|

| If you’re having trouble reading this, click here. |

|

s

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – July 6, 2020 – SHARE

|

|

<

|

|

|

| The Economy Bounces Back Strongly, but a Full Recovery Could Take Time |

|

| The Weekly Toplines |

|

With the beginning of the second half of 2020, the data last week continued to show a bounce back in economic activity in May and June after sharp declines in the spring months due to COVID-19 and the global recession. These data represent an encouraging sign, and yet, we must also note a couple of caveats.

- The depth of the downturn was severe—either the worst since the Great Recession or on record, depending on the indicator. These conditions will make it more difficult to get back to prerecession levels.

- We have experienced spikes in COVID-19 cases recently, which could impact the pace of reopenings for many businesses and consumers’ willingness to resume “normal” activities and spending. These factors also could dampen growth in forthcoming data.

Highlights from the data released last week:

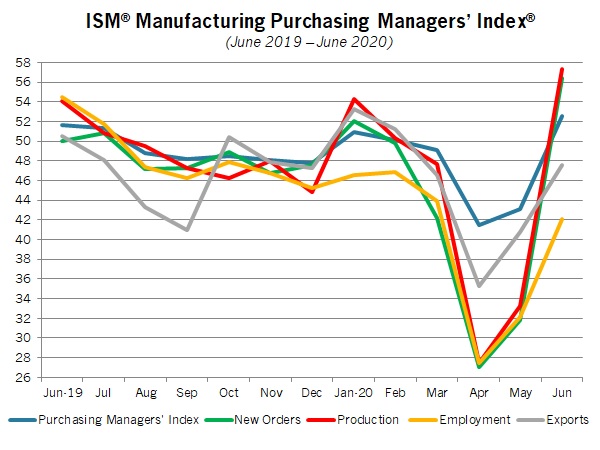

- The ISM® Manufacturing Purchasing Managers’ Index® reported that manufacturing activity rebounded in June, expanding at the fastest pace since April 2019. The improvements in June were led by the largest monthly jump in new orders in the survey’s history, as well as the biggest monthly growth in production since August 1952. Exports and hiring declined at slower rates.

- After declining by 11% and 13.5% in March and April, respectively, new orders for manufactured goods rose by 8% in May. On a year-over-year basis, new orders in the manufacturing sector have fallen by a sharp 15.8% since May 2019. With transportation equipment excluded, factory sales have fallen 11% year-over-year.

- New orders for core capital goods—a proxy for capital spending in the U.S. economy—rose 1.6% in May, but with a decline of 4.5% over the past 12 months.

- Consistent with other regional surveys, the Dallas Federal Reserve Bank found that manufacturing activity stabilized, improving from -74.0 in April to -49.2 in May to -6.1 in June. Manufacturers in the district expressed cautious optimism in their outlook in June.

- The U.S. economy added a very robust 4,800,000 nonfarm payroll workers in June, extending the gain of 2,699,000 employees added in May. Even with sizable job growth in the past two months, nonfarm payrolls have fallen by 14,661,000 since February. The unemployment rate declined from 13.3% in May to 11.1% in June.

- In June, manufacturers added 356,000 workers, building on the increase of 250,000 employees seen in May. A sizable rebound in motor vehicles and parts, which added 195,800 workers in June, led all segments. Yet, the sector continues to be down 757,000 workers since February.

- The current outlook is for manufacturing employment to bounce back to roughly 12,450,000 million workers by year’s end, with an unemployment rate around 9%.

- The Conference Board said that consumer confidence rose for the second straight month, recovering some of the sentiment seen after dropping in April to its lowest level in nearly six years. Americans expressed more optimism in their perceptions of income and labor markets, albeit still at weaker than desired levels.

- Private manufacturing construction spending dropped 4.1% to the slowest pace since July 2018. On a year-over-year basis, private construction spending among manufacturers has decreased 10.8% since May 2019.

- Led by sharp reductions in trade volumes, the U.S. trade deficit rose from $49.76 billion in April to $54.60 billion in May, its highest point since December 2018. Goods exports dropped to a level not seen since August 2009 and more than offset the decrease in goods imports, which fell to the weakest pace since September 2010.

