|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – January 6, 2020 – SHARE   |

|

|

| |

|

| ISM®: Manufacturing Activity Falls at Fastest Pace Since June 2009 |

|

| The Weekly Toplines |

|

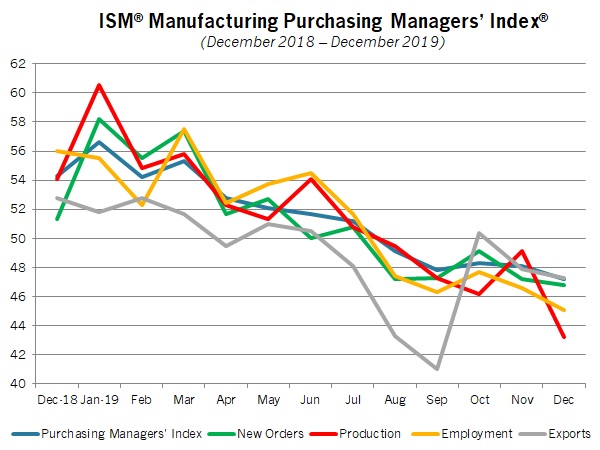

- The Institute for Supply Management® reported that manufacturing activity contracted for the fifth straight month, falling to the lowest level since June 2009. Indeed, even as other measures have shown some stabilization in the sector, the headline index from ISM® declined from 48.1 in November to 47.2 in December.

- This suggested that the manufacturing sector remained weak in December, with continued sales and export challenges and only cautious optimism for the coming months, according to the sample comments in the ISM® report.

- In addition, private manufacturing construction declined 2.4% in November to a five-month low. Spending in the sector has been more sluggish than desired over the past few years, and yet, activity rose a modest 2.1% over the past 12 months.

- The Dallas Federal Reserve Bank noted rebounding new orders, production, shipments and capacity utilization data in December, even as the composite index dropped from -1.3 in November to -3.2 in December. The headline measure contracted for the third straight month, with seven negative readings in 2019. The outlook for the next six months remained positive.

- In advance statistics, the goods trade deficit narrowed to the lowest level since October 2016, with goods imports dropping to a 25-month low. Final data will be released Jan. 7.

- Meanwhile, consumer confidence has remained relatively constant over the past four months, according to the Conference Board. Respondents in the latest survey felt more positive in their assessments of current conditions, but their view of the economic outlook weakened somewhat. Confidence levels remained elevated overall, buoyed by the strong labor market, even with some lingering anxieties and some worries about the income outlook.

- Speaking of jobs, this week will bring new employment data for December. The manufacturing workforce rebounded in November in the wake of the auto strike, with the sector adding just more than 5,000 additional employees per month year to date in 2019, down from 22,800 each month over the same time frame in 2018. Look for additional slight growth in December to end the year, with the overall labor market remaining solid.

- Other highlights this week include updates on consumer credit, factory orders and shipments, international trade and real GDP by industry.

|

|

|

| Economic Indicators |

|

Last Week’s Indicators:

(Summaries Appear Below)

Monday, December 30

Dallas Fed Manufacturing Survey

International Trade in Goods (Preliminary)

Tuesday, December 31

Conference Board Consumer Confidence

Wednesday, January 1

NEW YEAR’S DAY HOLIDAY

Thursday, January 2

None

Friday, January 3

Construction Spending

ISM® Manufacturing Purchasing Managers’ Index® |

|

|

|

This Week's Indicators:

Monday, January 6

None

Tuesday, January 7

Factory Orders and Shipments

International Trade Report

Wednesday, January 8

ADP National Employment Report

Consumer Credit

Thursday, January 9

Real GDP by Industry

Friday, January 10

BLS National Employment Report |

|

|

| Deeper Dive |

|

- Conference Board Consumer Confidence: Consumer sentiment has remained relatively constant over the past four months, averaging 126.4, according to the Conference Board. In the latest data, the headline index edged down from 126.8 in November to 126.5 in December. Americans felt more positive in their assessments of current conditions, but their view of the economic outlook weakened somewhat. Confidence levels remained elevated overall, even with some lingering anxieties. Indeed, 38.7% of respondents suggested that business conditions were “good,” unchanged from the prior survey, while those noting that conditions were “bad” decreased from 13.6% to 11.1%.

