|

| If you’re having trouble reading this, click here. |

|

| MONDAY ECONOMIC REPORT |

|

|

|

|

| Essential Takes on Leading Economic Indicators |

|

By Chad Moutray, Ph.D., CBE – December 21, 2020 – SHARE

|

|

<

|

|

|

| Manufacturing Production Rose for Seventh Straight Month |

|

| The Weekly Toplines |

|

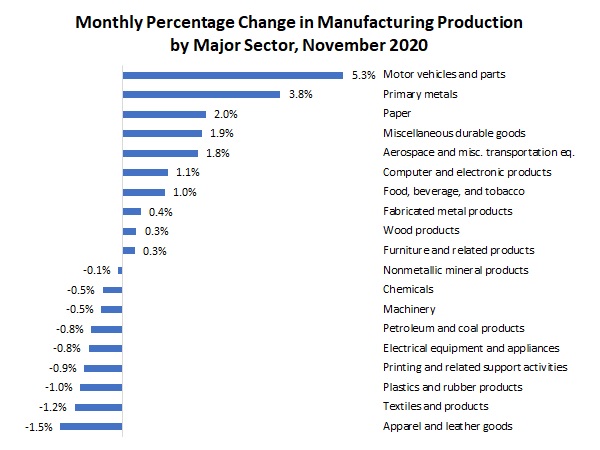

- Manufacturing production increased 0.8% in November, rising for the seventh straight month, led by strength in durable goods. The largest increases in output in November were in motor vehicles and parts, primary metals, paper, miscellaneous durable goods and aerospace and miscellaneous transportation equipment. Overall, manufacturing production remained 3.7% below the pre-pandemic pace in February.

- After November’s data notched the best readings since September 2014, the IHS Markit Flash U.S. Manufacturing PMI pulled back slightly in December. The index continued to signal a strong rebound overall since the spring. Input prices rose at the strongest pace since April 2018. The Eurozone data were also encouraging, improving to the best reading since May 2018, despite lingering COVID-19-related weaknesses in the services sector.

- The Kansas City, New York and Philadelphia Federal Reserve Banks each reported expanding manufacturing activity in December, although activity in New York and Philadelphia slowed somewhat. Manufacturers in each district remained very positive in their outlook.

- New residential construction rose 1.2% to 1,547,000 units at the annual rate in November, the strongest pace since February. The data were buoyed by continued strength in the single-family segment, which edged up to 1,186,000 units, the best reading since April 2007. The housing market has been boosted by historically low mortgage rates.

- Meanwhile, housing permits increased 6.2% to 1,639,000 units in November, the strongest pace since September 2006, pointing to solid growth in the housing market over the coming months. Builders also feel more upbeat in their expectations for single-family sales over the next six months, with sentiment in December not far from the record high seen in November.

- Consumer spending at retailers fell 1.1% in November, with Americans slowing their purchasing and extending the 0.1% decline seen in October. This weakness reflects caution on the part of consumers, but also lingering uncertainties related to the continued spread of COVID-19. Despite slipping over the past two months, retail sales have risen 4.1% since November 2019.

- Initial unemployment claims totaled 885,000 for the week ending Dec. 12, the highest level since the week ending Sept. 5 and the second straight weekly increase. At the same time, 20,646,779 Americans received some form of unemployment insurance benefit (including state and federal programs) for the week ending Nov. 28.

- The Federal Reserve plans to leave short-term interest rates near zero for the foreseeable future. In the economic projections, the median federal funds rate remains the same through 2023, but with some participants forecasting increases beginning in 2022. Beyond interest rates, the Fed will also continue to increase its asset purchases “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

|

|

|

| Economic Indicators |

|

Last Week's Indicators:

(Summaries Appear Below)

Monday, December 14

None

Tuesday, December 15

Industrial Production

New York Fed Manufacturing Survey

Wednesday, December 16

FOMC Monetary Policy Statement

IHS Markit Flash U.S. Manufacturing PMI

NAHB Housing Market Index

Retail Sales

Thursday, December 17

Housing Starts and Permits

Kansas City Fed Manufacturing Survey

Philadelphia Fed Manufacturing Survey

Weekly Initial Unemployment Claims

Friday, December 18

Conference Board Leading Indicators

State Employment Report

|

|

|

|

This Week's Indicators:

