|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – June 24, 2019 – SHARE

|

|

<

|

|

|

Four Out of Five Manufacturers Optimistic about Their Own Company’s Outlook |

|

| The Weekly Toplines |

|

- In the second quarter of 2019, about four out of five manufacturing respondents said that they were either somewhat or very optimistic about their own company’s outlook. While that was down from nearly 90 percent who said the same thing in the first quarter, it continues to reflect a mostly optimistic sentiment in the sector. In the nearly 21-year history of the survey, the average is 75.0 percent positive. Interestingly, small manufacturers were more optimistic about their own company’s outlook than their larger counterparts.

- The inability to attract and retain workers remained respondents’ top concern for the seventh consecutive survey; 68.8 percent of respondents identified that issue as their top concern. Trade uncertainties were the second-most-mentioned concern facing manufacturers; they were cited as a top company issue by 56.0 percent of those completing the survey. More than four-fifths of respondents said passage of the United States–Mexico–Canada Agreement was important for their company.

- Other economic data also reflect slower growth in the manufacturing sector. For instance, the IHS Markit Flash Manufacturing PMI dropped to 50.1 in June, its weakest pace since September 2009 and one that represents an ever-so-slight expansion. This was similar to the responses in the Philadelphia Federal Reserve Bank’s June survey, which found that activity expanded for the fourth straight month, but only barely. In contrast, the Empire State Manufacturing Survey contracted for the first time since October 2016, with declining new orders and hiring in the New York Fed’s district. Yet, each of these releases continue to show an upbeat outlook for the next six months.

- Meanwhile, there was mixed news in the housing market. New residential construction declined 0.9 percent, down from an annualized 1,281,000 units in April to 1,269,000 units in May. More importantly, these data reflect ongoing weaknesses for single-family activity, which fell from 876,000 units to 820,000 units for the month. This suggests that the housing market remains softer than desired despite reduced mortgage rates. On that note, the average 30-year mortgage rate was 3.84 percent last week, down from 4.94 percent seven months ago.

- For their part, builders feel upbeat about sales over the next six months despite affordability and workforce challenges, largely on expectations that construction will rebound in the coming months. Along those lines, housing permits—a proxy of future activity—edged up 0.3 percent in May, hovering close to the 1.3-million-unit threshold that remains a psychological barrier.

- Moreover, existing home sales rose 2.5 percent, up from an annualized 5.21 million units in April to 5.34 million units in May, a three-month high. Since May 2018, however, existing home sales have fallen 1.1 percent, down from 5.40 million units one year ago.

- The Federal Open Market Committee left short-term interest rates unchanged at the conclusion of its June 18–19 meeting. However, it signaled that a rate cut might be forthcoming, with the market anticipating such a move at the July 30–31 meeting. The Fed also provided economic projections, which seem to indicate the willingness of many members to cut the federal funds rate twice in 2019.

- In terms of the economy, the FOMC noted “solid” labor market growth, with the unemployment rate still near 50-year lows. Consumer spending had, in its estimation, rebounded, but business investment remained softer than desired.

Editor’s Note:I am excited to announce that Jim Hoke, a senior global economist at Deere & Company, will be the guest author for the Monday Economic Report on July 1. This will give us an opportunity to gain insights from a well-respected industrial economist with on-the-ground expertise in the sector.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, June 17

NAHB Housing Market Index

New York Fed Manufacturing Survey

Tuesday, June 18

Housing Starts and Permits

Wednesday, June 19

FOMC Monetary Policy Statement

Thursday, June 20

Conference Board Leading Indicators

Philadelphia Fed Manufacturing Survey

Friday, June 21

Existing Home Sales

IHS Markit Flash U.S. Manufacturing PMI

NAM Manufacturers’ Outlook Survey

State Employment Report

|

|

|

|

This Week's Indicators:

Monday, June 24

Chicago Fed National Activity Index

Dallas Fed Manufacturing Survey

Tuesday, June 25

Conference Board Consumer Confidence

Housing Starts and Permits

New Home Sales

Richmond Fed Manufacturing Survey

Wednesday, June 26

Durable Goods Orders and Shipments

International Trade in Goods (Preliminary)

Thursday, June 27

Gross Domestic Product (Second Revision)

Kansas City Fed Manufacturing Survey

Friday, June 28

Personal Consumption Expenditures Deflator

Personal Income and Spending

University of Michigan Consumer Sentiment

|

|

|

| Deeper Dive |

|

- Conference Board Leading Indicators: The Leading Economic Index was unchanged in May, its weakest reading since January. These data were pulled lower by reduced new orders in the manufacturing sector and softness in the stock market. This was counterbalanced, however, by consumer confidence, housing permits and lending conditions, each of which made a positive contribution to the LEI in May. Meanwhile, the Coincident Economic Index was up 0.2 percent in May, its strongest monthly gain so far in 2019. The rebound in industrial production in May helped lift the CEI, with manufacturing and trade sales, nonfarm payrolls and personal income also continuing to be bright spots in the economic data.

