|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

| By Chad Moutray, Ph.D., CBE – December 16, 2019 – SHARE |

|

|

| |

|

| Retail Sales Disappointed in November but Up 3.3% Year-Over-Year |

|

| The Weekly Toplines |

|

- Retail sales increased 0.2% in November, weaker than expected and possibly impacted by the late Thanksgiving and more compressed holiday shopping season. Spending excluding motor vehicles and gasoline station sales was flat in November. This suggests that consumers felt more hesitant in their purchases. With that said, retail spending has risen a modest 3.3% over the past 12 months.

- After increasing short-term rates at each of the past three Federal Open Market Committee meetings, the Federal Reserve made no changes to monetary policy at its Dec. 10–11 meeting, as expected. Participants noted that consumer spending and the labor market were bright spots in the economy, but business investment and trade provided drags on growth. Core inflation continues to remain well below the FOMC’s stated target of 2%, which would be consistent with slower growth than desired.

- Yet, the Federal Reserve feels that its recent moves should help to prolong the economic expansion, and it wants to see if those actions bear fruit as it looks at incoming data. The FOMC is not likely to reduce the federal funds rate again unless it sees signs of further deterioration in the economy.

- Producer prices for final demand goods rose 0.3% in November, or 1.1% over the past 12 months. Core inflation, which excludes food and energy costs, has grown 1.3% year-over-year, the slowest pace since September 2016 and continuing a deceleration trend for input prices.

- Consumer prices also increased 0.3% in November, but have risen by more over the past year. Core inflation for consumers has risen 2.3% year-over-year, with notably higher medical care services and shelter expenses, among other categories. Nonetheless, inflation appears to be stable for now and not really a major concern for the Federal Reserve.

- The National Federation of Independent Business reported that the Small Business Optimism Index rose from 102.4 in October to 104.7 in November. Small business owners generally remain positive in their outlook despite the slowing global economy and ongoing trade uncertainties. Respondents continued to cite the quality of labor as the top “single most important problem.”

- In a pre-holiday rush, statistical agencies will release a slew of important economic data next week. Highlights include updates on consumer confidence, GDP (second revision), housing starts and permits, industrial production, job openings, personal income and spending and manufacturing surveys from IHS Markit and the Kansas City, New York and Philadelphia Federal Reserve Banks.

- In particular, manufacturers will be looking for signs of stabilization—and perhaps a pickup—in manufacturing activity, with housing building on recent strength and consumer spending continuing to increase at a modest pace.

|

|

|

| Economic Indicators |

|

|

Last Week’s Indicators:

(Summaries Appear Below)

Monday, December 9

None

Tuesday, December 10

NFIB Small Business Survey

Productivity and Costs (Revision)

Wednesday, December 11

Consumer Price Index

FOMC Monetary Policy Statement

Thursday, December 12

Producer Price Index

Friday, December 13

Retail Sales |

|

|

|

Monday, December 16

IHS Markit Flash U.S. Manufacturing PMI

NAHB Housing Market Index

New York Fed Manufacturing Survey

Tuesday, December 17

Housing Starts and Permits

Industrial Production

Job Openings and Labor Turnover Survey

Wednesday, December 18

None

Thursday, December 19

Conference Board Leading Indicators

Existing Home Sales

Philadelphia Fed Manufacturing Survey

Friday, December 20

Gross Domestic Product (Second Revision)

Kansas City Fed Manufacturing Survey

Personal Consumption Expenditures Deflator

Personal Income and Spending

State Employment Report

University of Michigan Consumer Sentiment (Revision) |

|

|

| Deeper Dive |

|

- Consumer Price Index: Consumer prices rose 0.3% in November, slowing slightly from the 0.4% gain in October. Prices were buoyed by a jump in energy costs, up 0.8% in November, with food prices inching up 0.1% for the month. Over the past 12 months, the consumer price index has risen 2.0% (seasonally adjusted), up from 1.8% year-over-year in the prior release. At the same time, core inflation (which excludes food and energy) increased 0.2% in November, with 2.3% growth over the past 12 months.

Overall, inflation appears to be stable for now and not far from the Federal Reserve’s stated goal of core price inflation around 2%. Over the past year, consumer prices were notably higher for medical care services and shelter expenses, but prices for apparel and new and used vehicles have fallen year-over-year.

- FOMC Monetary Policy Statement: After increasing short-term rates at each of the past three Federal Open Market Committee meetings, the Federal Reserve made no changes to monetary policy at its Dec. 10–11 meeting, as expected. Participants noted that consumer spending and the labor market were bright spots in the economy, but business investment and trade provided drags on growth. Core inflation continues to remain well below the FOMC’s stated target of 2%, which would be consistent with slower growth than desired.

Yet, the Federal Reserve feels that its recent moves should help to prolong the economic expansion, and it wants to see if those actions bear fruit as it looks at incoming data. The FOMC is not likely to reduce the federal funds rate again unless it sees signs of further deterioration in the economy.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index rose from 102.4 in October to 104.7 in November. Small business owners generally remain positive in their outlook despite the slowing global economy and ongoing trade uncertainties. The percentage of respondents saying that now is a “good time to expand” increased from 23% to 29%, the best reading since May and strong overall.