Monday, December 21

Chicago Fed National Activity Index

Tuesday, December 22

Existing Home Sales

Gross Domestic Product (Second Revision)

Real GDP by Industry

Richmond Fed Manufacturing Survey

Wednesday, December 23

New Home Sales

Personal Consumption Expenditures Deflator

Personal Income and Spending

University of Michigan Consumer Sentiment (Revision)

Thursday, December 24

Durable Goods Orders and Shipments

Weekly Initial Unemployment Claims

Friday, December 25

CHRISTMAS DAY HOLIDAY

|

|

|

| Deeper Dive |

|

- Conference Board Leading Indicators: The Leading Economic Index rose 0.6% in November, increasing for the seventh consecutive month but still 2.3% lower than pre-pandemic levels in February. New manufacturing orders contributed positively to the LEI for the sixth straight month. Other bright spots in November included building permits, initial unemployment claims, the interest rate spread, lending conditions and the stock market. At the same time, the average workweek of production workers and consumer confidence both pulled the LEI lower for the month.

Meanwhile, the Coincident Economic Index also increased for the seventh consecutive month, albeit slowing to a gain of 0.2% in November and remaining down 4.1% since February. All four CEI components—industrial production, manufacturing and trade sales, nonfarm payrolls and personal income less transfer payments—contributed positively in November. For its part, manufacturing production rose 0.8% in November. However, output in the sector remained 3.7% below pre-pandemic levels (see below).

- FOMC Monetary Policy Statement: As expected, the Federal Reserve plans to leave short-term interest rates near zero for the foreseeable future, keeping the federal funds rate range at zero to 25 basis points. More importantly, in the economic projections, the median federal funds rate remains the same through 2023, but with some participants forecasting increases beginning in 2022. Beyond interest rates, the Fed will also continue to increase its asset purchases “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

This announcement suggests that the Federal Open Market Committee will continue to pursue highly accommodative monetary policies throughout 2021 and beyond, with an eye on stimulating growth in the face of continuing economic challenges. The FOMC cited progress in the economy, but with lingering uncertainties related to COVID-19 and with growth still below what was experienced before the pandemic. In its statement, the Federal Reserve added, “The path of the economy will depend significantly on the course of the virus.”

Participants upgraded their projections for economic growth relative to what was forecasted in September. The FOMC now expects a decline of 2.4% in real GDP in 2020, an improvement from the previous estimate of a 3.7% decline. The FOMC expects the economy to rebound by 4.2% and 3.2% in 2021 and 2022, respectively. In addition, participants anticipate that the unemployment rate will fall from 6.7% in 2020 to 5.0% in 2021 and 4.2% in 2022. They project core inflation will remain at or below 2.0% through 2023.

- Housing Starts and Permits: New residential construction rose 1.2% from 1,528,000 units at the annual rate in October to 1,547,000 units in November, the strongest pace since February. The data were buoyed by continued strength in the single-family segment, which edged up from 1,181,000 units to 1,186,000 units, the best reading since April 2007. At the same time, multifamily residential construction starts increased from 347,000 units to 361,000 units.

The housing market has been boosted by historically low mortgage rates. According to Freddie Mac, mortgage rates hit a new low last week, falling to 2.67% for the average 30-year fixed-rate mortgage. The sector has bounced back sharply following steep COVID-19-related declines in the spring. On a year-over-year basis, housing starts have risen 12.8% from 1,371,000 units in November 2019, with single-family activity jumping 27.1% over the past 12 months.

Meanwhile, housing permits increased 6.2% from 1,544,000 units in October to 1,639,000 units in November, the strongest pace since September 2006. These increases point to solid growth in the housing market over the coming months. For their part, builders also feel more upbeat in their expectations for single-family sales over the next six months, with sentiment in December not far from the record high seen in November (see below).

