|

| If you’re having trouble reading this, click here. |

|

s

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – June 1, 2020 – SHARE

|

|

<

|

|

|

| Manufacturing Optimism at Lowest Since the Great Recession |

|

| The Weekly Toplines |

|

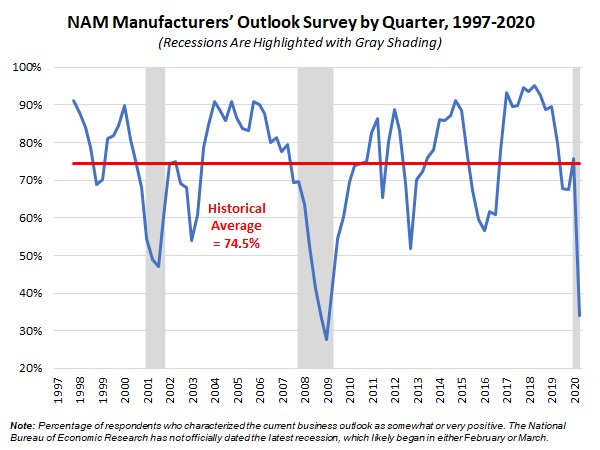

- In the latest NAM Manufacturers’ Outlook Survey, 33.9% of manufacturing respondents reported a positive outlook for their company, the lowest reading since the first quarter of 2009 and down from 75.6% in the previous survey. Large manufacturers were less positive than their small and medium-sized counterparts.

- Weak domestic demand was the top primary business challenge in the second quarter, supplanting the inability to attract and retain talent, which had been the top concern for 10 consecutive quarters. Yet half of respondents expect workforce challenges to be a concern once the COVID-19 crisis abates.

- The vast majority of manufacturers have continued operations (67.1%) or temporarily halted only part of their operations (31.6%). Among large manufacturers, 50.8% are completely operational, while roughly 73% of small and medium-sized firms state the same.

- Economic indicators released last week continued to show two things. First, the COVID-19 outbreak and the sharp drop in activity have resulted in historic declines for many economic measures, particularly in March and April. Second, the May data points suggest that the worst of those decreases might be behind us, with some encouraging bounce backs from record lows, albeit with ongoing negative challenges remaining.

- New orders for durable goods plummeted 17.2% in April, the largest monthly decline since August 2014. Transportation equipment sales were down a whopping 47.3% for the month. Core capital goods spending was off 5.8% in April.

- Regional surveys from the Dallas, Kansas City and Richmond Federal Reserve Banks said that the rate of decline for manufacturing activity slowed in May, but remained quite negative.

- Over the past 10 weeks, nearly 40.8 million Americans have filed for unemployment insurance, but continuing claims declined for the first time since February. Still, 14.5% of the workforce received unemployment insurance for the week of May 16.

- With Americans staying closer to home and many businesses closed, the savings rate soared to 33%, an all-time high. Indeed, personal spending plummeted by a record 13.6% in April. Durable and nondurable goods consumption declined by 17.3% and 16.2%, respectively.

- At the same time, personal income soared 10.5% in April, spurred by a $3 trillion increase in government transfer payments for the month, enough to offset sharp declines in employee compensation and proprietors’ income, including for manufacturers.

- The Conference Board and the University of Michigan and Thomson Reuters both reported slight increases in consumer confidence in May after plummeting to multiyear lows in April. Americans remain anxious in their outlook, however, particularly regarding jobs and income.

- In advance statistics, the goods trade deficit rose from $64.98 billion in March to $69.68 billion in April. Goods exports and imports were both off very sharply in April, down $32.17 billion and $27.47 billion, respectively, with the COVID-19 pandemic sending the global economy into a deep recession.

- The U.S. economy shrank by an annualized 5% in the first quarter, slightly down from the previous estimate of 4.8% and the largest quarterly decline since the fourth quarter of 2008, with sharp pullbacks in consumer and business activity.

