|

| If you’re having trouble reading this, click here. |

|

| Global Manufacturing Economic Update |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray and Linda Dempsey – January 10, 2019– SHARE

|

|

|

|

|

Weaker Global Growth Persists, but with a Modest Expansion Overall

|

|

| The Monthly Toplines |

|

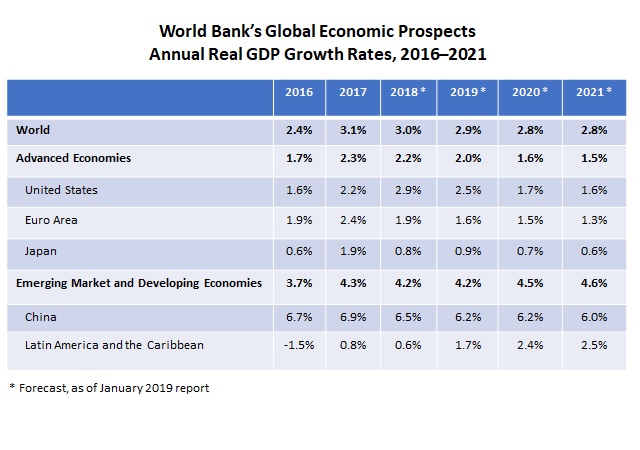

- The World Bank cut its global economic forecast slightly, as it now expects worldwide growth to expand by 3.0 and 2.9 percent in 2018 and 2019, respectively. Both were off 0.1 percent from the estimates made in the June release. For what it is worth, the World Bank predicts 2.9 percent and 2.5 percent in those two years in the United States (which, coincidently, is also my forecast right now.) The World Bank cites trade uncertainties, the strengthening U.S. dollar, increased volatility in financial markets and other challenges as downside risks to growth.

- The J.P. Morgan Global Manufacturing PMI™ registered 51.5 in December, down from 52.0 in November and signaling the slowest growth rate since September 2016. The headline index has decelerated since reaching nearly a seven-year high in December 2017 (54.5), even with a modest expansion overall.

- Economic growth continued to slip in December in the largest export destinations. In June, all those markets expanded, but the global economy has softened since then. In December, seven economies contracted, up from five in November. China and France both reported declining activity in December for the first time in 19 and 27 months, respectively, joining continuing contractions in Hong Kong, Italy, Mexico, South Korea and Taiwan.

- Even with some easing over the past few weeks, the dollar has trended higher overall, up 7.9 percent since January 25, 2018, against major currencies, according to the Federal Reserve. The appreciation in the dollar should make it harder for manufacturers to increase international demand, or at a minimum, it is squeezing the bottom line.

- Note that updated data on manufactured goods exports for November were not available on schedule due to the partial government shutdown. In the prior release, U.S.-manufactured goods exports have risen 6.6 percent through the first 10 months of 2018 relative to the pace at the same time frame in 2017.

- Chinese manufacturing activity slipped into contraction territory in December for the first time since May 2017, according to IHS Markit. The official manufacturing PMI also reflected contracting levels of activity, dropping to the lowest level since July 2016. Along those lines, industrial production and retail sales growth also decelerated in November, with the latter expanding at the slowest pace since May 2003. At the same time, fixed asset investment improved for the third straight month, and the Chinese government continues to take actions to stimulate economic growth.

- Similarly, the IHS Markit Eurozone Manufacturing PMI® dropped to the lowest level since February 2016. On a country-by-country basis, the data mostly reflect the softening seen in the headline index. This includes weaker expansions in Austria, Germany, Greece, Ireland and Spain, with contracting growth in both France and Italy. It was the first decline in manufacturing activity in France since September 2016, and recent political protests likely played a significant role in this finding. In contrast to those measures, the Netherlands and the United Kingdom both reported stronger data, with the latter inching up despite Brexit uncertainties.

- Trade will figure prominently in 2019, with activity expected on the new U.S.–Mexico–Canada Agreement (USMCA), China trade and tariff talks, Export-Import (Ex-Im) Bank financing, World Trade Organization (WTO) reform and many other trade issues.