Meanwhile, the sales data provided mixed results. Small business owners said that sales over the past three months accelerated, with the net percentage citing increases up from 4% to 12%, an 18-month high. Yet, those completing the survey felt more cautious in their expectations for the next three months, with the net percentage down from 17% to 13%. On the capital spending front, small firms noted pickups for actual expenditures over the past six months (up from 59% to 60%) and in their plans for the next three to six months (up from 29% to 30%), with both measures seeing their strongest figures since the spring.

The labor market data continue to remain solid. For instance, the net percentage planning to hire in the next three months picked up from 18% to 21%, and 38% of small business owners reported job openings, up from 34%. In addition, respondents cited the quality of labor as the top “single most important problem” for the 20th consecutive month.

- Producer Price Index: Producer prices for final demand goods and services were flat in November, slowing after a gain of 0.4% in October. At the same time, producer prices for final demand goods rose 0.3% in November after jumping 0.7% in October. Food and energy costs increased 1.1% and 0.6%, respectively. Core inflation for goods, which excludes food and energy, rose 0.2% for the month. Meanwhile, producer prices for final demand services fell 0.3% in November, offsetting the similar gain in October.

Over the past 12 months, producer prices for final demand goods and services have risen just 1.1%, up slightly from 1.0% in the previous release. In addition, core producer prices have grown 1.3% year-over-year, decelerating from 1.5% year-over-year in October and the slowest pace since September 2016. To illustrate just how much core PPI growth has eased over the past 12 months, the year-over-year rate registered 2.9% in November 2018.

Overall, the data continue to suggest that inflationary pressures remain low, with core prices well below the Federal Reserve’s stated goal of 2%. The Federal Open Market Committee has moved in recent months to stimulate growth to prolong the economic recovery, comforted but also concerned by the lack of inflation. With that said, the Federal Reserve is unlikely to make additional moves unless economic conditions deteriorate further.

- Productivity and Costs (Revision): Manufacturing labor productivity inched up 0.1% at the annual rate in the third quarter, a slight improvement from the earlier estimate of a 0.1% decline and better than the decrease of 2.4% in the second quarter.

Output in the sector rose 1.3% in the third quarter, ending two straight quarters of declines, with a similar trend for the number of hours worked, which increased 1.2%. Unit labor costs for manufacturers rose 3.0%. Durable goods manufacturers saw a 0.7% increase in labor productivity in the third quarter, with output and unit labor costs both up 1.8%. In contrast, labor productivity for nondurable goods manufacturers declined 0.8% despite output rising 0.8%. It was the first increase in nondurable goods output since the third quarter of 2018.

Meanwhile, nonfarm business labor productivity fell 0.2% in the third quarter, down from a gain of 2.5% in the second quarter and the first decline since the fourth quarter of 2015. Nonfarm output grew a modest 2.3% in the third quarter, and unit labor costs rose 2.5%.

- Retail Sales: Consumer spending increased 0.2% in November, slowing from the gain of 0.4% in October. Economists had been expecting stronger retail sales for the month, which could have been impacted negatively by the late Thanksgiving and more compressed holiday shopping season. Overall, the data were somewhat disappointing, suggesting that Americans felt more hesitant in their purchases. Along those lines, retail spending excluding motor vehicles and gasoline station sales was flat in November, down from an increase of 0.2% in October.

Retail sales have risen a modest 3.3% over the past 12 months. As such, consumer spending has continued to be a bright spot in the economy over the past year, increasing modestly, even as it has also been clear that Americans have slowed their spending year to date.

The underlying data provided mixed results. Retail spending increased in November for food and beverage stores; gasoline stations; motor vehicles and parts; and nonstore retailers, among others. In contrast, sales declined for the month for clothing and accessory stores; health and personal care stores; miscellaneous retailers; sporting goods and hobby stores; and food services and drinking places.

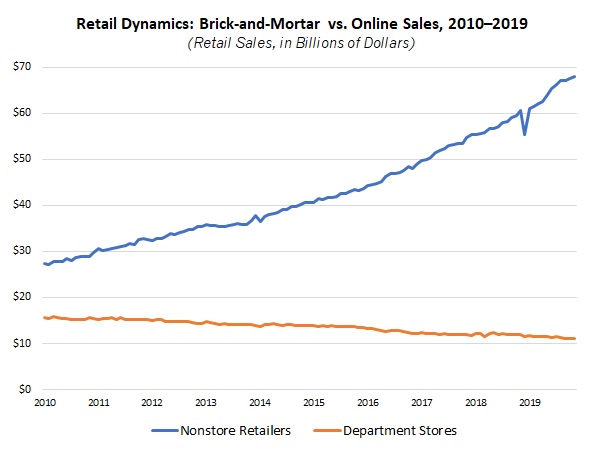

Notably, the changing dynamics of the retail sector are in full view, with department store sales down 0.6% in November and off 7.2% over the past 12 months. At the same time, sales for nonstore retailers rose 0.8% for the month and 11.5% year-over-year. |

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|

|