- In non-seasonally adjusted data, U.S.-manufactured goods exports totaled $396.58 billion though the first five months of 2020, dropping 15.74% from $470.69 billion for the same time frame in 2019.

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, June 29

Dallas Fed Manufacturing Survey

Tuesday, June 30

Conference Board Consumer Confidence

Wednesday, July 1

ADP National Employment Report

Construction Spending

ISM® Manufacturing Purchasing Managers’ Index®

Thursday, July 2

BLS National Employment Report

Factory Orders and Shipments

International Trade Report

Weekly Initial Unemployment Claims

Friday, July 3

None |

|

|

|

This Week's Indicators:

Monday, July 6

Real GDP by Industry

Tuesday, July 7

Job Openings and Labor Turnover Survey

Wednesday, July 8

Consumer Credit

Thursday, July 9

Weekly Initial Unemployment Claims

Friday, July 10

Producer Price Index |

|

|

| Deeper Dive |

|

- ADP National Employment Report: Manufacturing employment rose by 88,000 in June, extending the gain of 220,000 seen in May, according to ADP estimates. With that said, the sector lost 1,329,000 workers in the month of April, illustrating the significant climb that still needs to be made for manufacturing employment to recover to its pre-COVID-19 levels. Job growth should continue to return in the coming months as restrictions are eased and economic activity accelerates, albeit likely at a slower pace than preferred.

Overall, there were 2,369,000 more workers at nonfarm private business establishments in June, building on the growth of 3,065,000 employees seen in May. Still, even with that progress, the labor market remains down 14,277,540 workers since February, illustrating the jaw-dropping losses in employment experienced over the spring months.

In June, the largest job growth was seen in leisure and hospitality (up 961,000), construction (up 394,000), trade, transportation and utilities (up 288,000), education and health services (up 283,000) and professional and business services (up 151,000). Weakness continued, however, in the information (down 50,000) and natural resources and mining (down 26,000) sectors. Small and medium-sized businesses (i.e., those with fewer than 500 employees) added 1,496,000 workers, or 63.2% of the total.

- BLS National Employment Report: The U.S. economy added a very robust 4,800,000 nonfarm payroll workers in June, extending the gain of 2,699,000 employees added in May. As such, the jobs market continues to show signs of stabilization as economic activity starts to resume from the COVID-19 crisis, even as overall employment remains well below prerecessionary levels. Even with sizable job growth in the past two months, nonfarm payrolls have fallen by 14,661,000 since February.

The unemployment rate declined from 13.3% in May to 11.1% in June, with the number of unemployed workers falling from 20,985,000 to 17,750,000. In addition, the so-called “real unemployment rate”—a term that refers to those marginally attached to the workforce, including discouraged workers and the underemployed—declined from 21.2% to 18%. The participation rate in the labor force increased from 60.8% to 61.5%, with 1,705,000 more Americans in the labor force.

In June, manufacturers added 356,000 workers, building on the increase of 250,000 employees seen in May. The following sectors saw the largest increases in June in manufacturing employment, with petroleum and coal products (down 1,500) being the only segment with a decline for the month.

- Motor vehicles and parts (up 195,800)

- Miscellaneous durable goods (up 25,500)

- Plastics and rubber products (up 21,800)

- Machinery (up 17,500)

- Miscellaneous nondurable goods (up 16,100)

- Furniture and related products (up 12,400)

- Fabricated metal products (up 11,100)

With that said, the sector continues to be down 757,000 workers since February. As such, there is still a lot of room for improvement to get back to the pace of employment seen before the COVID-19 pandemic. All 19 major sectors in manufacturers have seen net declines between February and June, but the following continue to experience the largest decreases over that four-month period:

- Transportation equipment (down 160,000, with motor vehicles and parts down 124,300)

- Fabricated metal products (down 83,000)

- Food manufacturing (down 67,000)

- Printing and related support services (down 57,000)

- Machinery (down 55,000)

- Miscellaneous durable goods (down 44,000)

- Furniture and related products (down 38,000)

- Miscellaneous nondurable goods (down 36,000)

- Primary metals (down 34,000)

The current outlook is for manufacturing employment to bounce back to roughly 12,450,000 million workers by year’s end, with an unemployment rate around 9%.