- Right now, U.S. and Chinese officials are concluding talks in China to address key challenges in the Chinese market and potentially reach a deal to delay further new U.S. tariffs.

- The Trump administration is also planning next steps for congressional consideration of the USMCA, although the current partial government shutdown may delay some activity.

- The administration is also preparing to launch new negotiations with Japan and the European Union and eventually the United Kingdom.

- Manufacturers remain focused on restoring the Ex-Im Bank to full functionality and ensure a robust reauthorization in 2019.

|

|

|

| Global Economic Trends |

|

- Worldwide Manufacturing Activity: The J.P. Morgan Global Manufacturing PMI™ registered 51.5 in December, down from 52.0 in November and signaling the slowest growth rate since September 2016. The headline index has decelerated since reaching nearly a seven-year high in December 2017 (54.5), even with a modest expansion overall. In the latest survey, all the key measures eased in their growth rates except for output, which was unchanged. Exports contracted for the fourth consecutive month. Encouragingly, the index for raw material prices has also slowed, with that measure dropping to the lowest point since July 2017. That would seem to indicate that input costs have also stabilized in recent months after being highly elevated for much of 2018 and being one of manufacturers’ top concerns.

- Top 20 Markets for U.S.-Manufactured Goods: Economic growth continued to slip in December in the largest export destinations. In June, all those markets expanded, but the global economy has softened since then. In December, seven economies contracted, up from five in November. China and France both reported declining activity in December for the first time in 19 and 27 months, respectively, joining continuing contractions in Hong Kong, Italy, Mexico, South Korea and Taiwan. (There is no manufacturing PMI for comparison purposes for Belgium, which is our 12th-largest trading partner.)

- Trade-Weighted U.S. Dollar Index Against Major Currencies: Even with some easing over the past few weeks, the dollar has trended higher overall, up 7.9 percent since January 25, 2018, against major currencies, according to the Federal Reserve. This index reflects currency rates per U.S. dollar, suggesting the dollar can purchase somewhat more today than it could roughly one year ago. At the same time, manufacturers have noted challenges with a strong dollar for a few years, with the dollar up 20.6 percent since June 30, 2014.

- China: The Caixin China General Manufacturing PMI™ fell into contraction territory in December for the first time since May 2017. New orders, exports and employment all declined for the month, albeit just barely, pulling the headline index lower. On the other hand, output improved from being neutral in November to ever-so-slight growth in December. In addition, the index for future output ticked marginally higher, with modest growth expected over the next six months. Meanwhile, the official manufacturing PMI data from the National Bureau of Statistics of China also reflected contracting levels of activity, dropping from 50.0 in November to 49.4 in December, the lowest level since July 2016.

Overall, real GDP slowed as well, declining from 6.7 percent year-over-year in the second quarter to 6.5 percent in the third quarter. Along those lines, industrial production and retail sales growth decelerated in November, with the latter expanding at the slowest pace since May 2003 (although still at a strong pace of 8.1 percent year-over-year, but down from 10.2 percent one year earlier). At the same time, fixed asset investment improved for the third straight month, and the Chinese government continues to take actions to stimulate economic growth.

- Eurozone: The IHS Markit Eurozone Manufacturing PMI® dropped to the lowest level since February 2016, with that measure down from 51.8 in November to 51.4 in December. New orders and exports both contracted at a faster pace in the month, dragging overall sentiment lower. On the other hand, output, future output and employment improved a bit, with manufacturers in Europe still expecting a modest expansion in production for the next six months. On a country-by-country basis, the data mostly reflect the softening seen in the headline index. This includes weaker expansions in Austria, Germany, Greece, Ireland and Spain, with contracting growth in both France and Italy. It was the first decline in manufacturing activity in France since September 2016, and recent political protests likely played a significant role in this finding. In contrast to those measures, the Netherlands and the United Kingdom both reported stronger data, with the latter inching up despite Brexit uncertainties.

