decrease in the highly volatile nondefense aircraft and parts segment. Excluding transportation equipment, factory orders rose 0.3 percent in February. Overall, factory orders increased a modest 1.8 percent year-over-year, but with a more solid 3.3 percent rise since February 2018 with transportation equipment excluded.

- Meanwhile, higher energy costs led to increases in consumer and producer prices in March. Yet, pricing pressures have stabilized since mid-2018, which is welcome news for manufacturers. For example, core producer prices have grown 2.0 percent year-over-year, the slowest pace since August 2017. Similarly, core inflation for consumers also inched down to the slowest rate since February 2018 at 2.0 percent year-over-year.

- The moderation of input cost growth has provided some flexibility to the Federal Reserve, allowing it to pause on future rate hikes until it sees stronger economic conditions warrant further actions.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, April 8

Factory Orders and Shipments

Tuesday, April 9

Job Openings and Labor Turnover Survey

NFIB Small Business Survey

Wednesday, April 10

Consumer Price Index

Thursday, April 11

Producer Price Index

Friday, April 12

University of Michigan Consumer Sentiment

|

|

|

|

This Week's Indicators:

Monday, April 15

New York Fed Manufacturing Survey

Tuesday, April 16

Industrial Production

NAHB Housing Market Index

Wednesday, April 17

International Trade Report

Thursday, April 18

Conference Board Leading Indicators

IHS Markit Flash Manufacturing PMI

Philadelphia Fed Manufacturing Survey

Retail Sales

Friday, April 19

Gross Domestic Product by Industry

State Employment Report |

|

|

| Deeper Dive |

|

- Consumer Price Index: After being unchanged in November, December and January, consumer prices have rebounded in February and March, with upticks in both energy and food costs. In March, the consumer price index rose 0.4 percent, the fastest monthly pace in 14 months. Energy prices increased 3.5 percent in March, with food costs up 0.3 percent. Excluding food and energy, consumer prices edged up 0.1 percent. Over the past 12 months, the consumer price index has risen 1.9 percent, up from 1.5 percent in both January and February, which were the lowest rates since September 2016. Yet, consumer prices had risen 2.9 percent in July, the highest year-over-year rate since February 2012, reflecting a deceleration in consumer price growth since mid-2018.

At the same time, core inflation inched down from 2.1 percent year-over-year in February to 2.0 percent in March, the slowest rate since February 2018. Apparel, medical care services, new vehicles, shelter and transportation services have all seen costs rise over the past 12 months. Still, price growth appears to be stable for now, at the Federal Reserve’s stated goal of core price inflation around 2 percent.

- Factory Orders and Shipments: New orders for manufactured goods fell 0.5 percent in February, pulling back once again after being unchanged in January. With that said, there was a significant decrease in the highly volatile nondefense aircraft and parts segment, which dragged the headline number lower. Excluding transportation equipment, factory orders rose 0.3 percent in February, rebounding after inching down 0.1 percent in January. Overall, factory orders increased a modest 1.8 percent year-over-year, but with a more solid 3.3 percent rise since February 2018 with transportation equipment excluded.

In addition, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—edged down 0.1 percent in February to $68.9 billion, declining for the fifth time in the past seven months. As such, core capital goods spending has drifted somewhat lower since reaching an all-time high in July ($69.9 billion). On a more encouraging note, core capital goods spending has increased a modest 2.5 percent over the past 12 months.

Meanwhile, shipments rose 0.4 percent in February, rebounding somewhat from declines in the four prior months. Yet, the longer-term trendline remains promising, with 5.5 percent growth year-over-year or an increase of 3.9 percent over the past 12 months with transportation excluded.

- Job Openings and Labor Turnover Survey: Job openings in the manufacturing sector increased from 458,000 in January to 477,000 in February, with increased activity for both durable and nondurable goods firms. With that said, the pace of job postings has pulled back somewhat from 501,000 in December, which matched the record high in August. Still, over the past 12 months, manufacturing job openings have been solid, averaging nearly 471,000 per month over that time frame. While net hiring softened in February, the strong job postings figures should bode well for continued employment growth moving forward, especially since manufacturers continue to report difficulties in finding talent as their top concern. For a breakdown on job openings trends in 2018, click here for a new paper on this topic.

Meanwhile, nonfarm job openings pulled back from a record high, down from 7,625,00 postings in January to 7,087,000 in February. Manufacturing job openings were the exception, with each of the other major sectors seeing reduced job openings in February. Nonetheless, there were more job openings in the U.S. economy than the number of people looking for work (6,235,000 in February and 6,211,000 in March) for the 13th straight month. Moreover, there were 3,480,000 quits in the U.S. economy in February, just shy of the all-time high set in January, at 3,483,000. This suggests that Americans are switching jobs more often due to the tight market.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index inched slightly higher, up from 101.7 in February to 101.8 in March. As such, the headline index continued to stabilize after easing from August’s all-time high (108.8). Despite some softening, small businesses remain upbeat overall. The percentage of respondents saying the next three months would be a “good time to expand” has risen from 20 in January to 22 in February to 23 in March, even as it remained below the 34 reading in August (a record high).

At the same time, the labor market remained solid overall. The percentage of small business owners saying they had job openings in March was 39 percent, matching the all-time high set in December, and the net percentage planning to hire in the next three months rose from 16 percent to 18 percent in this survey. In addition, the quality of labor was the top “single most important problem” for the 13th straight month. Meanwhile, 60 percent of respondents reported making a capital expenditure in the past six months, up from 58 percent in February. Capital spending plans for the next three to six months were unchanged at 27 percent.

- Producer Price Index: Producer prices for final demand goods and services jumped 0.6 percent in March, the fastest monthly gain since October. Likewise, producer prices for final demand goods rose 1.0 percent, boosted by sharply higher energy costs, which increased 5.6 percent in March. However, core inflation for goods, which excludes food, energy and trade services, increased a more modest 0.2 percent for the month.

Over the past 12 months, producer prices for final demand goods and services have risen 2.2 percent, accelerating somewhat from 1.8 percent year-over-year in February. Nonetheless, core producer prices have grown 2.0 percent year-over-year, the slowest pace since August 2017. Overall, inflationary pressures have continued to decelerate since peaking at 3.1 percent year-over-year in September. The stabilization of raw material costs seen lately has been welcomed in the manufacturing sector, with rising input prices being a major challenge in recent surveys, including ours.

In addition, the moderation of input cost growth has provided some flexibility to the Federal Reserve, allowing it to pause on future rate hikes until it sees stronger economic conditions warrant further actions.

- University of Michigan Consumer Sentiment: The Index of Consumer Sentiment pulled back somewhat in preliminary data, down from 98.4 in March to 96.9 in April. Americans felt more upbeat in the latest survey about current economic conditions, but the drop in the headline index stemmed from a weakened assessment in future expectations. Despite some easing, however, consumers continued to be mostly upbeat, with the longer-term trendline remaining favorable. Final data will be released April 26.

|

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|