|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – September 14, 2020– SHARE

|

|

<

|

|

|

| Survey: Outlook Rebounding, Revenue Recovery Expected 2021 or Later |

|

| The Weekly Toplines |

|

- In the latest NAM Manufacturers’ Outlook Survey, 66.0% of respondents reported a positive outlook for their company in the third quarter, up from 33.9% in the second quarter, which had been the worst reading since the Great Recession. However, the outlook measure remains below the historical average of 74.4%. Weak domestic demand continued to be the top primary business challenge.

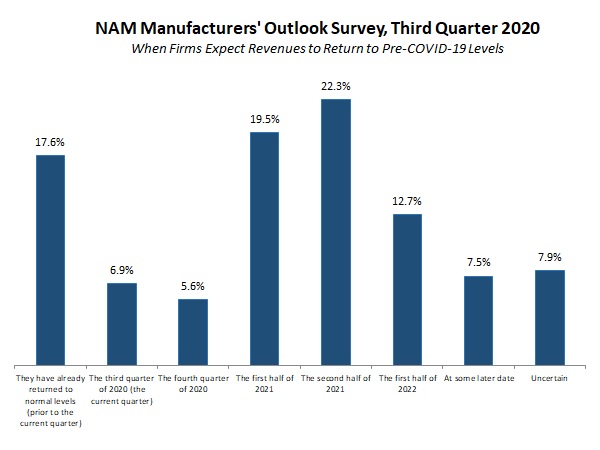

- Respondents were asked when they expect revenues to return to pre-pandemic levels. Sixty-two percent expect their firm’s revenues will not get back to pre-COVID-19 levels until 2021 or later. Just 17.6% note their revenues had already recovered, with 12.5% predicting them to bounce back in either the third or fourth quarter of 2020.

- More than half of manufacturers report higher production in the third quarter than in the second, with 22.7% predicting output will be lower and 24.8% feeling there will be no change. Similarly, 30.0% and 26.8% of those completing the survey anticipate that hiring and capital spending will increase in the third quarter, respectively, with roughly 45% seeing no change in either measure relative to the second quarter.

- Manufacturing job openings in July reached 408,000, the best reading since February. This improvement suggests that firms are once again increasing their interest in adding new workers, even as the sector attempts to rebound from the COVID-19 pandemic. Nonetheless, net hiring remained challenged, and the overall labor market has changed dramatically post-pandemic.

- Initial unemployment claims totaled 884,000 for the week ending Sept. 5, unchanged from the week ending Aug. 29. Meanwhile, continuing claims edged up from 13,292,000 for the week ending Aug. 22 to 13,385,000 for the week ending Aug. 29, with 9.2% of the workforce receiving unemployment insurance.

- The Small Business Optimism Index from the National Federation of Independent Business rose in August above the all-important threshold of 100, which is traditionally consistent with small business growth. Despite some progress, small business owners continued to cite lingering challenges, with an insufficient workforce once again the top “single most important problem.”

- U.S. consumer credit outstanding rose 3.6% in July, but revolving credit fell for the fifth straight month, decreasing by 9.1% year-to-date. This decline suggests that Americans have not only reduced their willingness to take on more credit, but they have also paid down some of their existing credit balances.

- Consumer and producer prices rose in August, building on gains seen in June and July. Yet, core inflation remains largely in check for now, as recent cost increases have largely reversed the deflationary pressures seen in the spring.

|

|

|

| Economic Indicators |

|

Last Week’s Indicators:

(Summaries Appear Below)

Monday, September 7

LABOR DAY HOLIDAY

Tuesday, September 8

Consumer Credit

NFIB Small Business Survey

Wednesday, September 9

Job Openings and Labor Turnover Survey

Thursday, September 10

NAM Manufacturers’ Outlook Survey

Producer Price Index

Weekly Initial Unemployment Claims

Friday, September 11

Consumer Price Index |

|

|

|

This Week's Indicators:

Monday, September 14

None

Tuesday, September 15

Industrial Production

New York Fed Manufacturing Survey

Wednesday, September 16

FOMC Monetary Policy Statement

NAHB Housing Market Index

Retail Sales

Thursday, September 17

Housing Starts and Permits

Philadelphia Fed Manufacturing Survey

Weekly Initial Unemployment Claims

Friday, September 18

Conference Board Leading Indicators

State Employment Report

University of Michigan Consumer Sentiment |

|

|

| Deeper Dive |

|

- Consumer Credit: U.S. consumer credit outstanding rose 3.6% in July. Yet, revolving credit (which includes credit cards and other credit lines) declined 0.4%, falling for the fifth straight month. Indeed, revolving credit has decreased 9.1% year-to-date. This decline suggests that Americans have not only reduced their willingness to take on more credit, but they have also paid down some of their existing credit balances. In contrast, nonrevolving credit (which includes auto and student loans) rose 4.8% in July, rising 1.9% through the first seven months of this year.