There will be new industrial production data for November released on January 14. In October, output bounced back, up 0.2 percent, after declining in September. With that said, production in the Eurozone has risen just 1.2 percent since October 2017, a rather disappointing pace. In a similar manner, retail sales rose 0.6 percent in November, but consumer spending increased a rather paltry 1.1 percent over the past 12 months. On a more encouraging note, the unemployment rate dropped to 7.9 percent in November, the lowest level since October 2008. That likely helped boost consumer spending in the month.

- Canada: The IHS Markit Canada Manufacturing PMI® expanded at the slowest pace since January 2017 in December, even as the data continued to report modest growth overall. Exports contracted ever so slightly for the first time in 13 months. Sentiment improved in Quebec, but other regions noted some weakening in the latest survey. Meanwhile, manufacturing sales inched down 0.1 percent in October, but with a solid 8.0 percent gain over the past 12 months. Retail sales rose 0.3 percent in October, with spending up a disappointing 0.6 percent year-over-year. At the same time, the unemployment rate was unchanged at 5.6 percent in December, remaining the lowest point since the survey began in 1976. Manufacturing employment increased by 23,900 in December, but with 30,100 fewer employees over the past 12 months.

- Mexico: The IHS Markit Mexico Manufacturing PMI™ contracted for the second straight month on falling output and employment, with the headline index unchanged at 49.7 in December. New orders expanded marginally for the month, and export sales slowed (but continued to grow modestly). On the positive side, the index for future output suggested that manufacturers continued to expect decent production growth over the next six months, albeit with some easing from the prior survey. With that said, industrial production fell 1.6 percent when adjusted for inflation in October, with manufacturing output off 2.2 percent. On a year-over-year basis, industrial production slowed from 1.8 percent growth over the past 12 months in September to 1.0 percent in October. New production data will be released January 11.

- Japan: The Nikkei Japan Manufacturing PMI® continued to expand somewhat modestly in December, improving a little from November’s pace, which was the slowest since August 2017. The pickup in sentiment in the latest survey stemmed from stronger new orders and output growth, but employment slowed, and exports contracted once again. Despite the pickup in the headline index, the measure for future output decelerated to the lowest mark since November 2016, but with expectations of still modest growth for the next six months. In the larger economy, industrial production fell 1.1 percent in November, but with 1.4 percent growth over the past 12 months.

- Emerging Markets: The IHS Markit Emerging Markets Manufacturing PMI® declined to the level in September, which was the lowest since August 2016. Overall activity in the emerging markets weakened across the year, weighed down by softer global growth and a strong U.S. dollar. In December, new orders and output weakened somewhat, with employment and exports declining. With that said, manufacturers continue to see healthy production growth over the next six months, with the index for future output unchanged at 59.7.

The country-by-country data on manufacturing activity mostly reflected weaker results. This included decelerating growth for Brazil, India, Nigeria, the Philippines, Russia, Singapore and Vietnam. In contrast, slight improvements occurred in both Kenya and Myanmar. At the other end of the spectrum, China and the Czech Republic both slipped into contraction for the first time since at least mid-2016. Other emerging markets that remained in negative territory in December with ongoing challenges included Hong Kong, Lebanon, Malaysia, Poland, South Korea and Taiwan.

|

|

| International Trade Policy Trends |

|

- United States, China hold first round of negotiations as clock ticks toward 90-day window. U.S. and Chinese officials held a first round of trade negotiations in Beijing from January 7 to 9, the first formal round of in-person talks since President Donald Trump and Chinese President Xi Jinping’s December 1 agreement to pause tariff escalation to allow for a 90-day negotiating period.

- USTR released this statement indicating that the negotiations covered a broad mix of topics, including the intellectual property, technology transfer and industrial policy issues raised by the Office of the U.S. Trade Representative (USTR) in its formal Section 301 investigation, as well as other trade barriers.

- Positive statements from both sides (including Commerce Secretary Wilbur Ross and Chinese Foreign Ministry spokesman Lu Kang) indicate that the first round of talks was constructive, aligning with pre-negotiation reports that the Chinese were planning to offer a broader mix of concessions on areas such as tariffs and potentially revisions to key aspects of its intellectual property or industrial policy regimes.

