|

| If you’re having trouble reading this, click here. |

|

| Global Manufacturing Economic Update |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

| By Chad Moutray – October 8, 2020 – SHARE |

|

|

|

| Continued Progress: Seven of the Top 10 Exports Markets Expanded in September |

|

| The Monthly Toplines |

|

- The J.P. Morgan Global Manufacturing PMI expanded in September at the fastest pace in 25 months, buoyed by recoveries in demand and strengthening in the outlook.

- In September, seven of the top 10 markets for U.S.-manufactured goods had expanding manufacturing sectors, up from six in August and just one (China) in May. As such, these major trading partners have continued to improve after plummeting in April to levels that were either the worst since the Great Recession or at record lows.

- The World Trade Organization predicts that global trade volumes could fall 9.2% in 2020, an improvement from the previous estimate of a 12.9% decrease this year. WTO predicts that global trade should rebound, rising by 7.2% in 2021.

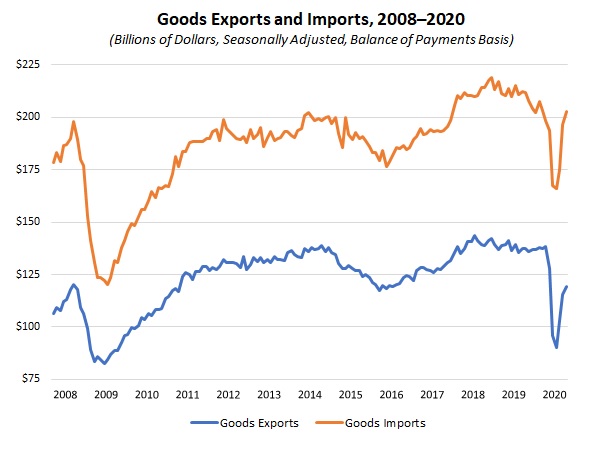

- The U.S. trade deficit rose to the highest level since August 2006, with goods imports rising faster than the increase in goods exports. The goods trade deficit rose to a new record. At the same time, the service-sector trade surplus dropped to its lowest level since January 2012.

- In non-seasonally adjusted data, U.S.-manufactured goods exports totaled $622.72 billion through the first eight months of 2020, dropping 17.31% from $753.07 billion for the same time frame in 2019.

- Other highlights include the following:

- In the latest survey from China, manufacturing new orders expanded at the fastest pace since January 2011, with exports increasing at the best rate since August 2017. Overall, industrial production grew 5.6% year-over-year, the best pace since December and a major improvement from the decline of 13.5% year-over-year seen in January/February.

- Industrial production experienced strong gains in the Eurozone and the United Kingdom in July, building on gains seen in May and June. The same was true in Canada regarding manufacturing sales. Yet, in each case—much like the United States—activity in the sector remained well below what was seen in February before the recession began.

- Among the top 10 markets for U.S.-manufactured goods, Brazil had the highest manufacturing PMI in September once again, hitting a new record high. Mexico continued to have the lowest manufacturing PMI, despite progress in recent months.

- The IHS Markit Emerging Markets Manufacturing PMI expanded for the third straight month to its fastest pace since April 2011.

- Manufacturers continue to advance efforts with the administration and Congress to open markets, ensure trade certainty and address challenges overseas, including the following:

- Asserting the importance of comprehensive U.S. trade agreements that open markets and set high standards

- Monitoring the U.S.–China security, trade and economic relationship

- Calling for a one-year delay in the implementation of the European Union’s proposed database on substances of concern in certain products

- Leading industry advocacy in support of congressional passage of a comprehensive Miscellaneous Tariff Bill

|

|

|

| Global Economic Trends |

|

- Worldwide Manufacturing Activity: The J.P. Morgan Global Manufacturing PMI expanded in September at the fastest pace in 25 monsths, buoyed by recoveries in demand and strengthening in the outlook. The headline index rose from 51.8 in August to 52.3 in September, growing for the third straight month from sharp declines in the spring from the COVID-19 pandemic. New orders (up from 52.8 to 53.6) accelerated at the best rate since April 2018, and exports (up from 49.9 to 51.7) rose for the first time since August 2018. Production (down from 53.6 to 53.5) eased marginally, but continued to expand modestly. However, the index for future output (up from 60.8 to 61.8) increased to a level not seen since May 2018, pointing to optimism for higher production over the next six months. Meanwhile, employment (up from 48.6 to 49.5) continued to stabilize, nearing neutral, even as hiring has contracted now for 10 consecutive months. In addition, input prices (up from 54.5 to 54.7) also picked up, rising to their highest levels since December 2018.