- Consumer Price Index: Consumer prices rose 0.4% in August, building on the 0.6% gains seen in both June and July. Energy prices have helped to buoy growth in the headline index over the past three months, rising 0.9% in August, with gasoline costs up 2.0%. Despite recent increases, energy prices remain 16.8% lower than one year ago. At the same time, food prices edged up 0.1% in August, with food costs up 4.1% year-over-year.

Excluding food and energy, consumer prices also rose 0.4% in August, easing somewhat from the 0.6% gain seen in July, which had been the fastest monthly increase since January 1991. Prices for used cars and trucks soared 5.4%, with apparel and household furnishings costs up 0.6% and 1.0% in August, respectively.

Over the past 12 months, the consumer price index has risen 1.3%, up from 1.0% in July. Meanwhile, core inflation (which excludes food and energy) has risen 1.7% since August 2019, inching up from 1.6% year-over-year in the previous release. Overall, consumer costs have jumped significantly over the past three months. However, inflationary pressures remain largely in check for now, with many costs bouncing back from deflationary pressures in the spring due to pullbacks in activity from the COVID-19 pandemic.

- Job Openings and Labor Turnover Survey: Manufacturing job openings in July reached 408,000, up from 346,000 in June and the best reading since February (422,000). This improvement suggests that firms are once again increasing their interest in adding new workers, even as the sector attempts to rebound from the COVID-19 pandemic and the overall labor market has changed dramatically.

This trend can also be seen in the larger economy. Nonfarm business job openings rose from 6,001,000 in June to 6,618,000 in July, which was also the strongest pace since February (7,004,000). To put that number in perspective, though, the number of unemployed Americans dropped from 17,750,000 in June, to 16,338,000 in July, to 13,550,000 in August, according to the latest jobs data. That translates into 2.5 unemployed workers for every one job opening in July.

Despite some progress in job openings, net hiring remained challenged. Manufacturers hired 321,000 workers in July, down sharply from 432,000 in June. At the same time, total separations declined from 392,000 to 353,000. Net hiring (or hiring minus separations) was -32,000 in July, down from a gain of 40,000 in June.

Digging into these data revealed signs of stabilization in the labor market, which has been hard hit in the pandemic. Nonfarm business layoffs decreased from 1,995,000 in June to 1,721,000 in July, the slowest pace since March 2019 (1,698,000). Meanwhile, layoffs in the manufacturing sector declined from 184,000 to 157,000.

- NAM Manufacturers’ Outlook Survey: In the latest quarterly release, conducted Aug. 14–28, 66.0% of respondents reported a positive outlook for their company in the third quarter, up from 33.9% in the second quarter. As such, positive sentiment in the manufacturing sector has nearly doubled since May, rebounding from the worst reading since the Great Recession, even as challenges persist and the outlook remains below the historical average of 74.4%.

Indeed, 50.6% of manufacturers report higher production in the third quarter than in the second, with 22.7% predicting output will be lower and 24.8% feeling there will be no change. Similarly, 30.0% and 26.8% of those completing the survey anticipate that hiring and capital spending will increase in the third quarter, respectively, with roughly 45% seeing no change in either measure relative to the second quarter.

Respondents were asked when they expect revenues to return to pre-pandemic levels. Sixty-two percent expect their firm’s revenues will not get back to pre-COVID-19 levels until 2021 or later. Just 17.6% note their revenues had already recovered, with 12.5% predicting them to bounce back in either the third or fourth quarter of 2020.

Weaker domestic demand remained the primary business challenge, but the percentage citing that as a concern dropped from 83.1% in the second quarter to 66.5% in the third quarter. Other top worries among manufacturers included the inability to attract and retain talent (55.1%), rising health care and insurance costs (51.1%), trade uncertainties (40.0%) and weaker global growth and slowing export sales (36.4%). Prior to COVID-19, workforce challenges had been the main concern for manufacturing respondents for 10 consecutive quarters, and the data suggest that it continues to be a struggle despite the dramatically changed labor market.