- Real GDP is expected to contract by at least a mind-numbingly large 32.5% at the annual rate. Once the COVID-19 outbreak starts to abate, economic activity should improve, with real GDP rebounding strongly in the third quarter, currently estimated to be a gain of around 16%. Yet, the economic damage will have been done, with the U.S. economy declining 4.5% in 2020.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, May 25

MEMORIAL DAY

Tuesday, May 26

Chicago Fed National Activity Index

Conference Board Consumer Confidence

Dallas Fed Manufacturing Survey

New Home Sales

Wednesday, May 27

Richmond Fed Manufacturing Survey

Thursday, May 28

Durable Goods Orders and Shipments

Gross Domestic Product (Revision)

Kansas City Fed Manufacturing Survey

NAM Manufacturers’ Outlook Survey

Weekly Initial Unemployment Claims

Friday, May 29

International Trade in Goods (Preliminary)

Personal Consumption Expenditures Deflator

Personal Income and Spending

University of Michigan Consumer Sentiment (Revision) |

|

|

|

This Week's Indicators:

Monday, June 1

Construction Spending

ISM® Manufacturing Purchasing Managers’ Index®

Tuesday, June 2

None

Wednesday, June 3

ADP National Employment Report

Factory Orders and Shipments

Thursday, June 4

International Trade Report

Productivity and Costs (Revision)

Weekly Initial Unemployment Claims

Friday, June 5

BLS National Employment Report |

|

|

| Deeper Dive |

|

- Chicago Fed National Activity Index: The Chicago Federal Reserve Bank’s National Activity Index plunged to a record low, down from -4.97 in March to -16.74 in April. The three-month moving average for the NAI registered -7.22 in April, also an all-time low figure and down from -1.69 in March. It was the 15th straight month with the three-month moving average below zero, suggesting growth below the historical trend. The data point in April reflects the economic hardship that resulted from the abrupt slowdown in activity due to the COVID-19 pandemic as the nation has fallen into a severe recession. Readings at -0.70 or lower are consistent with the U.S. economy being in a recession.

Employment and production pulled the NAI down sharply in April. Manufacturing production fell sharply by a record-setting 13.7% in April to the lowest level since July 1998, with durable and nondurable goods output plummeting 19.3% and 8.2%, respectively. Capacity utilization in the sector fell to 61.1%, an all-time low. At the same time, more than 38.6 million Americans have filed for unemployment insurance over the past seven weeks (see below), and the unemployment rate is likely to exceed 20% in May. Those two factors alone accounted for virtually all the decline to the headline index in April, with consumer spending and housing also dragging the NAI lower for the month.

- Conference Board Consumer Confidence: After dropping to its lowest level in nearly six years, consumer confidence inched up from 85.7 in April to 86.6 in May. Americans’ perceptions about the current economic environment declined further, down from 73.0 to 71.1, as consumers continued to be concerned about the COVID-19 outbreak and its implications. Indeed, the percentage of respondents suggesting that business conditions were “bad” jumped from 45.3% to 51.1%, with the percentage feeling that conditions were “good” dropping from 19.9% to 16.3%. With that said, survey respondents were more encouraged in their outlook for the coming months, up from 94.3 to 96.9, which the release attributes to signs of re-opening in the economy.

Nonetheless, Americans see sizable challenges in the labor market, with more saying that jobs were “hard to get” than those feeling that they were “plentiful.” The percentage feeling jobs were plentiful declined from 18.8% to 17.4%, but those saying jobs were hard to get dipped from 34.5% to 27.8%. In terms of the jobs outlook, the percentage of respondents expecting more jobs in the next six months declined from 41.2% to 39.3%, while those predicting fewer jobs edged down from 21.2% to 20.2%.

- Dallas Fed Manufacturing Survey: There continued to be sharp decreases in manufacturing activity in the Dallas Federal Reserve Bank’s district, but the pace of decline slowed, with the composite index of general business activity rising from -74.0 in April to -49.2 in May. Manufacturers in the Texas region have struggled materially during the COVID-19 pandemic, especially with severely reduced energy prices. The underlying data were very weak across the board, albeit with some easing in declines. Nearly 53% of respondents said that new orders decreased in May, down from 7.2% in April but still highly elevated, with 21.1% citing increased sales for the month, up from just 5.2% in April. The trends were similar for production, shipments, capacity utilization, hiring and capital spending.

In addition, manufacturers in the district remained negative in their outlook, even as the forward-looking composite index of business conditions improved from -43.0 in April, the lowest since November 2008, to -19.0. Yet, there was some cautious optimism about better data over the next six months, with nearly half of those completing the survey predicting increased production.