- Conference Board Consumer Confidence: After dropping in April to its lowest level in nearly six years, consumer confidence increased for the second straight month, rising from 85.9 in May to 98.1 in June. Americans’ perceptions improved for both the current economic environment and the expectations for the coming months, even as sentiment remained well below where it was before the COVID-19 pandemic. Indeed, the percentage of respondents suggesting that business conditions were “good” rose from 16.4% to 17.4%. The percentage feeling that conditions were “bad” dropped from 51.2% to 43.2%.

The labor market also remained weaker than desired, but it progressed in June. The percentage of respondents feeling jobs were “plentiful” increased from 16.5% to 20.8%, and those saying jobs were “hard to get” dropped from 29.2% to 23.8%. In terms of the jobs outlook, the percentage of respondents expecting more jobs in the next six months declined from 39.5% to 38.4%, while those predicting fewer jobs dipped from 19.9% to 14.2%.

- Construction Spending: Private manufacturing construction spending dropped 4.1% from $74.08 billion in April to $71.04 billion in May, the slowest pace since July 2018, as the sector grapples with the COVID-19 pandemic and pullbacks in activity. On a year-over-year basis, private construction spending among manufacturers has decreased 10.8% since May 2019.

Meanwhile, total private construction spending fell 3.3% in May, falling for the third straight month to a 15-month low. Private residential and nonresidential activity were off 4% and 2.4% in May, respectively, with private single-family home construction down 8.5% for the month. The largest declines in private nonresidential construction in May occurred in the health care (down 6.7%), manufacturing (down 4.1%), lodging (down 3.6%) and educational (down 3%) sectors, with gains seen for transportation (up 3.9%), amusement and recreation (up 1.1%) and communication (up 0.1%) projects. Over the past 12 months, private residential construction rose 0.7%, but private nonresidential construction declined 3.4% year-over-year.

Public construction spending rose 1.2% in May, with 4.7% growth over the past 12 months.

- Dallas Fed Manufacturing Survey: Consistent with other recent economic data, the Dallas Federal Reserve Bank found that manufacturing activity stabilized in June, bouncing back after two months of very sharp declines due to the COVID-19 pandemic. The composite index of general business activity has improved from -74.0 in April to -49.2 in May to -6.1 in June, suggesting that the rate of decline has lessened significantly since the previous survey. New orders, production and capacity utilization expanded somewhat in June, but employment and capital spending continued to contract, albeit by much less than in May.

Manufacturers in the district expressed cautious optimism in their outlook in June, with the forward-looking composite index of business conditions improving from -19.0 to 19.7. More than half of those completing the survey expect demand to increase over the next six months, with roughly 30% anticipating more hiring and capital investment. With that said, over 70% of respondents to a special question said that they felt it would take more than six months for revenues to get back to prerecession levels, with 26.7% feeling that it would take more than one year.

- Factory Orders and Shipments: After declining by 11% and 13.5% in March and April, respectively, new orders for manufactured goods rose by 8% in May, as the sector starts to bounce back from COVID-19 disruptions. Durable and nondurable goods sales were up 15.7% and 2%, respectively. Transportation equipment demand soared 82% in May, with motor vehicle and parts orders up 16.1%. Excluding transportation equipment, new factory orders increased 2.6%, and durable goods sales excluding transportation were up 3.7% for the month.

Despite progress in May, the pace of orders remains well below the prerecessionary pace. On a year-over-year basis, new orders in the manufacturing sector have fallen by a sharp 15.8% since May 2019. With transportation equipment excluded, factory sales have fallen 11% year-over-year. Moreover, new orders for core capital goods (or nondefense capital goods excluding aircraft)—a proxy for capital spending in the U.S. economy—rose 1.6% in May, but with a decline of 4.5% over the past 12 months.