- NFIB Small Business Survey: The National Federation of Independent Business reported that the Small Business Optimism Index increased from 98.8 in July to 100.2 in August, rising above the all-important threshold of 100, which is traditionally consistent with small business growth. Despite some progress, small business owners continued to cite lingering challenges. The percentage of respondents saying the next three months are a “good time to expand” edged up from 11% in July to 12% in August, but that remained well below the 26% who said the same thing in February. Moreover, a net 3% of small business owners expect sales to rise over the next three months, slowing from 13% and 5% in the June and July surveys, respectively. (That is still a vast improvement from April’s -42% reading, which was the lowest in the survey’s 46-year history.)

The employment indicators were mixed. On the positive side, a net of 21% of respondents said that they expect to add workers over the next three months, the best reading since February. Also, 33% noted that their company had job openings right now, up from 30% in the previous survey and the highest level since March. Yet, actual hiring has been negative on net for five straight months. Despite the changed labor market dynamics, an insufficient workforce was once again the top “single most important problem,” cited by 21% of respondents. Other top concerns were taxes (17%), poor sales (15%) and government regulation (11%).

Regarding capital spending, 47% of small firms have made an investment over the past six months, down from 49% in the previous survey and the slowest pace since December 2010. The percentage of respondents planning to make a capital investment over the next three to six months remained at 26%, matching the average pace experienced over the past year.

- Producer Price Index: Producer prices for final demand goods and services rose 0.3% in August, slowing from the 0.6% increase seen in July, which was the fastest monthly increase in input costs since October 2018. Likewise, producer prices for final demand goods increased 0.8% and 0.1% in July and August, respectively. Energy and food costs each pulled back, down 0.1% and 0.4% for the month, respectively. It was the third straight monthly decline for food prices, which have edged up just 0.2% year-over-year despite tremendous volatility since the spring due to the COVID-19 pandemic. In contrast, energy costs have fallen 12.4% over the past 12 months. Core inflation for raw material goods, which excludes food and energy, rose 0.3% in August, the same pace as observed in July.

Over the past 12 months, producer prices for final demand goods and services have decreased 0.2%, the highest reading since March. At the same time, core producer prices have risen 0.3% since August 2019, up from 0.1% growth year-over-year in the previous release and also a five-month high.

The bottom line is that inflation remains largely in check for raw material costs, even as producer prices have risen in recent months. Given the deflationary pressures seen in the economy in the spring, it should not be a surprise that prices would bounce back strongly at some point. For its part, the Federal Reserve has pursued extraordinary monetary policy measures to help prop up the economy, and it remains committed to its stimulative stance for the foreseeable future.

- Weekly Initial Unemployment Claims: Initial unemployment claims totaled 884,000 for the week ending Sept. 5, unchanged from the week ending Aug. 29. Despite being flat for the week, initial claims have decelerated since peaking at 6,867,000 for the week ending March 28, averaging 1,007,500 over the past six weeks. However, they remain highly elevated, illustrating continuing pain in the labor market. To put the current numbers in perspective, initial claims peaked during the Great Recession at 665,000 for the week ending March 28, 2009.

Meanwhile, continuing claims edged up from 13,292,000 for the week ending Aug. 22 to 13,385,000 for the week ending Aug. 29. These data have also eased notably since peaking at 24,912,000 for the week ending May 9, even as it remains clear that too many Americans remain unemployed in the U.S. economy overall. In the latest data, 9.2% of the workforce received unemployment insurance, inching up from 9.1% in the previous report. |

|

| Manufacturing Leadership Council |

|

The NAM’s Manufacturing Leadership Council is hosting its annual leadership meeting as a virtual event on October 27–29, 2020. Now called Rethink: The Manufacturing Leadership Council Summit, this event offers you the opportunity to see how your peers at other manufacturing companies have implemented advanced technologies and changed culture, leadership practices, organizational structures and workforce strategies to save time and money. You will learn about these techniques straight from the executives themselves. Speakers will include Gerald Johnson, vice president, Global Manufacturing, General Motors; Jim Beilstein, vice president, Advanced Manufacturing, Owens Corning; Bart Talloen, vice president, Supply Chain Strategy and Deployment, J&J; and many more. You will also see presentations of case studies from winning Manufacturing Leadership Award Winner projects and have access to an on-demand library from more than 40 of our winners this year. NAM members have an individual registration option to attend at no additional cost. Low-cost team passes can be purchased for up to 25 people. |

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

|

|