In special questions, 67% of manufacturers in the Dallas Federal Reserve region reported they had applied for a Small Business Administration Paycheck Protection Program loan, and of those who applied, 98.6% said that they had received the funds. Respondents noted that the PPP dollars were being used to prevent layoffs and/or furloughs (83.3%), prevent wage reductions (65.3%), helped the company pay bills and/or rent (50%) and allowed for some rehiring of workers (18.1%).

- Durable Goods Orders and Shipments: New orders for durable goods plummeted 17.2% in April, the largest monthly decline since August 2014 and extending the decline of 16.6% in March. There were sharp drops for aerospace and automobiles, with transportation equipment sales down 47.3% for the month. Excluding transportation equipment, new orders declined 7.4% in April, pulled lower by reduced sales in every major category except for communications equipment. Nondefense capital goods excluding aircraft—a proxy for capital spending in the U.S. economy—decreased 5.8% in April, building on the 1.1% decline seen in March.

Over the past 12 months, new orders for durable goods have dropped a mind-numbing 29.3%, or with transportation equipment excluded, sales have fallen 9.3% since April 2019. Core capital goods orders have also declined 6.3% year-over-year.

Meanwhile, shipments of durable goods decreased 17.7% in April, with a decline of 6.3% without transportation equipment included. Since April 2019, durable goods shipments have fallen 22.2%, and excluding transportation, shipments have declined 7.5% year-over-year. At the same time, core capital goods shipments for durable goods have decreased 7% over the past 12 months.

- Gross Domestic Product (Revision): The U.S. economy shrank by an annualized 5% in the first quarter, slightly down from the previous estimate of 4.8% and the largest quarterly decline since the fourth quarter of 2008, as the nation grappled with the COVID-19 outbreak and sharp pullbacks in consumer and business activity. Indeed, personal consumption expenditures fell 6.8% at the annual rate, the fastest decline in consumer spending since the second quarter of 1980, with Americans staying closer to home and retail businesses closed or at limited capacity. Breaking the consumer spending data down further:

- Durable goods spending plummeted 13.2% at the annual rate in the first quarter, the most since the fourth quarter of 2008, subtracting 0.98% from top-line GDP growth.

- Nondurable goods spending rose 7.7% in the first quarter, the best reading since the second quarter of 2000, contributing 1.04% to headline growth.

- Service-sector spending fell 9.7% in the first quarter, the worst quarter in the series’ history, which dates to 1947, subtracting 4.75% from top-line growth.

The real GDP data for the second quarter will be worse, with the U.S. economy expected to contract by at least a mind-numbingly large 32.5% at the annual rate. Once the COVID-19 outbreak starts to abate, economic activity should improve, with real GDP rebounding strongly in the third quarter, currently estimated to be a gain of around 16%. Yet, the economic damage will have been done, with the U.S. economy declining 4.5% in 2020.

Other highlights in the latest release:

- The housing market and government spending were bright spots. In the first quarter, residential investment jumped 18.5% at the annual rate, adding 0.66% to top-line GDP growth. The combination of federal, state and local government spending contributed another 0.15%.

- Nonresidential fixed investment fell 7.9% in the first quarter, the weakest reading since the second quarter of 2009, with sharp declines in business spending for equipment and structures, down 16.7% and 3.9%, respectively. Nonresidential fixed investment subtracted 1.06% from headline growth, dragging down GDP for the fourth straight quarter.

- The largest shift between the previous estimate and the current revision was in business inventories. Businesses continued to spend less to stock their shelves, with inventories subtracting 1.43% from real GDP growth for the fourth straight quarter. The prior estimate was for inventories dragging down headline growth by just 0.53%.

- Net exports were the largest positive contributor to real GDP growth in the first quarter, adding 1.32% to top-line growth, but it was for the wrong reasons. Slowing global growth reduced trade activity, with goods exports and imports down 1.2% and 11.5%, respectively. Likewise, service-sector exports and imports plummeted 21.5% and 29.9%, respectively.

- International Trade in Goods (Preliminary): In advance statistics, the goods trade deficit rose from $64.98 billion in March to $69.68 billion in April. Goods exports and imports were both off very sharply in April, down $32.17 billion and $27.47 billion, respectively, with the COVID-19 pandemic sending the global economy into a deep recession. The data were down across the board, with the decline in exports led by weaknesses for automotive vehicles, capital and consumer goods and industrial supplies. The reduction in imports stemmed from sizable decreases in automotive vehicles and capital and consumer goods. Final data will be released June 4, which will also include the service-sector trade surplus.