Single-family permits increased from 1,128,000 units in October to 1,143,000 units in November, the highest reading since March 2007. In contrast, multifamily permitting soared from 416,000 units to 496,000 units. Over the past 12 months, housing permits have risen 6.2% from 1,510,000 units in November 2019, with single-family permits jumping 22.2% year-over-year.

- IHS Markit Flash U.S. Manufacturing PMI: After November’s data notched the best readings since September 2014, manufacturing activity pulled back slightly in December. However, the index continued to signal a strong rebound overall since the spring, according to preliminary data from IHS Markit. The headline index declined from 56.7 in November to 56.5 in December, with new orders (down from 57.4 to 55.7), exports (down from 50.5 to 50.3) and output (down from 59.2 to 57.3) each slowing for the month. The index for future output (down from 78.3 to 70.8) also decelerated, but it remained consistent with expectations for strong growth in production over the coming months. On the other hand, employment strengthened somewhat, expanding for the fifth straight month. Input prices (up from 61.6 to 65.4) rose at the strongest pace since April 2018.

In Europe, manufacturers reported stronger growth in December, despite lingering COVID-19-related weaknesses in the services sector. The IHS Markit Flash Eurozone Manufacturing PMI rose from 53.8 in November to 55.5 in December, the strongest reading since May 2018. The underlying data were higher across the board, including the fastest growth for new orders, exports and output. Employment continued to stabilize, although it has contracted now for 20 consecutive months. The index for future output was the best since February 2018, signaling upbeat assessments about production growth in the first half of 2021. Nonetheless, input prices have risen at rates not seen since November 2018.

The data were also stronger in “flash” reports from France and Germany and, outside the Eurozone, in the United Kingdom. After contracting in November, French manufacturers once again reported stronger activity in December, despite strict restrictions being imposed due to the pandemic. Meanwhile, the PMI readings for Germany and the U.K. were the best since February 2018 and November 2017, respectively.

- Industrial Production: Manufacturing production increased 0.8% in November, building on the 1.1% gain seen in October and rising for the seventh straight month. Durable and nondurable goods production rose 1.5% and 0.1% for the month, respectively. Overall, manufacturing production remained 3.7% below the pre-pandemic pace in February. Output in the sector continued to rebound following the 20.0% decline between February and April due to the COVID-19 pandemic. Expressed on a year-over-year basis, manufacturing production has declined 3.7% since November 2019, with durable and nondurable goods output down 4.3% and 2.6%, respectively.

Manufacturing capacity utilization increased from 72.0% in October to 72.6% in November. This percentage represents tremendous progress from April’s rate of 60.1%, which marked the lowest rate in the history of the series, which dates to January 1948. By comparison, before the pandemic, manufacturing capacity utilization registered 75.2% in February. In November, the largest increases in manufacturing production occurred in motor vehicles and parts (up 5.3%), primary metals (up 3.8%), paper (up 2.0%), miscellaneous durable goods (up 1.9%) and aerospace and miscellaneous transportation equipment (up 1.8%), among others. In contrast, apparel and leather goods (down 1.5%), textiles and products (down 1.2%) and plastics and rubber products (down 1.0%) were among the sectors with declining output in November.

On a year-over-year basis, three of the major manufacturing sectors have experienced increased production over the past 12 months: computer and electronic products (up 1.5%), food, beverage and tobacco products (up 1.5%) and paper (up 1.2%). Motor vehicles and parts production was unchanged year-over-year in November. The biggest year-over-year declines occurred in petroleum and coal products (down 14.0%), furniture and related products (down 10.7%), printing and related support activities (down 10.6%) and aerospace and miscellaneous transportation equipment (down 10.3%).

Meanwhile, total industrial production rose 0.9% and 0.4% in October and November, respectively. Mining production increased 2.3% in November, but utilities output declined by 4.3% on warmer temperatures. Over the past 12 months, industrial production has dropped 5.5%, with mining and utilities output falling 12.5% and 8.9% year-over-year, respectively. Total capacity utilization increased from a record low 64.2% in April to 73.3% in November, which is encouraging. Yet, total capacity utilization registered 76.9% in February before the pandemic.