- Existing Home Sales: The National Association of Realtors said that existing home sales rose 2.5 percent, up from an annualized 5.21 million units in April to 5.34 million units in May, a three-month high. Sales were higher in every region of the country; single-family and condominium and co-op sales also went up in May. While these data were encouraging and likely boosted by lower mortgage rates, the housing market has been challenged by affordability and workforce issues, and that can be seen in the year-over-year data. Since May 2018, existing home sales have fallen 1.1 percent, down from 5.40 million units one year ago. Currently, the market has 4.3 months of supply, up for the third straight month from 3.6 months in February. The median sales price for existing homes rose 4.8 percent over the past 12 months, up to $277,700 in the latest data.

- FOMC Monetary Policy Statement: The Federal Open Market Committee left short-term interest rates unchanged at the conclusion of its June 18–19 meeting. However, it signaled that a rate cut might be forthcoming, with the market anticipating such a move at the July 30–31 meeting. The Federal Reserve dropped any reference to being “patient” in its statement. Instead, the committee noted that it will closely watch incoming data—especially given “uncertainties” in the outlook—and “act as appropriate to sustain the expansion.”

In addition, the Fed also provided economic projections, including “dot plots,” or the responses of all participants in terms of the outlook. Those forecasts show a split among the participants, which include voting and nonvoting members. More to the point, seven responses predicted two rate decreases in the federal funds rate this year, with another showing one cut. Interestingly, the only dissent came from James Bullard, the president of the St. Louis Federal Reserve Bank, who noted that he would have voted to lower rates instead of keeping them unchanged.

In terms of the economy, the FOMC noted “solid” labor market growth, with the unemployment rate still near 50-year lows. Consumer spending had, in its estimation, rebounded, but business investment remained softer than desired. Inflation also continued to be below its target range. The Federal Reserve predicts 2.1 percent growth in real GDP in 2019, with 2.0 percent seen in 2020. The unemployment rate will be 3.6 percent this year, which is the current level, inching up to 3.7 percent in 2020. Meanwhile, core inflation is expected to be 1.8 percent in 2019, rising to 1.9 percent next year.

- Housing Starts and Permits: New residential construction declined 0.9 percent, down from an annualized 1,281,000 units in April to 1,269,000 units in May. More importantly, these data reflect ongoing weaknesses for single-family activity, which fell from 876,000 units to 820,000 units for the month. This suggests that the housing market remains softer than desired despite reduced mortgage rates. The decrease in single-family starts was enough to offset the jump in multifamily activity, which rose from 405,000 to 449,000, its best reading in 14 months. Over the past 12 months, new residential construction starts have fallen 4.7 percent, down from 1,332,000 units in May 2018, with single-family starts down a whopping 12.5 percent year-over-year.

For their part, builders feel upbeat about sales over the next six months (see below) despite affordability and workforce challenges. They base this optimism largely on expectations that construction will rebound in the coming months. Along those lines, housing permits—a proxy of future activity—edged up 0.3 percent, up from 1,290,000 units at the annual rate in April to 1,294,000 units in May. This was the best reading since January, hovering close to the 1.3-million-unit threshold that remains a psychological barrier. Still, new residential permitting decreased by 0.5 percent year-over-year, down from 1,301,000 units in May 2018, with single-family permits off 3.3 percent.

- IHS Markit Flash U.S. Manufacturing PMI: Manufacturing activity in the United States slowed to a crawl, with the headline index dropping from 50.5 in May to 50.1 in June. That suggests that the sector was growing (barely) at the weakest pace since September 2009. In the latest data, output and hiring slowed to just barely above neutral. At the same time, new orders rebounded in June after contracting in May, with exports also improving to neutral. Looking ahead six months, manufacturers completing the survey remained upbeat in their outlook for production, with the measure for future output up from 61.1 to 61.7. Pricing pressures continued to decelerate, with raw material costs expanding at the weakest pace since June 2017.

Separately, IHS Markit also released survey results for the Eurozone, with manufacturing activity contracting for the fifth straight month in June, albeit with some stabilization. The IHS Markit Flash Eurozone Manufacturing PMI inched up from 47.7 in May to 47.8 in June. That remained not far from March’s figure (47.5), which was the lowest in six years. Activity in Germany has now contracted in every month so far in 2019, but at a slower pace of decline in June. The index for future output in Germany moved to almost neutral, which was promising. In contrast, manufacturers in France reported expanding growth for the second consecutive month, with the best reading on output since October 2018.