- Kansas City Fed Manufacturing Survey: After declining at the fastest pace in the survey’s history in April, which dates to 1994, the rates of decline in manufacturing activity slowed in April, even as firms grappled with the COVID-19 outbreak. The composite index increased from -30 in April to -19 in May, with continued decreases in activity across the board, but with easing in the pace of decline. For instance, 46% of respondents said that they had reduced orders in May, which was an improvement from 69% who said the same thing in April—but still quite elevated. In contrast, the percentage suggesting that sales had increased ticked up from 16% in April to 27% in May.

Turning to the outlook, manufacturers continued to have negative expectations about growth over the next six months, albeit with the forward-looking composite index rising from -6 to -2. In a special question, the release states, “Around 32 percent of factory contacts expect business activity to return to levels similar to activity before COVID-19 within 6-12 months once restrictions are lifted, while 23 percent indicated it would take more than a year for business

activity levels to resume normalcy.”

- NAM Manufacturers’ Outlook Survey: In the second quarter of 2020, 33.9% of manufacturing respondents reported a positive outlook for their company, the lowest reading since the first quarter of 2009 and down from 75.6% in the previous survey. Overall, the data reflect a sector that is experiencing its worst contraction since the Great Recession—a finding that mirrors other economic indicators. Nevertheless, manufacturers have continued to operate through the crisis. The vast majority have continued operations (67.1%) or temporarily halted only part of their operations (31.6%). Among large manufacturers, 50.8% are completely operational, while roughly 73% of small and medium-sized firms state the same.

Weak domestic demand was the top primary business challenge in the second quarter (83.1%), supplanting the inability to attract and retain talent (41%), which had been the top concern for 10 consecutive quarters. Rising health care and insurance costs (49.6%), weaker global growth and slower export sales (41.6%) and access to COVID-19 testing and adequate PPE materials (40%) were also top of mind among manufacturing business leaders.

Despite moving workforce concerns out of the top spot, respondents continue to expect struggles in identifying workers over the longer term, especially as more Americans retire. Indeed, 50.5% of manufacturing leaders anticipate that difficulties in attracting and retaining employees will continue to be a challenge over the next 12 to 18 months assuming the COVID-19 crisis abates.

Respondents were asked about the specific ways that COVID-19 impacted their businesses. More than 86% said that they had limited business travel, and 78.3% have required flexible work arrangements. Other top responses included disrupted supply chains (59.5%), unplanned production stops (49.6%), the furloughing of some workers (39.8%) and pay cuts for some workers (22.2%). Meanwhile, almost 77% of manufacturers said that they were reevaluating what work could be done remotely where possible. This is notable given the difficulties that many manufacturers would face in moving tasks away from the shop floor; yet it speaks to the need to rethink operations. In fact, two-thirds of respondents said that the COVID-19 outbreak will likely force them to reengineer the production process or operations with social distancing in mind.

Finally, firm size was once again a major factor in explaining a manufacturer’s outlook. Just 22.5% of large manufacturers (i.e., those with 500 or more employees) were positive about their company’s outlook, with 26.2% of respondents saying that they were very negative. In contrast, 42.4% of small firms (i.e., those with fewer than 50 employees) had a positive outlook, with 17.3% reporting a very negative outlook. Medium-sized businesses (i.e., those with 50 to 499 employees) had 37.4% who had a positive outlook, with 19.4% being very negative.

- New Home Sales: After falling sharply in the prior two months, new single-family home sales ticked up 0.6% in the latest data, rising from 619,000 units in March to 623,000 units in April. Despite the slight increase, new home sales have plummeted 19.5% since 774,000 units in January. Residential sales have slowed as the nation has grappled with the COVID-19 crisis and Americans have sheltered in place. In April, there were more sales in every region except for the West.

There were 6.3 months of supply of new homes on the market in April, edging down from 6.4 months in March but still higher than the five months in January. The median sales price was $309,900, down 8.6% from the $339,000 median one year ago.

- Personal Consumption Expenditures Deflator: The PCE deflator decreased 0.5% in April, building on the decline of 0.2% in March, with deflationary pressures in the economy in light of the sharp COVID-19 downturn. Reduced energy costs, which fell 9.2% in April, helped to keep a lid on price growth for the month despite food costs rising 2.4%. The core PCE deflator, which excludes food and energy prices, was off 0.4% in April, with prices for goods off 0.8% for the month.