Meanwhile, the percentage of Americans feeling that jobs were “plentiful” rose from 44.0% to 47.0%, which remained significantly higher than those responding that jobs were “hard to get,” which ticked up from 12.4% to 13.1%. At the same time, income expectations slipped somewhat, which might explain the easing in the outlook component. The percentage of consumers anticipating higher incomes over the coming months dropped from 22.9% to 21.1%, with those predicting reduced incomes inching up from 6.2% to 7.7%.

- Construction Spending: Private manufacturing construction spending declined 2.4% in the latest data, down from $72.93 billion at the annual rate in October to $71.15 billion in November, a five-month low. Nonetheless, construction activity in the sector has risen a modest 2.1% over the past 12 months, up from $69.67 billion in November 2018. With that said, manufacturing construction has been more sluggish than desired over the past few years, with activity remaining well below the all-time high of $86.65 billion in June 2015.

Meanwhile, total private construction spending increased 0.4% in November, with residential construction up 1.9% but nonresidential activity down 1.2%. New single-family construction increased 1.2%, but multifamily activity was flat for the month. On a year-over-year basis, residential and nonresidential construction spending has risen 2.7% and 0.2%, respectively. At the same time, public-sector construction rose 0.9% in November, with 12.4% growth over the past 12 months.

- Dallas Fed Manufacturing Survey: Manufacturers reported rebounding new orders, production, shipments and capacity utilization data in December, even as the composite index dropped from -1.3 in November to -3.2 in December. The headline measure contracted for the third straight month, with seven negative readings in 2019. The sample comments noted weaknesses in the auto and energy sectors and difficulties in finding sufficient talent, with some lingering uncertainties in the global outlook but cautious optimism for a “good” but “soft” year ahead. In December, the expansions for employment and capital expenditures picked up, which was encouraging.

Manufacturers in the Texas district continued to feel positive in their assessments for the next six months, albeit with the forward-looking index for general business activity edging down from 7.3 in November to 6.4 in December. Nearly 43% of respondents predicted increased orders over the coming months, with 49.1% seeing more production. One-third of those completing the survey anticipate stronger capital spending, with 30.1% forecasting additional hiring.

- International Trade in Goods (Preliminary): In advance statistics, the goods trade deficit narrowed to the lowest level since October 2016, down from $66.80 billion in October to $63.19 billion in November. Goods exports rose by $925 million, with goods imports falling to a 25-month low (down $2.68 billion). Sizable declines occurred in imports for capital goods and consumer goods. Final data will be released Jan. 7, which will also include the service-sector trade surplus.

- ISM® Manufacturing Purchasing Managers’ Index®: The Institute for Supply Management® reported that manufacturing activity contracted for the fifth straight month, falling to the lowest level since June 2009. Indeed, even as other measures have shown some stabilization in the sector, the headline index from ISM® declined from 48.1 in November to 47.2 in December. This suggested that the manufacturing sector remained weak in December, with continued sales and export challenges and only cautious optimism for the coming months, according to the sample comments.

The underlying data decreased across the board, including deepening contractions for new orders, production, employment and exports. Indeed, the index for production plummeted from 49.1 to 43.2, a reading not seen since April 2009. Inventories and imports also contracted, but at a slower pace in the latest data. In contrast to those measures, prices increased in December after falling in the six previous months.

|

|

| Take Action |

|

- The Manufacturing Leadership Council is partnering with The Manufacturing Institute—the workforce and education partner of the NAM—to examine what skills are most in demand, both in current operations and for expected roles on the shop floor over the coming years. If you have not already done so, please take a moment to complete this short 10-question survey by Wednesday, Jan. 8, 2020, at 5:00 p.m. EST. All responses will be kept confidential, and the results will be posted online soon.

|

|

|

Thank you for subscribing to the NAM's Monday Economic Report.

If you're part of an NAM member company and not yet subscribed, email us. If you're not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Interested in becoming a presenter of the Monday Economic Report? Email us. |

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

|

|

|

|

|

|

|

|

|

|