- Trade Outlook: The WTO predicts that global trade volumes could fall 9.2% in 2020 after edging down 0.1% in 2019. On the positive side, this forecast is an improvement from the April estimate of a 12.9% decrease in global trade. Still, the WTO adds that these “estimates are subject to an unusually high degree of uncertainty since they depend on the evolution of the pandemic and government responses to it.” Encouragingly, the WTO expects global trade to rebound, increasing by 7.2% in 2021. In a similar way, the WTO predicts that global real GDP will decrease by 4.8% in 2020, but rise by 4.9% in 2021.

- Sentiment in Major Markets: In September, seven of the top 10 markets for U.S.-manufactured goods had expanding manufacturing sectors, up from six in August and just one (China) in May. As such, these major trading partners have continued to improve after plummeting in April to levels that were either the worst since the Great Recession or at record lows. Here are more details on each of these major markets (in order of their ranking for U.S.-manufactured goods exports in 2019):

- Canada (up from 55.1 to 56.0, the best reading since August 2018): Manufacturers reported the strongest growth in new orders and output in at least two years, with employment rising at rates not seen since January 2019. The index for future output was the best in 14 months.

- Mexico (up from 41.3 to 42.1, declining at slowest pace since March): Mexico once again reported the weakest PMI among the top 10 markets. Although activity continued to deteriorate very sharply, manufacturers expressed cautious optimism for stronger production in the outlook. The index for future output expanded for the first time since the pandemic began.

- China (down from 53.1 to 53.0): New orders expanded at the fastest pace since January 2011, with exports increasing at the best rate since August 2017. Although production eased somewhat, respondents were upbeat about future activity. Hiring expanded for the first time in 2020.

- Japan (up from 47.3 to 47.7, the highest reading since February): Despite progress across the board, Japanese manufacturing activity remained severely challenged, contracting for the 17th straight month. Yet, the index for future output suggests optimism, with that measure at its best reading since June 2018.

- United Kingdom (down from 55.2 to 54.1, pulling back from the best reading since February 2018): New orders and production continued to expand at solid rates despite easing in September, and exports grew at their best pace since May 2018. Hiring fell for the eighth straight month, albeit at a slower rate of decline.

- Germany (up from 52.2 to 56.4, the best reading since July 2018): New orders, exports and output each soared to their fastest growth rates since December 2017. The index of future output rose to its strongest level since February 2018. At the same time, hiring continued to deteriorate, albeit at a slower pace.

- Netherlands (up from 52.3 to 52.5, expanding for the second straight month): Activity in the sector grew at the best reading since February, buoyed by strength in production, which notched its fastest rate since December 2018. New orders and exports slowed somewhat, but continued to expand very modestly. However, hiring weakened further, contracting for the seventh consecutive month. Manufacturers were mostly upbeat about future output, but with some easing from August’s survey.

- South Korea (up from 48.5 to 49.8, the highest reading since January): Manufacturing activity has contracted in every month so far in 2020 (and in 21 of the past 25 months). Encouragingly, output expanded for the first time since October 2018. The index for future output remained at positive levels for the second straight month, but with some easing in the latest survey. New orders and exports stabilized, nearing neutral in September.

- Brazil (up from 64.7 to 64.9, a new record high): In September, new orders and output pulled back somewhat from record highs in August but remained solid overall. Employment expanded at the fastest rate since February 2010, and exports rebounded to the best reading since April 2016. Brazil had the highest PMI among the top 10 markets for U.S.-manufactured goods, and survey respondents were very optimistic in their outlook.

- France (up from 49.8 to 51.2, expanding for the third time in the past four months): New orders and output picked up, and exports bounced back in September. While employment has contracted in every month so far this year, hiring declined at a slower pace in the latest survey. The index for future output pointed to cautious optimism for modest growth in production over the next six months.

- Regional and National Trends: Here are some other economic trends worth noting.

- China: In August, industrial production grew 5.6% year-over-year, the best pace since December and a major improvement from the decline of 13.5% year-over-year seen in January/February. At the same time, retail sales have increased by 0.5% year-over-year in August, the first positive reading since December. These gains are encouraging, despite being notably slower than before the COVID-19 pandemic. In contrast, fixed-asset investment has declined 0.3% year-over-year, remaining negative for the seventh straight month.