Meanwhile, factory shipments increased 3.1% in May, following steep 5.5% and 14% decreases in March and April, respectively. Shipments of durable and nondurable goods rose 4.4% and 2% in May, respectively. With transportation equipment excluded, shipments increased 2% for the month. Since May 2019, manufactured goods shipments have decreased 17%, or a decline of 11.2% without transportation equipment included. Core capital goods shipments have fallen 7.7% year-over-year.

- International Trade Report: The U.S. trade deficit rose from $49.76 billion in April to $54.60 billion in May, its highest point since December 2018. COVID-19 has slowed economies around the world and caused a global recession, leading to a sharp reduction in trade volumes. Goods exports dropped from $95.50 billion to $89.97 billion, a level not seen since August 2009. That level more than offset the decrease in goods imports, which declined from $167.32 billion to $166.02 billion, the weakest pace since September 2010. Service-sector trade volumes also declined dramatically, both for exports and imports, with the service-sector trade surplus decreasing from $22.06 billion to $21.46 billion, the lowest level since February 2016. On the positive side, petroleum imports at $5.95 billion reached their lowest levels since June 1999.

May saw sizable decreases in goods exports in every major category except for consumer goods, which rose by $557 million. The largest declines in goods exports were in industrial supplies and materials (down $3.93 billion), non-automotive capital goods (down $869 million), automotive vehicles and parts (down $426 million) and foods, feeds and beverages (down $314 million). For goods imports, the declines in automotive vehicles and parts (down $4.38 billion) and non-automotive capital goods (down $643 million) offset gains for consumer goods (up $1.91 billion) and industrial supplies and materials (up $2.27 billion).

The underlying data reflect weaknesses in the economy and shifting trade patterns for airplanes, automobiles and parts, jewelry, machinery, metals and petroleum, pharmaceuticals and semiconductors and electronics, among other trends.

In non-seasonally adjusted data, U.S.-manufactured goods exports totaled $396.58 billion though the first five months of 2020, dropping 15.74% from $470.69 billion for the same time frame in 2019.

- ISM® Manufacturing Purchasing Managers’ Index®: The Institute for Supply Management® reported that manufacturing activity rebounded in June, expanding at the fastest pace since April 2019. It bounced back from a sharp contraction in the prior three months due to COVID-19 and the global economic recession. As the economy started to get back on track after easing of COVID-19-related restrictions, the improvements in June were led by the largest monthly jump in new orders (up from 31.8 to 56.4) in the survey’s history, as well as the biggest monthly growth in production (up from 33.2 to 57.3) since August 1952. With that said, it will take more progress for the manufacturing sector to fully recover. Exports (up from 39.5 to 47.6) contracted in June for the fourth straight month, albeit with some stabilization, and employment (up from 32.1 to 42.1) continued to decline significantly even with some progress in the latest data.

Raw material prices (up from 40.8 to 51.3) also reflect the steadying of economic activity in June, with input costs expanding slightly following deflationary pressures in the four prior months. At the same time, 65.6% of respondents said that prices did not change in June relative to May. Meanwhile, inventories (up from 50.4 to 50.5) rose marginally for the second consecutive month. Yet, stockpiles remain low overall, meaning that additional production will be necessary to meet any increase in demand, according to Timothy Fiore, chair of the ISM® Manufacturing Business Survey Committee.

- Weekly Initial Unemployment Claims: The week ending June 27 saw 1,427,000 initial unemployment claims, down slightly from the 1,482,000 claims added for the week ending June 20. Initial claims have continued to decelerate since peaking at 6,867,000 for the week ending March 28, but they remain highly elevated.

Meanwhile, continuing claims inched up from 19,231,000 for the week ending June 13 to 19,290,000 for the week ending June 20, with 13.2% of the workforce receiving unemployment insurance for the week.

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Interested in becoming a presenter of the Monday Economic Report? Email us. |

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

| You received this email because you signed up for the NAM’s Monday Economic Report as a part of your NAM membership. |

|

| Manage my email newsletters and alerts | Unsubscribe |

|

|

|

| © 2020 National Association of Manufacturers |

|

|

|

|

|

|