- NAHB Housing Market Index: The National Association of Home Builders and Wells Fargo reported that confidence pulled back in June from May’s reading, which had been the best since October. The Housing Market Index declined from 66 in May to 64 in June. NAHB Chief Economist Robert Dietz said that “builders continue to grapple with excessive regulations, a shortage of lots and lack of skilled labor that are hurting affordability and depressing supply.” Yet, it is also important to note that respondents continue to feel optimistic overall, and reduced mortgage rates should help boost demand. Indeed, the index for expected single-family sales six months from now inched down from 72 to 70—a figure that remains quite elevated.

- NAM Manufacturers’ Outlook Survey: In the second quarter of 2019, about four out of five manufacturing respondents said that they were either somewhat or very optimistic about their own company’s outlook. While that was down from nearly 90 percent who said the same thing in the first quarter, it continues to reflect a mostly optimistic sentiment in the sector. In the nearly 21-year history of the survey, the average is 75.0 percent positive. Interestingly, small manufacturers were more optimistic about their own company’s outlook than their larger counterparts.

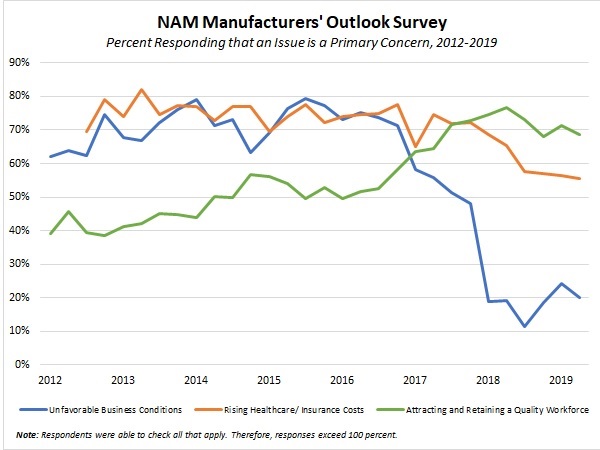

The inability to attract and retain workers remained respondents’ top concern for the seventh consecutive survey; 68.8 percent of respondents identified that issue as their top concern. The manufacturing industry’s skills gap challenge is a long-standing problem, but one that has been exacerbated by recent economic successes, including an unemployment rate near 50-year lows and a labor market with more job openings than people looking for work. In the December 2018 iteration of this survey, nearly 30 percent of manufacturers reported that they were forced to turn down business opportunities due to their inability to find sufficient talent—a challenge heightened by the tight labor market and baby boomer retirements.

Trade uncertainties were the second-most-mentioned concern facing manufacturers; they were cited as a top company issue by 56.0 percent of those completing the survey. It is also abundantly clear that firms that are more upbeat about export growth are also more optimistic in their overall outlook. Indeed, among those manufacturers who expect to grow their exports over the next 12 months, 92.0 percent expressed optimism about their company’s prospects. That compares to a 44.0 percent positive reading for those manufacturers anticipating declining exports.

It is no secret that manufacturers rely on trade to grow their businesses. Manufacturers in America sell more to Canada and Mexico, our country’s largest two trading partners, than to our next 11 trading partners combined. Therefore, it should not be a surprise that more than four-fifths of respondents said passage of the United States–Mexico–Canada Agreement was important for their company.

- New York Fed Manufacturing Survey: Manufacturers activity in the New York Federal Reserve Bank’s district in June plunged to its first negative reading since October 2016. The headline index decreased from 17.8 in May to -8.6 in June, with declining new orders, employment and the average workweek for the month. Growth for shipments slowed. At the same time, respondents to the Empire State Manufacturing Survey remain optimistic in their outlook for the next six months, even with some easing in the latest data. Nearly 46 percent of those completing the survey said that they anticipate higher sales over the coming months, and 27.6 percent and 24.8 percent predict more hiring and capital expenditures, respectively. Meanwhile, raw material costs accelerated in June and are expected to remain somewhat elevated moving forward, even as the pace of growth has decelerated from the sharp rises seen last year.

- Philadelphia Fed Manufacturing Survey: Manufacturing activity expanded for the fourth straight month in June, but only barely. The composite index of general business activity plunged from 16.6 in May to 0.3 in June, with slower growth for new orders, shipments, employment and the average workweek. In addition, pricing pressures have continued to decelerate, expanding at the slowest pace since October 2016. More importantly, manufacturers in the district remain optimistic in their outlook for the next six months. More than half of the respondents expect new orders and shipments to rise in the coming months, with 35.1 percent and 32.8 percent anticipating increased hiring and capital spending, respectively.

- State Employment Report: Ohio created the most net new manufacturing jobs in May, adding 2,400 workers, with Florida (up 2,000) close behind. In addition, Texas saw the greatest job gains in the sector over the past 12 months, with manufacturing employment in the state up 26,300 since May 2018. Other states with the fastest manufacturing job growth year-over-year included Florida (up 11,500), California (up 10,800) and Washington (up 10,100). Meanwhile, Vermont had the lowest unemployment rate in the nation in May at 2.1 percent.

|

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|