- Europe: In July, industrial production rose 4.1%, building on the strong gains seen in May and June. But, Eurozone production remained well below pre-recessionary levels, with output down 7.7% year-over-year. For its part, retail sales increased 4.4% in August, with spending up 3.7% over the past 12 months. Given the volatility seen since the COVID-19 crisis began, the modest growth in retail sales year-over-year is impressive (and mirrors trends seen in the United States). The unemployment rate increased from 7.9% in July to 8.1% in August.

- United Kingdom: Industrial production rose 5.2% in July, building on the strong gains seen in May and June. However, output remained 7.0% below where it was in February, illustrating the sharp declines in manufacturing activity seen during the COVID-19 pandemic. An update on U.K. industrial production will be released on Oct. 9. Meanwhile, retail sales increased 0.8% in August, rising for the fourth straight month. Encouragingly, retail spending has risen by 2.5% from February’s pre-pandemic levels.

- Canada: Manufacturing sales soared 7.0% in July, extending the very sizable gains seen in May and June. Despite increases over the past three months, manufacturing sales in Canada remained 5.4% below the pace seen in February before the COVID-19 pandemic began. Additionally, retail sales were up 0.6% in July. Despite tremendous volatility since the spring, retail spending has risen 1.1% since February. In August, the unemployment rate was 10.2%, improving from 10.9% in July. The number of manufacturing workers rose by 29,400 in August, but employment in the sector declined by 85,000 over the past year. September job figures will be released on Oct. 9.

- Mexico: Industrial production rose 6.9% in real terms in July, but it has fallen 11.6% over the past 12 months. Manufacturing production jumped 11.0% in real terms in July, but it declined 9.5% year-over-year. August figures will be released on Oct. 12. [Note: The link is in Spanish.]

- Japan: Industrial production rose 1.7% in August, increasing for the third straight month. However, production has fallen 13.3% over the past year. On the retail front, consumer spending increased 4.6% in August, rebounding from the 3.4% decline seen in July and rising for the third time in the past four months. Yet, on a year-over-year basis, retail sales have decreased 1.9%. [Note: The retail sales link is in Japanese.]

- Emerging Markets: The IHS Markit Emerging Markets Manufacturing PMI rose from 52.5 to 52.8, expanding for the third straight month and at its fastest pace since April 2011. New orders and exports accelerated, buoying the headline index. Output eased somewhat, but continued to expand modestly. Employment stabilized to the best reading since January. The index for future output signaled optimism about production over the next six months, increasing at the strongest pace since February. [Note: There is no link for this release.]

- Trade-Weighted U.S. Dollar Index:

Since April 24, the U.S. dollar has fallen 5.9% against a broad-based index of currencies for goods and services, according to the Federal Reserve. The index reflects currency rates per U.S. dollar, suggesting the dollar can purchase somewhat less today than it could a few months ago. Overall, the recent pullback reverses the trend seen earlier in the spring, when investors flocked to the U.S. dollar and dollar-denominated assets due to the COVID-19 pandemic. The current trend coincides with signs of improvements in manufacturing activity in the global economy, but it has also been exacerbated by lingering concerns about COVID-19 in the U.S.

Despite recent declines, manufacturers continue to cite a strong dollar as a challenge, both to their earnings and for increasing international demand. Over a longer time horizon, the U.S. dollar has risen 10.0% since Feb. 1, 2018, with 25.7% growth since July 1, 2014.

- International Trade:The U.S. trade deficit rose to the highest level since August 2006, jumping from $63.37 billion in July to $67.10 billion in August. Goods imports increased from $196.44 billion to $202.96 billion, the best reading since January. That was enough to outpace the growth in goods exports, which rose from $115.62 billion to $119.10 billion, a five-month high. More importantly, the goods trade deficit rose from $80.81 billion to $83.86 billion, a new record. In addition, the service-sector trade surplus has fallen over the course of this year, down from $24.30 billion at the end of last year to $16.76 billion in August, the lowest level since January 2012.