Since April 2019, the PCE deflator has risen 0.5%, down from 1.8% year-over-year in February and 1.3% in March and the lowest since December 2015. Core inflation registered 1% year-over-year in April, down from 1.7% in March, inching down from 1.8% in February to a rate not seen since January 2011. The core PCE deflator has remained below the Federal Reserve’s stated goal of 2% core inflation for 16 straight months.

As such, inflationary pressures are not a concern for the Federal Open Market Committee currently. Instead, especially in light of the current COVID-19 crisis, the Federal Reserve is more concerned with contracting U.S. and global demand and deflation. Indeed, the Federal Reserve has undertaken extraordinary measures over the past two months to help prop up the economy and to address credit and liquidity concerns in financial markets.

- Personal Income and Spending: Americans stayed home and reduced their overall spending in April as consumers grappled with the COVID-19 outbreak, and the savings rate soared to 33%, an all-time high. Indeed, personal consumption expenditures plummeted by a record 13.6% in April (with data dating back to 1959), with goods and service-sector spending down 16.5% and 12.2% for the month, respectively. Durable and nondurable goods consumption declined by 17.3% and 16.2%, respectively. On a year-over-year basis, personal spending fell 16.9%, with durable and nondurable goods consumption down 25.5% and 11.6%, respectively. In addition, service-sector consumption has declined 17.2% over the past 12 months.

In contrast, personal income soared 10.5% in April, spurred by government assistance checks to combat the COVID-19 crisis. Transfer payments from the government jumped by $3 trillion in April to nearly $6.3 trillion. That was enough to offset sharp declines in employee compensation and proprietors’ income, which dropped by 7.7% and 12.2%, respectively. For instance, manufacturing wages and salaries fell from $900.2 billion in March to $791.9 billion in April. With more activity starting to come back online in May, we expect improvements in the next release.

- Richmond Fed Manufacturing Survey: As with many other sentiment surveys, the pace of decline in manufacturing activity in the Richmond Federal Reserve Bank’s district slowed in May, rebounding somewhat—albeit still in contraction territory—from the lowest level in the survey’s history, which dates to November 1993. The composite index of general business activity rose from -53 in April to -27 in May. The pace of decline eased for new orders, shipments, capacity utilization, employment and the average workweek, but capital spending deteriorated further, falling at a record rate. On a more encouraging note, respondents were positive in their expectations for demand, shipments and hiring to rebound over the next six months.

Raw material costs increased 1.05% at the annual rate in May, down from 1.48% in April and the lowest in three years. In addition, manufacturers predict a slight easing in input price growth moving forward, with respondents expecting an annualized 1.87% increase six months from now, down from 1.93% in the prior survey.

- University of Michigan Consumer Sentiment (Revision): After falling to the lowest level since December 2011, the Index of Consumer Sentiment edged up from 71.8 in April to 72.3 in May, according to the University of Michigan and Thomson Reuters. This was off somewhat from the previous estimate of 73.7 in May, but it continues to suggest that consumer confidence has stabilized, particularly in their assessments of current economic conditions. CARES Act relief checks helped to improve confidence in the latest data, but discretionary spending remains cautious given uncertainties in the economic outlook, according to the release. Final data will be released on May 29.

- Weekly Initial Unemployment Claims: There were 2,123,000 initial unemployment claims for the week ending May 23, down from the 2,446,000 claims added for the week ending May 16. Since peaking at 6,867,000 for the week ending March 28, initial claims have decelerated, which is encouraging. However, these levels continue to be heartbreaking and unprecedented. Over the past 10 weeks, 40,767,000 Americans filed for unemployment insurance, illustrating dire conditions in the labor market as the COVID-19 crisis has taken hold. Eleven states had at least 50,000 initial unemployment claims in the last week, with California, Florida, Georgia, New York and Washington exceeding 100,000.

Meanwhile, continuing claims decreased from 24,912,000 for the week of May 9 in this report to 21,052,000 for the week of May 16. That means that 14.5% of the workforce received unemployment insurance for the week, down from 17.1% in the previous report.

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Interested in becoming a presenter of the Monday Economic Report? Email us. |

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

| You received this email because you signed up for the NAM’s Monday Economic Report as a part of your NAM membership. |

|

| Manage my email newsletters and alerts | Unsubscribe |

|

|

|

| © 2020 National Association of Manufacturers |

|

|

|

|

|

|

|