- Kansas City Fed Manufacturing Survey: Manufacturing activity expanded for the seventh straight month, with the composite index of general business conditions rising from 11 in November to 14 in December. Growth for new orders, shipments, employment and the average workweek accelerated in the latest survey, but production slowed somewhat. The change in exports, which have seesawed from month to month during the second half of this year, returned to growth in December. At the same time, prices for raw materials jumped at the fastest pace since May 2011. Meanwhile, the report says, “More than three-quarters of factory contacts indicated the recent surge in COVID-19 cases has negatively affected their firm’s business.”

Nonetheless, respondents continued to feel cautiously positive about additional growth over the next six months, with solid expansions expected for new orders, production and hiring and modest gains for capital spending and exports.

- NAHB Housing Market Index: The National Association of Home Builders and Wells Fargo said that confidence pulled back in December from the record high reached in November, but with optimism still very robust. The Housing Market Index declined from 90 in November to 86 in December. HMI data exceeding 50 suggest that more builders feel positive in their outlook than negative. The latest data continue to suggest that builders feel extremely upbeat in their assessments of the housing market, buoyed by historically low mortgage rates. NAHB Chief Economist Robert Dietz cited rising construction costs and shortages of available lots and workers.

The HMI eased slightly in every region of the country. The index for current single-family home sales slipped from 96, an all-time high, to 92—still a very solid reading. At the same time, the index for expected single-family sales eased from a record 89 to 85. Even with the decline, builders expressed optimism about increased sales moving forward.

- New York Fed Manufacturing Survey: In December, manufacturing activity expanded in the New York Federal Reserve Bank’s district for the sixth consecutive month, albeit at the slowest pace since August. The composite index of general business activity declined from 6.3 in November to 4.9 in December, with slower growth in new orders. At the same time, shipments, employment and prices paid expanded faster, with hiring and input costs accelerating at the best rates since December 2018. The average workweek continued to increase modestly at the same pace as in the previous release. Inventories have fallen for nine straight months.

Meanwhile, manufacturers in the Empire State Manufacturing Survey remain upbeat about stronger activity over the next six months, with the forward-looking composite index rising from 33.9 in November to 36.3 in December. More than 47% of respondents expect new orders and shipments to expand moving forward, with nearly one-third anticipating more employment and capital spending.

- Philadelphia Fed Manufacturing Survey: Manufacturing activity expanded for the seventh straight month, albeit ending the year with softening growth in both November and December. The composite index decreased from 32.3 in October to 26.3 in November to 11.1 in December. In the latest data, growth in new orders, shipments, employment and the average workweek decelerated. The labor market variables pulled back from results in the previous survey, which had marked the strongest paces since at least mid-2018. Encouragingly, however, labor market variables remained positive. The prices paid for input costs also eased somewhat in December after rising in November by the fastest rate in two years, with 63.4% of respondents citing no change in raw material prices.

At the same time, although the index slipped somewhat, manufacturers in the district remained very positive in their outlook. The forward-looking composite index dropped from 44.3 to 39.2, with the outlook still solid overall. More than 55% of business leaders in the region expect new orders and shipments to increase over the next six months. Nearly 45% predicted more hiring, and 32.5% anticipated additional capital spending.

In some special questions, respondents forecast wage growth of 2.5% in 2021, with health benefits rising by 5.3%. They anticipate that overall compensation will increase by 3.9% next year. They predict that prices in 2021 for energy, intermediate goods and other raw materials will rise by 1.2%, 2.4% and 3.6%, respectively.