In August, strong growth occurred in goods exports for industrial supplies and materials (up $3.85 billion) and foods, feeds and beverages (up $1.08 billion, largely from soybeans). However, nonautomotive capital goods exports were down by $1.42 billion. On the other side of the ledger, goods imports were buoyed by large increases for consumer goods (up $3.82 billion), automotive vehicles and parts (up $1.66 billion), nonautomotive capital goods (up $830 million) and foods, feeds and beverages (up $687 million). Consumer goods imports soared to a record high ($57.85 billion). However, industrial supplies and materials imports fell by $1.55 billion.

- U.S.-Manufactured Goods Exports: In non-seasonally adjusted data, U.S.-manufactured goods exports totaled $622.72 billion through the first eight months of 2020, dropping 17.31% from $753.07 billion for the same time frame in 2019.

|

|

| International Trade Policy Trends |

|

- NAM submits comments calling for U.S. trade agreements that open markets, set high standards. On Oct. 2, the NAM submitted these comments to the U.S. International Trade Commission to aid in an investigation into the economic impact of trade agreements implemented under U.S. trade authorities procedures. The comments detail critical elements of U.S. trade agreements for manufacturers, the impact of trade agreements on manufacturing in the United States and the need for new comprehensive agreements to combat unfair barriers overseas. Specifically, the NAM underscores the following key points:

- As manufacturers in the United States lead the nation’s economic recovery and renewal, it is critical that the United States negotiate trade agreements that comprehensively open markets and set in place high standards.

- Future growth opportunities for the U.S. manufacturing sector will rest in large part on the ability to increase overseas sales.

- Manufacturers support the continued negotiation of comprehensive, high standard and market-opening trade agreements to advance the goals of our industry to promote free and fair trade and ensure sustained economic growth.

Learn more.

- Administration, Congress focus on China with continued restrictions, legislative plans and “phase one” deal implementation efforts. China remained an active area for U.S. policymakers in both the administration and Congress. The administration enforced restrictions related to national security. Congress unveiled China-focused legislative packages from both parties that continue to indicate that non-trade concerns are largely driving the relationship and dueling rhetoric at venues like the United Nations. The NAM remains actively engaged with the full range of U.S.–China developments, including, but not limited to, the continued implementation of the U.S.–China “phase one” trade deal. On this issue, China has signaled policy commitments in areas including intellectual property protection, while sending mixed signals on purchasing commitments.

- In late September, both parties in Congress issued new legislative plans designed to combat China concerns.

- On Sept. 17, Senate Minority Leader Chuck Schumer (D-NY) and 10 other Senate Democrats released the America Labor, Economic competitiveness, Alliances, Democracy and Security (America LEADS) Act. It offers broad recommendations related to domestic competitiveness, workforce development, human rights and foreign policy.

- On Sept. 30, House Republican Leader Kevin McCarthy (R-CA) and 15 Republican House members unveiled the final report from the China Task Force. The report lists roughly 400 recommendations for the administration, Congress and other stakeholders to address problematic Chinese behavior in areas such as ideological competition, supply chains, national security, technology, economics/energy and competitiveness.

- In late September, the Department of Commerce’s Bureau of Industry and Security added 35 Chinese companies (first batch, second batch) to its formal Entity List. BIS took this action based on the companies’ involvement in China’s island-building efforts in the South China Sea and their diversion of U.S.-origin unmanned aerial vehicle parts to Iran. As with previous additions of companies such as Huawei and Hikvision, the action triggers new BIS licensing requirements.

- In late September, federal judges in California and Washington D.C. temporarily froze the key implementation of pieces of President Trump’s August executive orders that had barred transactions with Tencent (owner of messaging and payment app WeChat) and ByteDance (owner of social media app TikTok). The decisions, which came only days after the Department of Commerce’s release of detailed guidance to implement the orders, granted preliminary injunctions and thus froze, but did not halt, the orders.

- On Sept. 19, China’s Ministry of Commerce issued long-awaited final regulations (English, Chinese) for its so -called “unreliable entity list,” a potential list of foreign companies and individuals subject to specific restrictions. The announcement does not add specific companies to this list, but is effective immediately, opening the door for entities to be added going forward.

Learn more.

- NAM supports European association letter calling for a delay in EU Substances of Concern In Products database implementation. On Sept. 21, the NAM joined 40 other associations in a public letter sent to European Commission President Ursula von der Leyen, urging a one-year delay in the implementation of the European Union’s proposed database on substances of concern in articles as such or in complex objects (products).

