|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – January 14, 2019– SHARE

|

| |

|

<

|

|

Federal Reserve Cautious to Future Rate Hikes | Job Openings Still Strong |

|

| The Weekly Toplines |

|

- Signs increased that the Federal Reserve might pause or slow the pace of interest rate increases in 2019, particularly as the economy has softened somewhat. (For more on the current state of the economy, see my guest column in The Hill.)

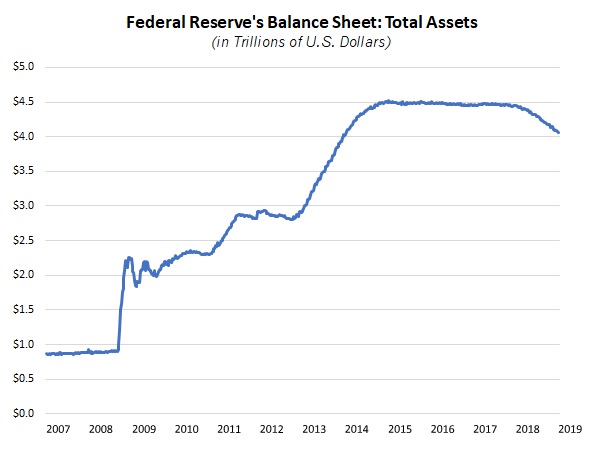

- In the minutes from the December 18–19 meeting of the Federal Open Market Committee (FOMC), participants stressed that future hikes were not on a “preset course” and would be data dependent. Federal Reserve Board Chair Jerome Powell reiterated that point further in a speech, suggesting that the FOMC would not rush to raise rates until economic conditions warranted such action. He also commented on the Federal Reserve’s balance sheet, which should fall below $4 trillion in the coming weeks for the first time since December 2013.

- The Federal Reserve did receive some good news on the inflation front. Reduced energy costs helped to pull consumer prices lower in December, the first decline since March. The consumer price index has risen 1.9 percent over the past 12 months, the first year-over-year reading below 2 percent since July 2017 and down from 2.9 percent in July (the highest year-over-year rate since February 2012). With that said, core inflation remained at 2.2 percent year-over-year for the fifth straight month.

- There were 493,000 job openings in the manufacturing sector in November, not far from August’s all-time high (508,000). In addition, durable goods firms reported the most job postings in November (324,000) since January 2001.

- Overall, the job openings data provided another solid reading regarding manufacturing job growth, consistent with the strong outlook and a tight labor market. Indeed, manufacturers continue to report difficulties in finding talent as their top concern. For the ninth consecutive month, there were more job openings in the U.S. economy (6,888,000 in November) than the number of people looking for work (6,018,000 in November and 6,294,000 in December).

- New data on factory orders and international trade were not released on schedule due to the partial government shutdown.

- Small business owners remain upbeat despite the fourth consecutive pullback in optimism in the National Federation of Independent Business’s monthly survey. The easing in December stemmed largely from reduced sales expectations, which were the lowest since April. On the other hand, workforce challenges remained the top “single most important problem” for the 11th consecutive month, and 39 percent of small business owners said they had job openings in December, a new record high in the survey’s history.

- There were some signs of softness in earnings for several key retailers, even as consumer spending has been expanding modestly overall. For its part, consumer credit outstanding increased 6.7 percent in November, including a 5.5 percent gain for revolving credit. The data suggest Americans were more willing to incur credit card debt in both October and November after some hesitance to do so in September. Overall, consumer credit has increased 4.3 percent over the past 12 months.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, January 7

Factory Orders and Shipments*

Tuesday, January 8

Consumer Credit

International Trade Report*

Job Openings and Labor Turnover Survey

NFIB Small Business Survey

Wednesday, January 9

None

Thursday, January 10

None

Friday, January 11

Consumer Price Index

|

|

|

|

This Week's Indicators:

Monday, January 14

None

Tuesday, January 15

New York Fed Manufacturing Survey

Producer Price Index

Wednesday, January 16

NAHB Housing Market Index

Retail Sales*

Thursday, January 17

Housing Starts and Permits*

Philadelphia Fed Manufacturing Survey

Friday, January 18

Industrial Production

State Employment Report

University of Michigan Consumer Sentiment

*This indicator will not be released on schedule due to the partial government shutdown. |

|

|

| Deeper Dive |

|

- Consumer Credit: U.S. consumer credit outstanding increased 6.7 percent in November, extending the solid gain of 7.6 percent in October. Total consumer credit registered $3.979 trillion in November, with $1.042 trillion in revolving credit and $2.937 trillion in nonrevolving credit. Nonrevolving credit (including auto and student loans) jumped 7.1 percent in November, and revolving credit (including credit cards and other lines of credit) rose 5.5 percent. The data suggest Americans were more willing to incur credit card debt in both October and November after some hesitance to do so in September. Overall, consumer credit has increased 4.3 percent over the past 12 months

- Consumer Price Index: Consumer prices edged down 0.1 percent in December, the first decline since March. Reduced energy costs, down 3.5 percent for the month, helped to pull down the headline number in December, offsetting the 0.4 percent gain for food prices. Excluding food and energy, consumer prices increased 0.2 percent in December for the third straight month. The consumer price index has risen 1.9 percent over the past 12 months, the first year-over-year reading below 2 percent since July 2017 and down from 2.9 percent in July (the highest year-over-year rate since February 2012).

With that said, core inflation remained at 2.2 percent year-over-year for the fifth consecutive month, suggesting price growth excluding food and energy has remained stable for now, albeit at a pace that is higher than Americans have become accustomed to in recent years.

- Factory Orders and Shipments: This indicator from the Census Bureau will be updated once the partial government shutdown ends.

- International Trade Report: This indicator from the Census Bureau will be updated once the partial government shutdown ends.

- Job Openings and Labor Turnover Survey: Job openings in the manufacturing sector pulled back somewhat, down from 504,000 in October to 493,000 in November, but remained not far from August’s all-time high (508,000). Durable goods firms reported the most job postings in November (324,000) since January 2001, with the pullback in the headline number stemming from a decline in openings for nondurable goods manufacturers for the month (down from 187,000 to 169,000). In addition, there were 378,000 hires in November, with 364,000 separations (which include quits, layoffs and retirements). As a result, there was net hiring of 14,000 workers in the manufacturing sector in November, down from 36,000 in October. Overall, this is another solid reading for manufacturing job growth, consistent with the strong outlook and a tight labor market. Indeed, manufacturers continue to report difficulties in finding talent as their top concern.

For the ninth consecutive month, there were more job openings in the U.S. economy (6,888,000 in November) than the number of people looking for work (6,018,000 in November and 6,294,000 in December). With that said, the number of nonfarm payroll job openings also eased for the month, even as it remained not far from the all-time high (7,293,000) set in August.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index pulled back for the fourth straight month from August’s all-time high (108.8), with the headline index dropping to a 14-month low (104.4). Despite some softening, small businesses remain upbeat overall. The percentage of respondents saying the next three months would be a “good time to expand” has declined from 34 in August (a record high) to 24 in December but continued to suggest decent activity. The deceleration in the latest headline index stemmed largely from reduced sales expectations, which were the lowest since April.

At the same time, the labor market remained solid. Respondents cited the quality of labor (23 percent) as the top “single most important problem” for the 11th consecutive month, illustrating the current difficulty in finding new workers. Indeed, 39 percent of small business owners said they had job openings in December, a new record high in the survey’s history. Hiring and capital spending plans also remained strong. Along those lines, 61 percent of small business owners reported a capital expenditure over the past six months, the same pace as in the November release and a robust reading overall.

|

|

| Take Action |

|

- Please consider participating in a new survey jointly carried out by The Manufacturing Institute and PwC (and conducted by Zpryme Research) covering a wide range of timely issues surrounding the smart factory and smart products. The survey can be found via this link: https://www.surveymonkey.com/r/KVQHT8P. Thanks for completing this survey and/or for passing it along to those in your organization for whom it might be a good fit.

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|