- The broad range of the issues on the table and pre-negotiation statements from U.S. Trade Representative Robert Lighthizer that the United States may need to apply more tariffs to secure meaningful outcomes, however, still raise significant questions about the prospects of a deal and point to future rounds of negotiations.

- As the negotiations began, NAM President and CEO Jay Timmons expressed hope that negotiations “move the ball forward” to boost business certainty and a bilateral trade deal with China.

The NAM will be monitoring closely negotiations for outcomes, next steps or statements from either side and will be reporting further this week as negotiations wrap up and details emerge. For additional information about these issues, NAM activity or how to get involved, contact NAM Director of International Business Policy Ryan Ong.

- Trump administration seeks USMCA passage in first half of 2019. Following the November 30 signing of the USMCA by the United States, Canada and Mexico, the Trump administration is preparing for congressional consideration during the first half of 2019. Under Trade Promotion Authority (TPA) procedures, President Trump is required to submit to Congress by January 29 a description of the changes to existing laws necessary to bring the United States into compliance with the USMCA. The U.S. International Trade Commission is required under TPA to publish by March 15 an assessment of the likely impact of the USMCA on the U.S. economy; due to the partial government shutdown, however, this deadline might be extended for every day of the shutdown. The NAM has called for Congress to move expeditiously to review the USMCA to restore certainty to the North American market and is working closely with NAM members to move this important agreement forward. For more information, contact NAM Vice President of International Economic Affairs Linda Dempsey and NAM Director of International Trade Policy Ken Monahan.

- Modified KORUS FTA enters into force, with U.S. truck import tariff phaseouts delayed until 2041. On January 1, the amended U.S.–Korea Free Trade Agreement (KORUS FTA) entered into force, following the December 7 ratification by the Korean National Assembly of the modified agreement and a December 21 Presidential Proclamation issued by President Trump that delayed until 2041 the phaseout of the 25 percent U.S. tariff on truck imports from Korea under the agreement. For more information, contact NAM Director of International Trade Policy Ken Monahan.

- USTR releases U.S.–Japan Trade Agreement negotiating objectives, and public comments on U.S.–UK negotiating objectives due by January 15. On December 21, the USTR released a summary of specific U.S. negotiating objectives for the proposed United States–Japan Trade Agreement, and the negotiations could begin as early as January 21. USTR has also requested public comments on U.S. negotiating objectives for a trade agreement with the United Kingdom, with comments due by January 15. In response to USTR requests last year, the NAM provided manufacturers’ priorities on U.S. trade negotiations with Japan and the European Union. For more information, contact NAM Director of International Trade Policy Ken Monahan.

- Ex-Im Bank faces reauthorization year without a quorum of its board of directors. With the arrival of the 116th Congress, the four nominations to the Ex-Im Bank’s board have lapsed, further delaying action to achieve a fully functional export credit agency. The White House will have to re-nominate individuals to lead the Ex-Im Bank. Furthermore, the Ex-Im Bank’s authorization to operate will lapse as of September 30, 2019. The expected new chair of the House Financial Services Committee, Rep. Maxine Waters (D-CA), recently affirmed her commitment to the Ex-Im Bank and is expected to lead the effort on a robust reauthorization of the agency. The NAM has been active in speaking with senior administration officials and congressional leaders as well as new members of Congress to highlight the importance of a fully functioning Ex-Im Bank and the costs to jobs and manufacturing of the current inaction. Most recently, the NAM sent this letter to Senate leadership requesting immediate action in support of a quorum and published this blog post about the consequences of the Ex-Im Bank board vacancies. For more information, contact NAM Director of Trade Facilitation Policy Jessica McBroom.

- British Parliament set to vote on Brexit deal on January 15. On January 15, the British Parliament will vote on the EU–UK agreement on the withdrawal of the United Kingdom from the European Union. The United Kingdom would leave the European Union without a transition agreement on March 29, unless the British Parliament does not approve the agreement by that date, the United Kingdom holds another public referendum on Brexit to see if the electorate might now oppose the United Kingdom’s departure from the European Union, or the European Union agrees to extend the March 29 deadline with unanimous agreement by all EU member states. For more information, contact NAM Director of International Trade Policy Ken Monahan.