- Retail Sales: Consumer spending at retailers fell 1.1% in November, with Americans slowing their purchasing and extending the 0.1% decline seen in October. This weakness reflects caution on the part of consumers, but also lingering uncertainties related to the continued spread of COVID-19. In the latest data, consumers spent more at food and beverage stores (up 1.6%), building material and garden supply stores (up 1.1%) and nonstore retailers (up 0.2%). But those gains were more than offset by decreased retail spending in other areas. This decline included reduced sales at department stores (down 7.7%), clothing and accessories stores (down 6.8%), food services and drinking places (down 4.0%), electronics and appliance stores (down 3.5%), gasoline stations (down 2.4%), motor vehicles and parts dealers (down 1.7%) and furniture and home furnishings stores (down 1.1%), among others.

Despite slipping over the past two months, retail sales have risen 4.1% since November 2019. However, that pace has eased from 6.1% and 5.5% year-over-year in September and October, respectively. Perhaps more encouragingly, retail spending increased by a robust 5.9% over the past 12 months with motor vehicles and parts and gasoline excluded.

The bright spots on a year-over-year basis included nonstore retailers (up 29.2%), sporting goods and hobby stores (up 19.6%), building material and garden supply stores (up 18.7%), food and beverage stores (up 10.9%) and motor vehicles and parts dealers (up 6.0%). In contrast, department stores (down 19.0%), food services and drinking places (down 17.2%), gasoline stations (down 17.1%), clothing and accessory stores (down 16.1%) and electronics and appliance stores (down 8.3%) each experienced retail sales declines over the past 12 months.

- State Employment Report: Missouri created the most net new manufacturing jobs in November, adding 5,200 workers. Other states with notable employment growth for the month included Wisconsin (up 4,200), Tennessee (up 2,600), Kentucky (up 2,500), Utah (up 2,400) and Arkansas (up 1,900).

Despite gains over the past seven months, manufacturing employment figures remain down by 599,000 since the COVID-19 pandemic began. Since February, the states with the largest job decreases in the sector included California (down 97,000), Michigan (down 62,600), New York (down 45,700), Indiana (down 36,700), North Carolina (down 35,900) and Pennsylvania (down 34,800). In contrast, Utah (up 3,900), Colorado (up 3,600) and Idaho (up 3,400) were among the few states with higher employment in the sector since February.

The national unemployment rate edged down from 6.9% in October to 6.7% in November, and the unemployment rate fell in 25 states in the latest data. New Jersey had the highest unemployment in the country at 10.2%, followed closely by Nevada (10.1%) and Hawaii (10.1%). At the other end of the spectrum, the lowest unemployment rates in the United States in November occurred in Nebraska (3.1%), Vermont (3.1%), South Dakota (3.5%), Iowa (3.6%) and New Hampshire (3.8%).

- Weekly Initial Unemployment Claims: Initial unemployment claims totaled 885,000 for the week ending Dec. 12, the highest level since the week ending Sept. 5 and up from 862,000 in the previous release for the week ending Dec. 5. It was the second straight weekly increase in the number of Americans filing for first-time unemployment benefits, a reflection of softening in the labor market due to the continued spread of COVID-19 and new restrictions on activity. The data remain elevated despite significant progress since peaking at 6,867,000 for the week ending March 28.

Meanwhile, continuing claims declined from 5,781,000 for the week ending Nov. 28 to 5,508,000 for the week ending Dec. 5, consistent with 3.8% of the workforce and the lowest level since the week ending March 21. At the same time, 20,646,779 Americans received some form of unemployment insurance benefit (including state and federal programs) for the week ending Nov. 28, up from 19,043,498 for the week ending Nov. 21, largely on increased state and pandemic assistance.

|

|

|

Thank you for subscribing to the NAM’s Monday Economic Report.

If you’re part of an NAM member company and not yet subscribed, email us. If you’re not an NAM member, become one today!

|

|

|

|

|

|

|

|

|

| Interested in becoming a presenter of the Monday Economic Report? Email us. |

|

| Questions or comments? Email NAM Chief Economist Chad Moutray at [email protected]. |

|

| You received this email because you signed up for the NAM’s Monday Economic Report as a part of your NAM membership. |

|

| Manage my email newsletters and alerts | Unsubscribe |

|

|

|

| © 2020 National Association of Manufacturers |

|

|

|

|

|

|

|