The letter aligns with an NAM-led letter sent to the European Commission in June that was signed by about 50 global associations flagging concerns with the SCIP database. In the new letter, the NAM and other associations stress support for the European Union’s circular economy ambitions and efforts to meet the expanded information requirements that can mean tens of thousands of new notifications for manufacturers. The letter stresses, however, that the European Chemical Agency’s multi-month implementation delay, coupled with the operational impact of the global COVID-19 pandemic, have made such a delay critical to ensure that the final database is robust, effective and crafted in line with the economic and environmental impact.

Learn more.

- Manufacturers continue campaign in support of congressional passage of the MTB. The USITC released a final report in August on nearly 2,500 petitions for temporary tariff relief for the 2021–2023 period under the MTB. The NAM is once again leading industry advocacy in support of congressional passage by the end of 2020 of this critical legislation for manufacturers. Passage of a comprehensive MTB by the end of this year could eliminate more than $1.5 billion worth of tariffs for three years on products not made or available in the United States.

Learn more.

- U.S. announces plans to eliminate tariffs on aluminum imports from Canada:On Sept. 15, the United States announced the elimination of tariffs on imports of nonalloyed, unwrought aluminum from Canada, retroactive to Sept. 1. The United States had reinstated these tariffs on Aug. 6.

- According to the U.S. announcement, six weeks after the end of any month from September through December, the United States will determine whether actual shipments meet “expected” import volumes.

- If actual imports from Canada exceed 105% of the expected volume for any month during the period, the United States will impose the 10% tariff retroactively on all shipments made in that month.

- The United States has not yet issued an official notice that will eliminate the tariffs.

Learn more.

- The Federal Emergency Management Agency initiates Defense Production Act Voluntary Agreement for critical medical supplies. Throughout the coronavirus pandemic, access to critical medical supplies and personal protective equipment has been the focus of governments around the globe. In the United States, the Defense Production Act provides special authorities for the government to work in close collaboration with manufacturers and distributors of such supplies to ensure strategic and effective plans of action to provide for the national defense. FEMA, in close partnership with the Department of Health and Human Services, has initiated a Voluntary Agreement under Section 708 of the Defense Production Act. Under the agreement, private sector participants are afforded a safe harbor from antitrust laws to facilitate the exchange of information, collaborate and adjust commercial operations for particular products when deemed to be necessary for U.S. national defense. Companies and organizations interested in participating in the Voluntary Agreement can learn more here.

Learn more.

- United States and Brazil hold CEO Forum on bilateral economic priorities. On Sept. 28, the 11th meeting of the U.S.–Brazil CEO Forum was held in Brasília and Washington.

- Government participants included U.S. Secretary of Commerce Wilbur Ross, U.S. National Economic Council Director Larry Kudlow, Brazilian Minister of the Civil Cabinet of the Presidency Walter Braga Netto and Brazilian Minister of Economy Paulo Guedes.

- At the meeting, the United States and Brazil underscored the importance of mutually beneficial economic growth and prosperity. They also reiterated the value of bilateral mechanisms, such as the U.S.–Brazil Commercial Dialogue, the Agreement on Trade and Economic Cooperation led by the Office of the U.S. Trade Representative, the Defense Industry Dialogue and the U.S.–Brazil Energy Forum.

Learn more.

|

|

| Take Action |

|

Indo-Pacific Business Forum

Oct. 27–29

Virtual | Hanoi, Vietnam

The event will be hosted virtually and in-person on Oct. 28–29 from Hanoi, Vietnam (Oct. 27 and 28 in the United States). This premier public–private event is supported by the governments of the United States and Vietnam. This is the leading event for promoting trade, investment and economic cooperation between the United States and its partners throughout the Indo-Pacific. This year’s event will highlight regional projects currently underway or envisioned for the future that incorporate best practices. Projects include major U.S.-led Indo-Pacific Strategy initiatives such as the Digital Connectivity and Cybersecurity Partnership, the Infrastructure Transaction and Assistance Network and the Asia Enhancing Development and Growth through Energy Initiative (Asia EDGE). Learn more.

- For a listing of upcoming U.S. Trade and Development Agency missions, click here.

- For a listing of upcoming Commerce Department trade missions, click here.

|

|

Thank you for subscribing to the NAM’s Global Manufacturing Economic Update.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

| Unsubscribe |

|

| © 2020 National Association of Manufacturers |

|

|

|

|

|

|

|

|

|

|