- CPTPP enters into force on December 30 for six countries. On December 30, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) entered into force for the six countries that ratified the agreement in 2018: Australia, Canada, Japan, Mexico, New Zealand and Singapore. It is expected that the agreement will enter into force for Vietnam on January 14. The CPTPP will enter into force for the other four signatory countries (Brunei, Chile, Malaysia and Peru) 60 days after the completion of their respective domestic ratification processes. For more information, contact NAM Director of International Trade Policy Ken Monahan.

- Members call for work to resolve “crisis” in WTO. Concerns over the stalemate in WTO negotiations, the implementation of existing WTO commitments and the future of the WTO Appellate Body continued to dominate several sets of WTO discussions last month in Geneva.

- At the WTO’s biennial trade policy review of the United States, several WTO members, including China and the European Union, criticized U.S. unilateral actions imposing tariffs, the United States’ continued blocking of Appellate Body judges and other actions. Deputy U.S. Trade Representative Dennis Shea defended U.S. actions, indicating that the “crisis is caused by the fundamental incompatibility of China’s trade-distorting, non-market economic regime with an open, transparent and predictable international trading system.” He added that “[i]t is compounded by members’ collective failure over many years to address this problem” as well as other problems cited by the United States.

- Further discussion on WTO Appellate Body issues occurred at a meeting of the WTO Dispute Settlement Body.

- Ambassador Lighthizer, European Union Trade Commissioner Cecilia Malmström and Japanese Minister of Economy, Trade and Industry Hiroshige Seko met in Washington, D.C., on January 9 to discuss some of these issues as part of their trilateral work to address non-market-oriented policies.

- The WTO will hold an interactive meeting on January 17 to discuss many of these issues further and find ways to modernize and make improvements to the WTO.

For more information, contact NAM Vice President of International Economic Affairs Linda Dempsey and NAM Director of International Trade Policy Ken Monahan.

- NAM submits comments in response to Commerce Department’s emerging technology request. As part of the Commerce Department’s implementation of the new Export Control Reform Act (ECRA) enacted last year, Commerce published an advanced notice of proposed rulemaking for potential export controls of emerging technologies.

- In addition to direct engagement with the Commerce Department, the NAM submitted these comments to emphasize that updates to export controls must be carefully calibrated and be developed through a deliberative and ongoing process with continued and frequent private-sector engagement.

- The NAM comments also emphasized that new controls must take into consideration the need to strengthen and fortify America’s manufacturing and defense industrial base and supply chains through several detailed recommendations.

The NAM will continue to engage on these issues as the Commerce Department takes next steps toward ECRA’s implementation. For more information, contact NAM Director of Trade Facilitation Policy Jessica McBroom.

|

|

| Take Action |

|

- State Department’s Bureau of Economic and Business Affairs publishes “Working for American Businesses” overview. The Bureau of Economic and Business Affairs has published a brochure highlighting the various services available to U.S. businesses within the agency, including related to its advocacy center, business leads and commercial services in embassies overseas. Further inquiries can be sent to [email protected].

- BIS Introduction to Export Controls. The Bureau of Industry and Security (BIS) has developed a one-stop, how-to page to assist small companies in better understanding export administration regulations. To learn more, paste this link into your browser: https://www.bis.doc.gov/smallbiz.

- Stop Fakes Roadshow

Ongoing – May 2019

This roadshow delivers important information about intellectual property to the audience that needs it most: start-ups, entrepreneurs, small and medium-sized businesses, independent creators and inventors. Experts from multiple government agencies that deal with intellectual property issues present the information. To learn more, click here.

- U.S. Opportunities for Exporting Manufacturing Equipment to China

January 16, 2019

Webinar

Webinar participants will be introduced to export opportunities in China, the third-largest U.S. export market for plastics and rubber working equipment. U.S. firms interested in entering or expanding as a supplier to China’s manufacturing sector (e.g., rubber and plastic manufacturing equipment) will learn the latest market insights from China, key sector trends and actionable commercial opportunities. For more information and to register for the webinar, click here.

- Indo-Pacific LNG Supply and Gas Infrastructure Reverse Trade Mission

February 16–23, 2019

Washington, D.C., and Houston, Texas

A delegation from Indonesia, Vietnam and the Philippines will learn about U.S. LNG supply options and the capabilities of U.S. equipment and service providers. The visit, hosted by the U.S. Trade and Development Agency (USTDA), includes a business roundtable allowing U.S. companies to meet with and showcase their solutions to the delegation, as well as learn about upcoming project opportunities. For more information, please contact Eliza Chon.

- China Clean Energy Business Briefing

February 25, 2019

Boston, Massachusetts

The USTDA is hosting a business briefing for U.S. companies where delegates will present on China’s urban and construction waste management goals and how U.S. businesses can get involved. The delegation includes senior-level decision-makers from China’s Ministry of Ecology and Environment, as well as senior managers of private environmental technology companies. For more information, click here.

- China Pharmaceutical Industry Workshop

February 28, 2019

Washington, D.C.

The USTDA will host an industry workshop in Washington, D.C., for U.S. companies that will feature discussions on key industry issues, such as lifecycle pharmaceutical quality control, post-marketing assessments, new trends in product development and retail distribution. U.S. attendees will have an opportunity to connect directly with senior officials from the China National Medical Products Administration and to learn about the needs and goals of China’s pharmaceutical sector. For more information, click here.

- U.S. Commercial Service Trade Mission to the Southern Cone Region

March 24–29, 2019

Argentina, Bolivia, Chile, Paraguay, Uruguay

This Department of Commerce trade mission includes a business conference with regional-focused sessions as well as consultations with U.S. diplomats representing commercial markets throughout the South America region. The trade mission will give participants the opportunity to conduct business-to-business meetings with potential customers and business partners in Argentina, Bolivia, Chile, Paraguay and Uruguay. Application deadline is January 18. For more information, click here.

- Healthcare Technology & Health Services Trade Mission

April 6–11, 2019

Saudi Arabia, Kuwait and Qatar

The International Trade Administration (ITA) is organizing a trade mission to introduce U.S. firms to the rapidly expanding health care sectors in Saudi Arabia, Kuwait and Qatar and to assist U.S. companies in pursuing opportunities in this sector. Application deadline is February 15. For more information, click here.

- Trade Winds: Indo Pacific Forum & Mission

May 6–13, 2019

India, Sri Lanka, Bangladesh

Trade Winds, the largest annual U.S. government–led trade mission, will combine a conference and trade mission to India, Sri Lanka and Bangladesh, where U.S. exporters will meet with decision-makers on opportunities they’ve learned about at the Discover Global Markets: Indo-Pacific conference and other Asia-related events. Application deadline is February 15. For more information, click here.

- FABTECH

May 7–9, 2019

Monterrey, Mexico

FABTECH is the primary gathering for leading metal manufacturers in Mexico. Attendees from Mexico and South America will converge to find solutions, network, learn and experience firsthand the latest innovations in the metal forming, fabricating, welding and finishing industries. For more information, click here.

- U.S. Commercial Service Trade Mission to Central America

August 18–23, 2019

Central America

The 2019 Trade Americas program offers U.S. companies not only the opportunity to explore seven markets but also the ability to have one-on-one consultations with U.S. diplomats and officers with expertise in commercial matters throughout the Western Hemisphere region. Application deadline is July 31. For more information, click here.

- Cyber Security Trade Mission

September 23–27, 2019

Denmark, Norway and Sweden

The ITA is organizing a trade mission to introduce U.S. firms and organizations to Northern Europe’s information and communication technology, security and critical infrastructure protection markets. Application deadline is June 14. For more information, click here.

- For a listing of upcoming USTDA missions, click here.

- For a listing of upcoming Commerce Department trade missions, click here.

|

|

Thank you for subscribing to the NAM’s Global Manufacturing Economic Update.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|